Booth’s Finance MBA curriculum takes an empirical approach to the evaluation of risk and reward.

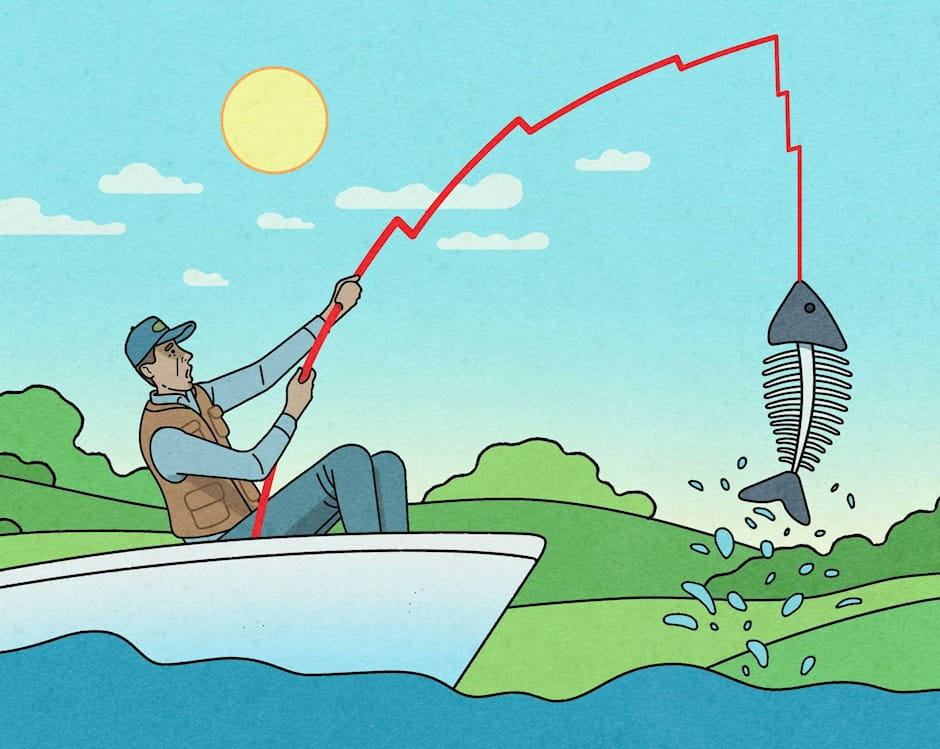

Our corporate finance offerings will prepare you at the business level: Should a company buy or build? Should it borrow money or issue stock? How should it compensate executives? Should it hedge costs, and if so, how?

Investment courses prepare you to make decisions in financial markets: What determines stock and bond prices? How do you evaluate a fund manager? What financial risks carry big rewards, and how should an investor allocate his or her portfolio to take advantage of them?

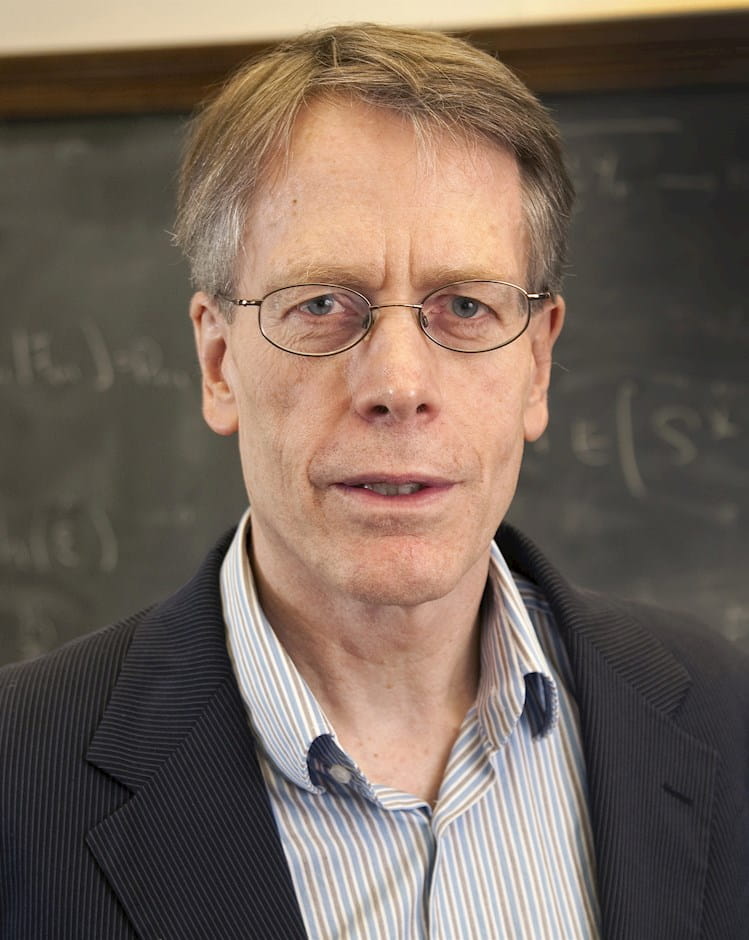

In our collaborative culture of inquiry and debate, you'll learn to look beyond easy answers to find better solutions.