Summary

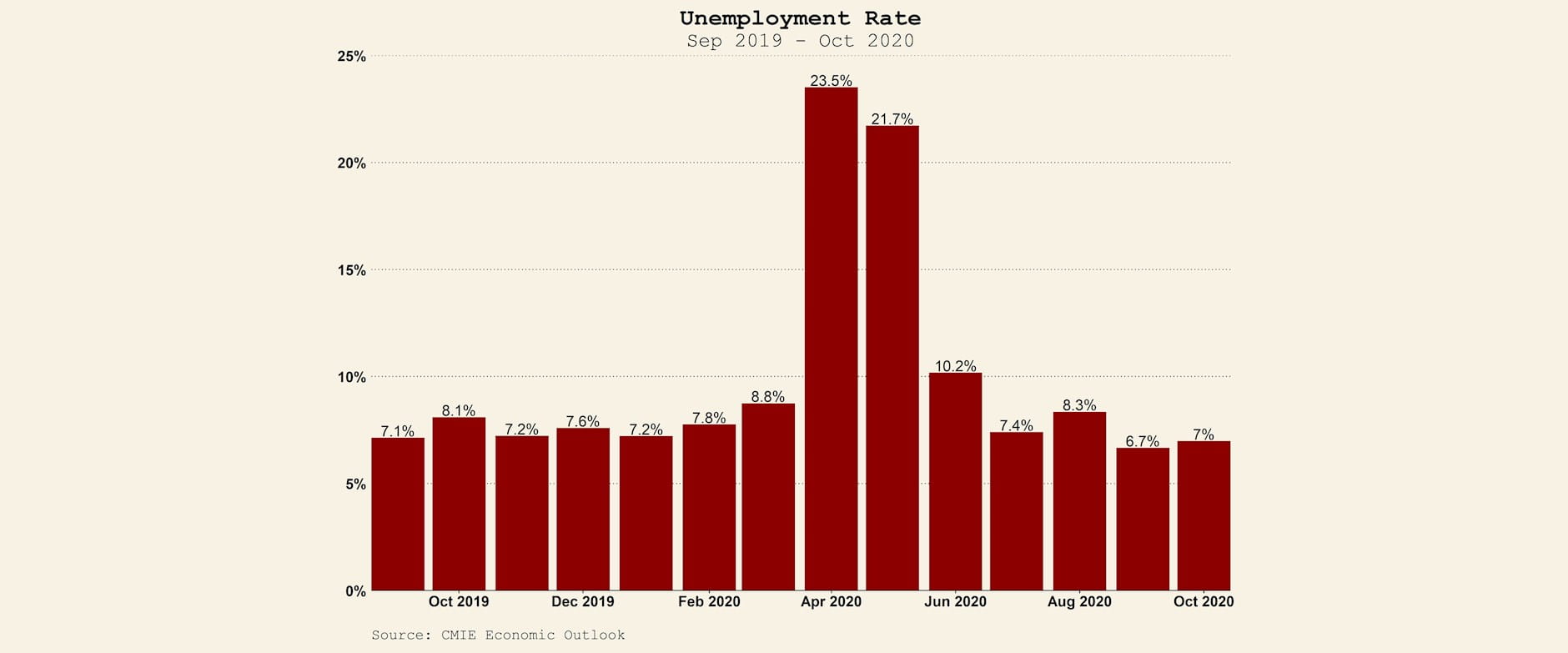

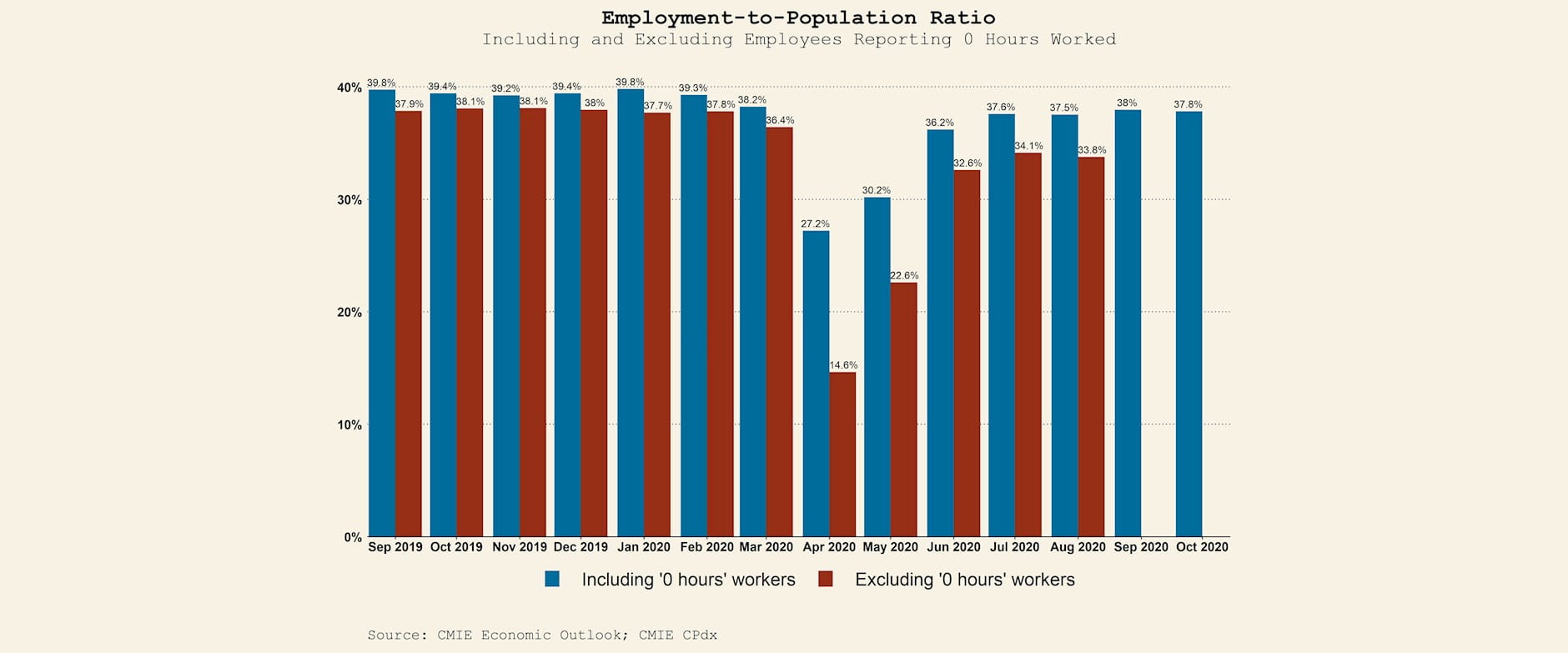

When the lockdown ended there were rapid improvements in unemployment, employment, income, and consumption. But, the recovery is not complete. Most of these economic indicators have still not reached their pre-lockdown levels, and whether and when they will do so remains unclear. Further, these figures make it clear that the comprehensive view granted by household level data provides important insights beyond those possible from more aggregated indicators.

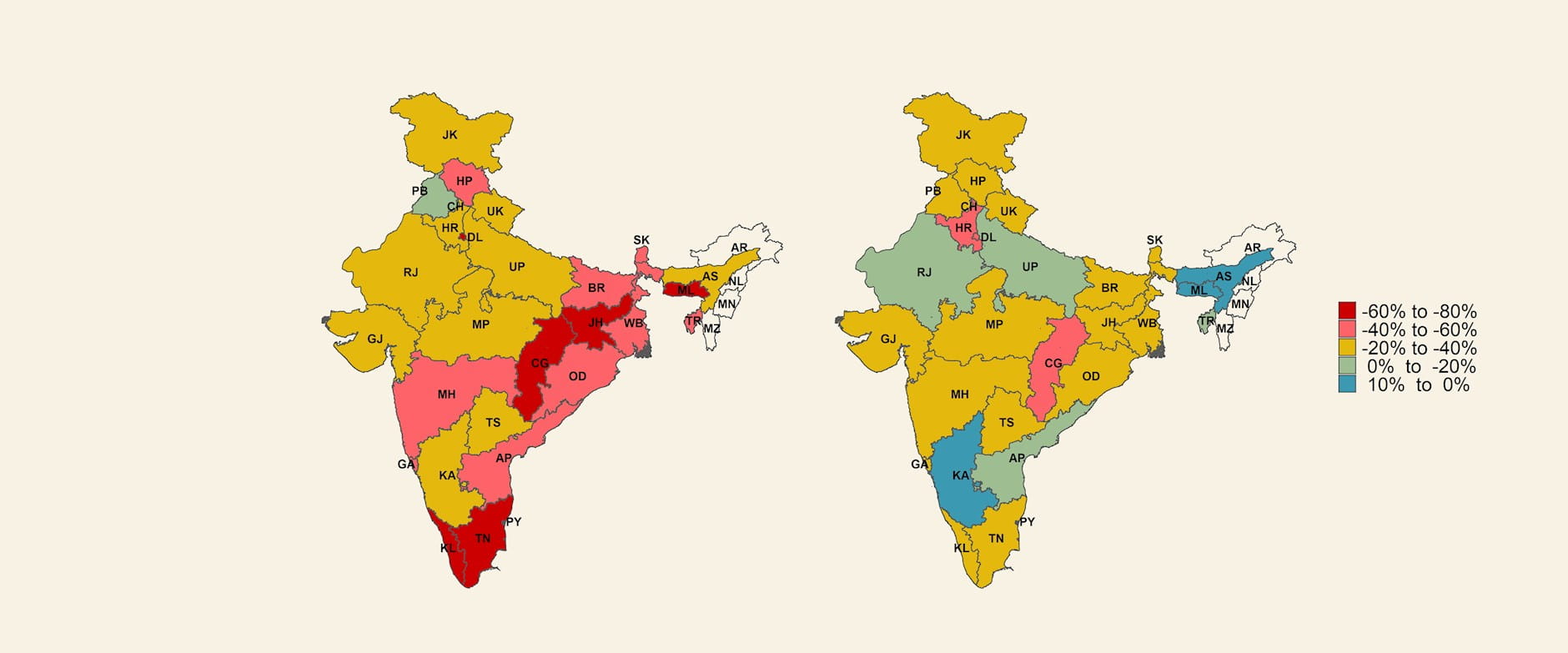

The Indian central government has recently announced a new stimulus package worth 15 percent of India’s GDP. [23] Critically, this includes schemes to incentivize job creation and to increase demand. As new data become available, we will continue to document trends over time and assess whether these stimulus measures are helping accelerate the recovery in household incomes and expenses. We will also try to understand what drives the large geographic variation in the severity of the economic shock and the speed of recovery and investigate why some individuals and households take longer to recover from the lockdown than others.

Check back to Rustandy's Coronavirus Social Impact Research page for the latest results. Read the press announcement.

Marianne Bertrand, Chris P. Dialynas Distinguished Service Professor of Economics, University of Chicago Booth School of Business, and Faculty Director, Chicago Booth's Rustandy Center for Social Sector Innovation and UChicago’s Poverty Lab; Rebecca Dizon-Ross, Associate Professor, University of Chicago Booth School of Business; Kaushik Krishnan, Chief Economist, Centre for Monitoring Indian Economy (CMIE); and Heather Schofield, Assistant Professor, Perelman School of Medicine and The Wharton School at the University of Pennsylvania. Emails: marianne.bertrand@chicagobooth.edu; kkrishnan@cmie.com; hschof@wharton.upenn.edu

Acknowledgements

We thank Adarsh Kumar and Karthik Tadepalli for excellent research assistance.

[1] — CPHS is conducted across the country, except in Arunachal Pradesh, Nagaland, Manipur, Mizoram, Andaman & Nicobar Islands, Lakshadweep, Dadra & Nagar Haveli and Daman & Diu. Some parts of Jharkhand and Chhattisgarh are no longer surveyed due to concerns for CMIE staff safety. Ladakh is also not surveyed as it is not accessible year-round. Data from CPHS is available as a subscription service entitled Consumer Pyramids dx. The data for this piece was downloaded on November 12, 2020 from the CPdx website. CMIE could conduct slight revisions of the data, particularly for monthly income and expenditure data for May and June 2020.

[2] — CPHS execution during the lockdown of 2020, Mahesh Vyas (19 Aug 2020), How We Do It Series, Consumer Pyramids Household Survey, CMIE.

[3] — October 2020 Review of Indian Economy: Macro-economic Performance, Manasi Swamy (14 Oct 2020).

[4] — October GST collection tops Rs 1 lakh crore, 1st time since February, Times of India (Nov 2 2020).

[5] — Government's revenues muted despite green shoots, Manasi Swamy (31 Oct 2020).

[6] — November 2020 Review of Indian Economy: Financial Market Performance, Manasi Swamy (5 Nov 2020).

[7] — October 2020 Review of Indian Economy: Sectoral Performance, Janaki Samant (21 Oct 2020).

[8] — October 2020 Review of Indian Economy: Macro-economic Performance, Manasi Swamy (14 Oct 2020).

[9] — Core industries' output nears year-ago level in September, Manasi Swamy (04 Nov 2020).

[10] — CMIE’s definitions for workforce statistics match those that are used broadly. Details of their methodology and definitions can be found here.

[11] — Petroleum products demand struggles to recover, Manasi Swamy (19 Oct 2020).

[12] — The employment-to-population ratio is computed among those 15 years of age or older. Anyone engaged in any economic activity on either the day of the survey or the preceding day of the survey, or is generally regularly engaged in any such activity, is considered to be employed. “Excluding '0 hours' workers” remove from the count of the employed individuals reporting zero hours of work on a representative day in the week period prior to being surveyed; this measure is only available until August 2020, the latest month of published CPHS data.

[13] — Others have also pointed to a collapse in the employment rate. See Employment falls in October (2 Nov 2020), Mahesh Vyas, CMIE; Labour markets weak in October, Mahesh Vyas (19 Oct 2020), Economic Outlook, CMIE; Labour force shrinks in September, Mahesh Vyas (2 Oct 2020), Economic Outlook, CMIE; Deceptive fall in the unemployment rate, Mahesh Vyas (21 Sep 2020), Economic Outlook, CMIE.

[14] — South Asia Economic Focus, Fall 2020 : Beaten or Broken? Informality and COVID-19, World Bank; Job losses in white and blue collar workers, Mahesh Vyas (14 Sep 2020); Salaried job losses, Mahesh Vyas; An unhealthy recovery, Mahesh Vyas (10 Aug 2020).

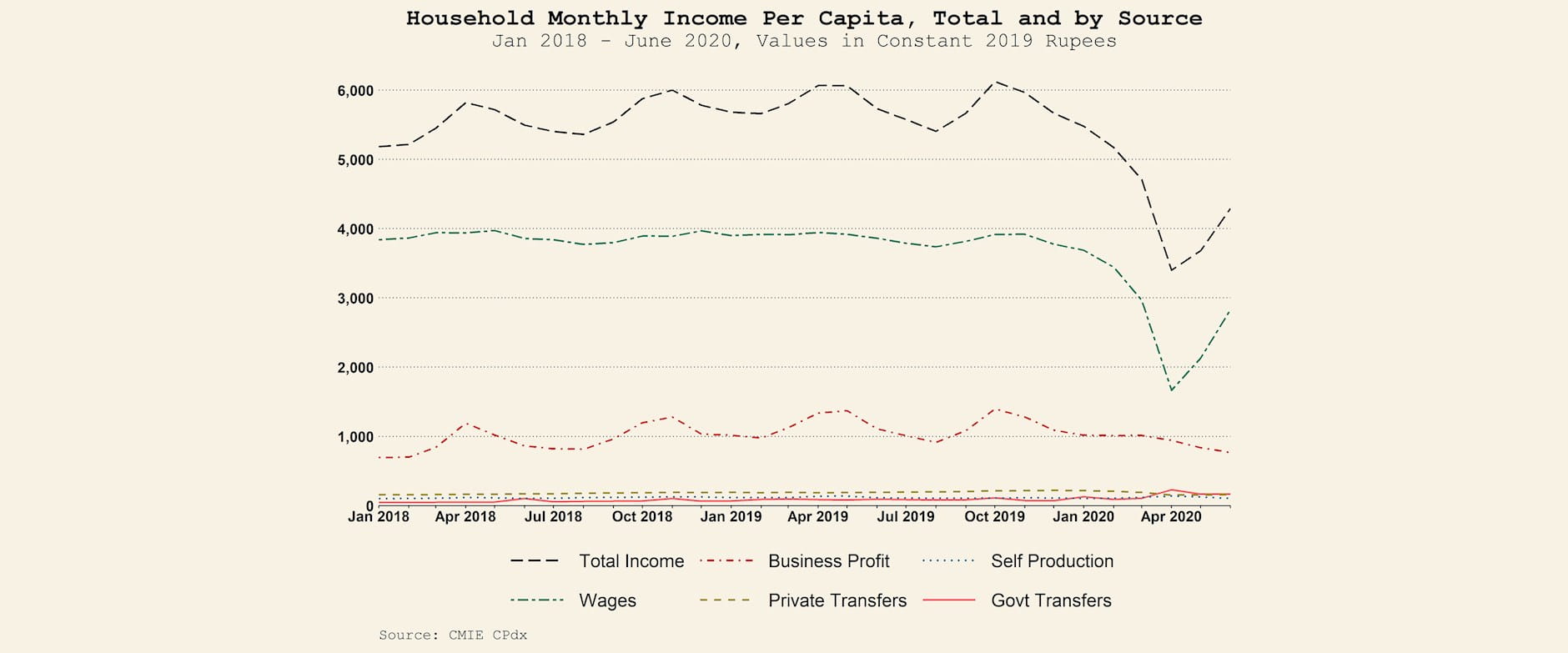

[15] — Per capita incomes are calculated by dividing the sum of household members' incomes by household size. Values are reported in inflation-adjusted constant 2019 Rupees using CPI data from the Ministry of Statistics and Program Implementation. Values are weighted using CMIE’s ‘country’ level weights to be nationally representative.

[16] — The R is deep, long and broad, Mahesh Vyas (19 Mar 2020), Economic Outlook, CMIE; It's a deeper recession, Mahesh Vyas (17 Mar 2020); The worst not yet over for Indian economy, Manasi Swamy (2 Mar 2020); Labour metrics flounder in February, Mahesh Vyas (2 Mar 2020); It's recession, Mahesh Vyas (24 Feb 2020); The Misery Index, Mahesh Vyas (17 Feb 2020); Where are the jobs?, Mahesh Vyas (28 Jan 2020); Indian economy in troubled waters, Manasi Swamy (3 Dec 2019).

[17] — CMIE records income earned from self-production and business profits at the household level. More often than not, such income cannot be attributed to an unambiguous person. Therefore, such data is collected at the household level, making it difficult to map these other sources of income into occupations. However, if a businessman or a self-employed individual takes a salary from the business, it is recorded by CMIE as wage income. Wage income also include over-time payments, bribes, monetary value of in-kind goods, and rent reimbursed by the employer.

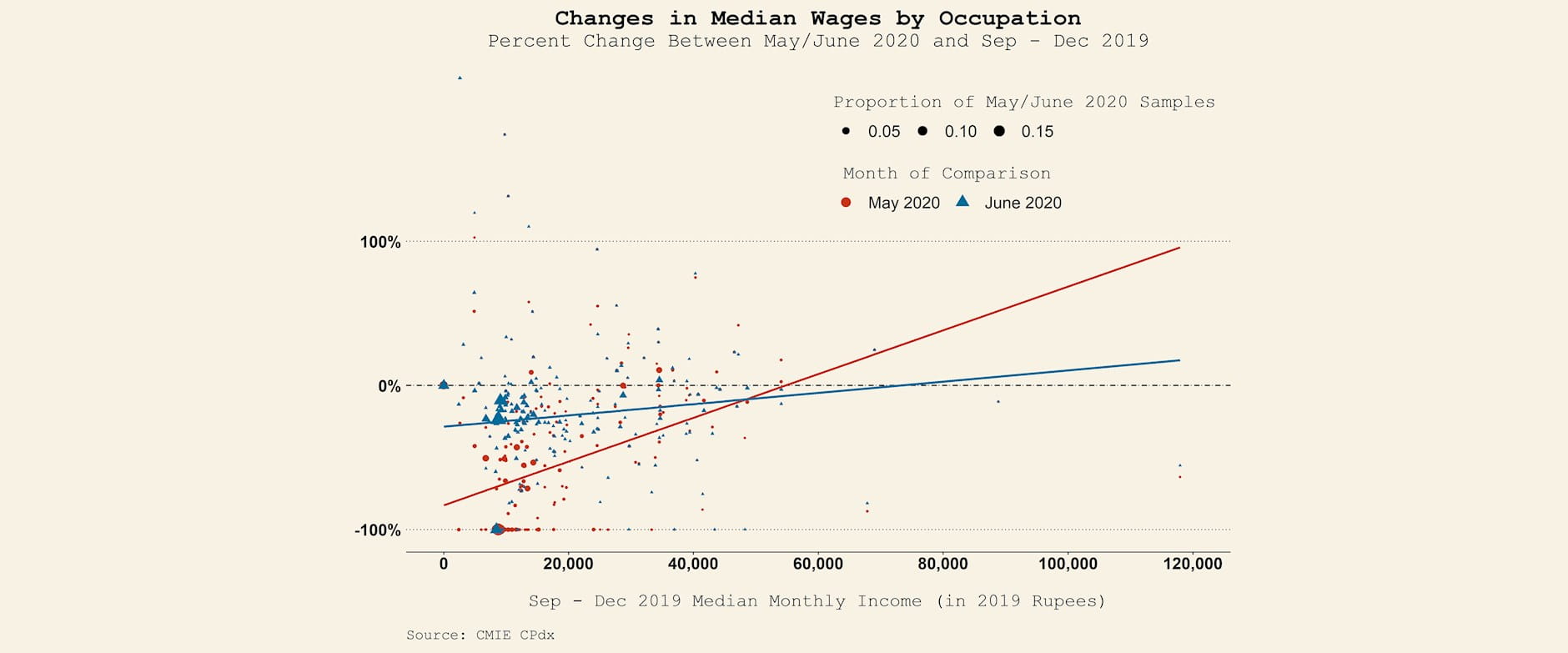

[18] — For the purposes of this chart, a member's occupation is assumed to be constant throughout a wave. Simple (unweighted) medians of wages for each occupation are taken for the period/months of interest. Size of the bubble corresponds to the unweighted proportion of the total sample employed in that occupation in May and June 2020 respectively. Only those occupations observed in the base period (Sep - Dec 2019) and the month of interest (May or June 2020) are included. Chart values reflect the percentage change in median wages in each occupation between the base period and month of interest. Occupations with Rs. 0 median wages in both waves are recorded to have a 0 percent change. Solid lines for May and June 2020 represent fitted values of the weighted regression run on percentage change in year-on-year income and Sep - Dec 2019 median monthly income; weights for the regression are the counts of the sample in an occupation in the respective month of interest. Values are reported in inflation-adjusted constant 2019 Rupees using CPI data from the Ministry of Statistics and Program Implementation.

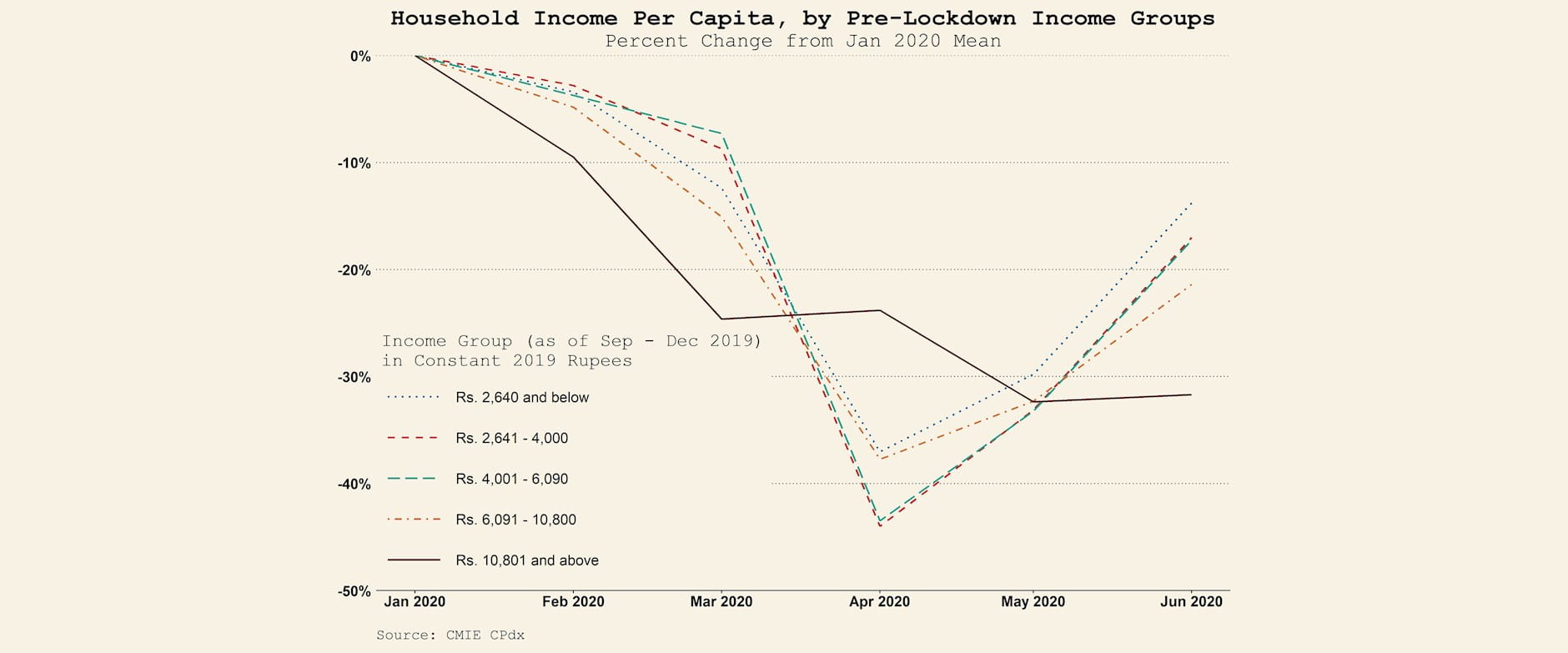

[19] — Sample is restricted to households in CMIE's September - December 2019 wave. Households that shifted residences have also been excluded. These restrictions require us to impose an additional adjustment factor to CMIE’s ‘country’ weights to account for the change in the sample. Our reweighting procedure causes the small town stratum in Udhampur district and the small and large towns strata in Anantnag district, both in Jammu and Kashmir to be dropped. Small towns are defined to be those with fewer than 20,000 households in Census 2011, and large towns are defined to contain 60,000-200,000 households in Census 2011. The five income groups are selected based on monthly income per capita in the September - December 2019 wave and they respectively account for, from lowest income group to highest, 20 percent, 25 percent, 25 percent, 20 percent, and 10 percent of the weighted sample in September 2019. We report changes in mean per capita income in each group relative to the group's mean income in January 2020. Per capita value is calculated by dividing household's total income by household size. Values are adjusted for inflation using CPI data from the Ministry of Statistics and Program Implementation.

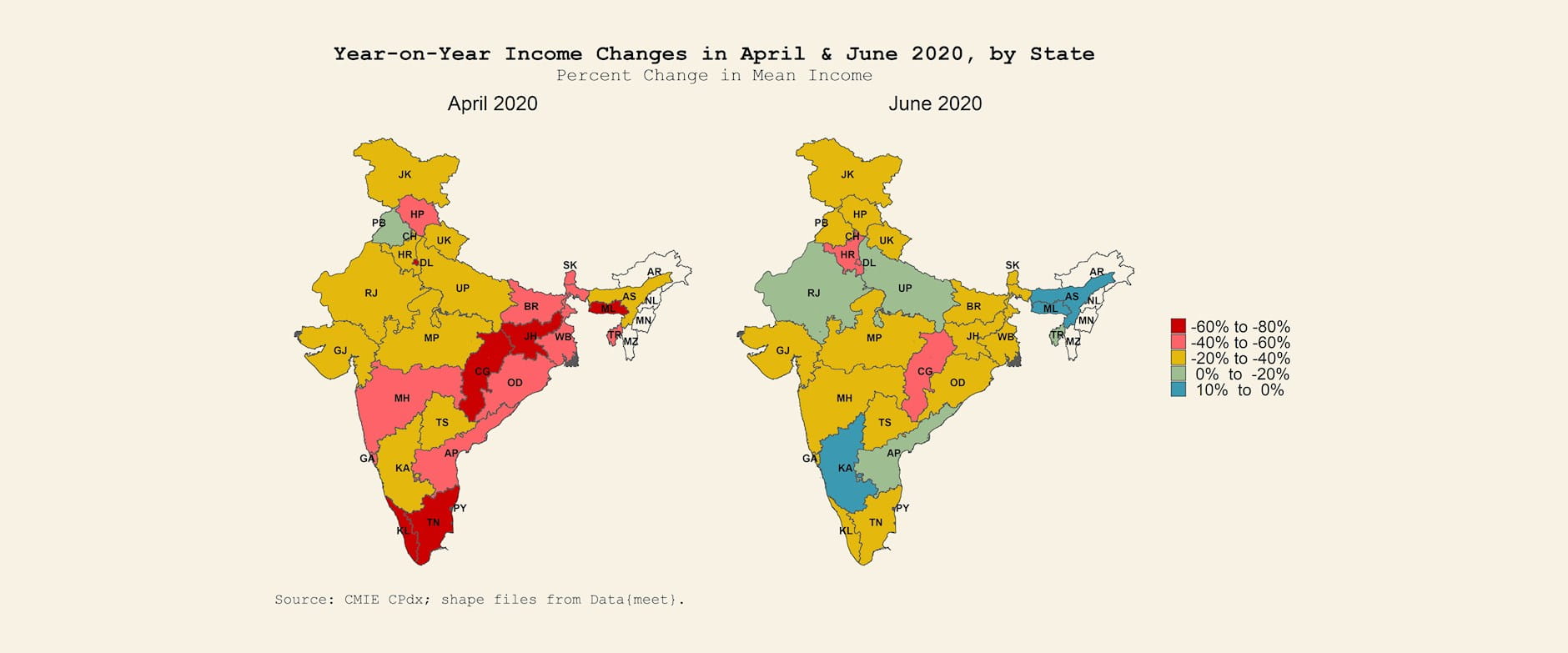

[20] — This figure uses shapefiles for India from Community Created Maps of India by Data{meet}. These shape files depict ISO countries and not sovereign states. We do not claim these to be maps that accurately depict India’s sovereign or internal political borders. Any queries or issues regarding these shape files should be directed to Data{meet}. Values are adjusted for inflation using CPI data from the Ministry of Statistics and Program Implementation. Values are weighted using CMIE’s provided ‘state’ level weights in order to appropriately represent mean values of each state.

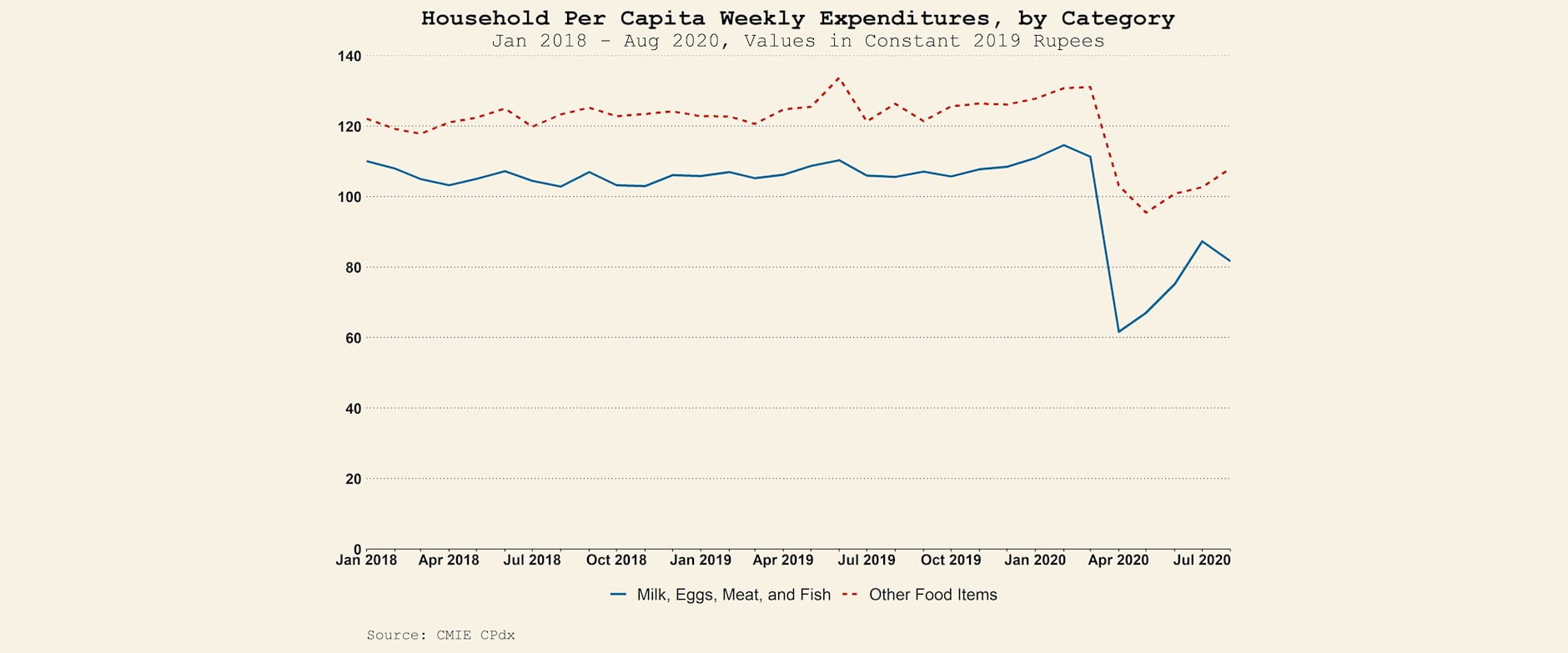

[21] — Per capita value is calculated by dividing household’s weekly expenditures by household size. Values are reported in inflation-adjusted constant 2019 Rupees using CPI data from the Ministry of Statistics and Program Implementation. In order to reflect month-on-month changes, an unweighted mean is taken for each month of survey execution. “Other Food Items” include vegetables and wet spices, including potatoes and onions, fruits, bread, biscuits, salty snacks, sweets, chocolates, cakes and ice cream.

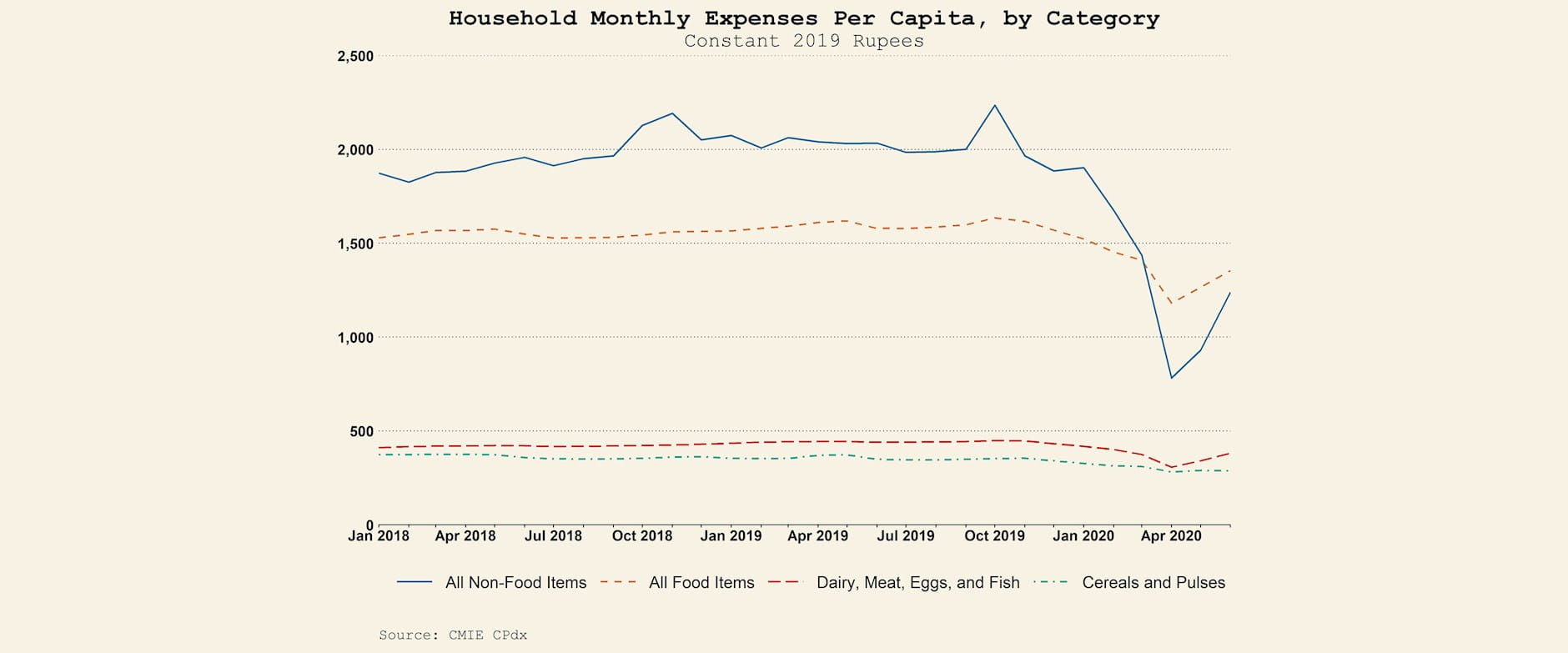

[22] — Per capita value is calculated by dividing household’s monthly expenditures by household size. Values are reported in inflation-adjusted constant 2019 Rupees using CPI data from the Ministry of Statistics and Program Implementation. All series, except “Cereals and Pulses,” use CMIE’s 'adjusted' monthly expenditure data. Values are weighted using CMIE’s provided ‘country’ level weights in order to be nationally representative.

[23] — Atmanirbhar Bharat 3.0: Total stimulus package announced is of Rs 29.87 lakh core, 15 percent of GDP, says FM Sitharaman, Moneycontrol News.