As the business world considers the importance of striving for social as well as financial returns, students at the University of Chicago Booth School of Business will soon be able to direct investments into companies already embracing the practice.

With a $1 million gift from Booth alumnus Ron Tarrson, ’72 (XP-31), Chicago Booth’s Rustandy Center for Social Sector Innovation has established the Steven Tarrson Impact Investment Fund—one of the largest student-managed impact investing funds in the country

The impact investment fund will support direct private investments into early-stage social impact companies, allowing Booth MBA students to gain real-world experience in impact investing and crucial connections to a network of early-stage impact investors partnering with the fund.

“Increasingly, students are picking business schools based on their ability to help students address social issues,” said Rob Gertner, Chicago Booth’s Joel F. Gemunder Professor of Strategy and Finance and John Edwardson Faculty Director of the Rustandy Center. “This fund gives Booth students a unique opportunity to link theory to practice, and the Rustandy Center is poised to make Booth an education leader in the field of impact investing. The Steven Tarrson Impact Investment Fund is an indispensable component in achieving this.

Investors around the globe are embracing impact investing as a way to leverage capital for social good. According to the 2019 Annual Impact Investor Survey by the Global Impact Investing Network, impact investing is an industry on the rise, with impact measurement and management becoming increasingly important to investors’ goals.

The fund joins an ever-growing list of impact investing resources available to students at Booth, including internships, courses in traditional and social impact investing, scholarships, competitions, events, and one-on-one mentoring led by the Rustandy Center, Booth’s destination for people committed to helping solve complex social and environmental problems. (To view a complete list of the Rustandy Center’s offerings, click here.)

“Despite this growth in the overall impact investing ecosystem, a gap remains in early-stage catalytic funding for social enterprises,” Gertner said. “The fund will seek to fill some of those capital gaps to support the next generation of social entrepreneurs.”

Real-World Investing Experience

The idea for the Steven Tarrson Impact Investment Fund started with Booth students. Years of continued interest culminated in spring 2019, when students collaborated with the Rustandy Center to research funds at peer schools, survey student interest, and explore models that might work.

Tarrson’s gift creates a fund that puts them at the center of day-to-day operations, supported by the Rustandy Center and with oversight from Booth faculty and investment professionals. Participating students will source investment deals, perform due diligence, and make investment recommendations to an external investment committee.

“The launch of this student-run impact investment fund demonstrates the Rustandy Center's and Chicago Booth's commitment to not only educating students in impact investing but also, more broadly, enabling students to solve pressing global issues,” said Lexi Zarecky, ’19, a recent graduate and Chartis Group consultant who researched the fund project. “I’m extremely excited for future students to have this opportunity and look forward to seeing the impact this fund will have on the global community!”

The investment fund differs from others at the University of Chicago because students are only considering direct investments in external mission-driven companies.

“Hands-on experience is critical for any student—or any investor, really—who hopes to move into impact investing,” said Priya Parrish, ’09, the Rustandy Center’s impact investor in residence and managing partner at Chicago’s Impact Engine. “Few business schools have a fund of comparable size backed by the breadth of resources and mentoring from the Rustandy Center. I’m proud to be an alumna of a business school that’s so committed to educating future leaders in the impact investing field.”

A Continued Investment in the Future

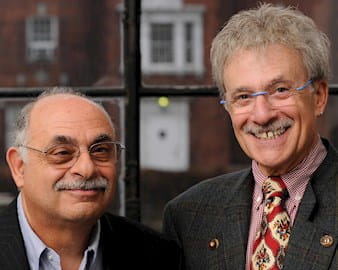

The goal of the Steven Tarrson Impact Investment Fund—named in honor of Ron Tarrson’s brother—is to complement Booth’s growing impact investing offerings. A long-time supporter of the business school’s programs, faculty, and students, Ron Tarrson has given more than $5 million to Chicago Booth. He is managing partner and director of Santa Fe Aero Services and The Jet Center Santa Fe, suppliers of avionics, maintenance, fuel, hangar, and concierge services for private and corporate aviation at the Santa Fe, New Mexico, Regional Airport.

Tarrson has been an early supporter and volunteer at the Rustandy Center. He serves on the Rustandy Center Advisory Council, is a sponsor of the John Edwardson, ’72, Social New Venture Challenge (SNVC), and in 2017 established the Tarrson Social Venture Fellowship, which provides funding and advising to recent University of Chicago alumni who work on their social enterprise full time after graduation. This gift furthers his legacy of providing catalytic capital for early stage social ventures and social entrepreneurs while also supporting experiential learning for Booth students.

“Situated in a top school for finance and investing, Booth’s Rustandy Center is seeding the growth of the impact investing field,” Ron Tarrson said. “I’m proud to help Booth students make an impact in this space post-graduation.”

If you'd like to receive updates on social impact stories, events, and research at Chicago Booth, sign up for the Rustandy Center's newsletter. Note: We want to demonstrate our commitment to your privacy. You can review Chicago Booth’s privacy notice for more information.

Questions about the fund? Contact Will Colegrove at will.colegrove@chicagobooth.edu.