Instead of focusing on cutting costs, Roman is thinking ahead to the future, luring top tech and finance talent to the company.

From an early age, Roman’s intelligence and curiosity stood out. Born in Paris to two artists, he grew up reading the books that lined the walls of their apartment. He also had a talent for mathematics, which he studied, along with economics, at Paris Dauphine University, graduating in 1985. He then earned his MBA in 1987, having completed the Full-Time MBA Program, in which he studied finance and econometrics.

“I’m very grateful to have made friends for life,” Roman said. “I’m also very grateful to have met a few people who taught me there were things I could do, difficult topics I could learn, and difficult classes I could take that I didn’t think I was able to.”

From 1987 to 2005, he worked at Goldman Sachs, building his reputation in prime brokerage as the industry boomed. By 1998, Roman was partner, and in 2001, he was named cohead of worldwide global securities services. In 2003, he became cohead of the European equities division.

Roman joined London-based hedge fund GLG Partners as co-CEO in 2005, and earned the trust of investors through his careful study of the industry and extensively detailed grasp of GLG’s funds and the markets as a whole. He steered the firm through various crises, and helped to list GLG on the New York Stock Exchange in mid-2007. In 2010, he initiated the sale of GLG to London investment management firm Man Group, for $1.6 billion, a move considered by many at the time to be a gamble for Man Group.

“One thing that Booth did for me was to [instill] this incredible quest for knowledge and for data. I was lucky enough to learn from some of the best minds of the generation,” said Roman. “The quantum jump in terms of intellectual curiosity and knowledge that I gained from my education I will always be thankful for.”

Roman was named president and COO at Man Group before becoming CEO in 2013. The stock more than doubled in price during his first two years. His big-picture focus had a marked impact when he made the call to reduce Man Group’s reliance on its AHL Diversified Fund, cutting costs and diversifying the business through a series of acquisitions. It paid off: Man Group’s assets increased by 38 percent and its share price by 20 percent.

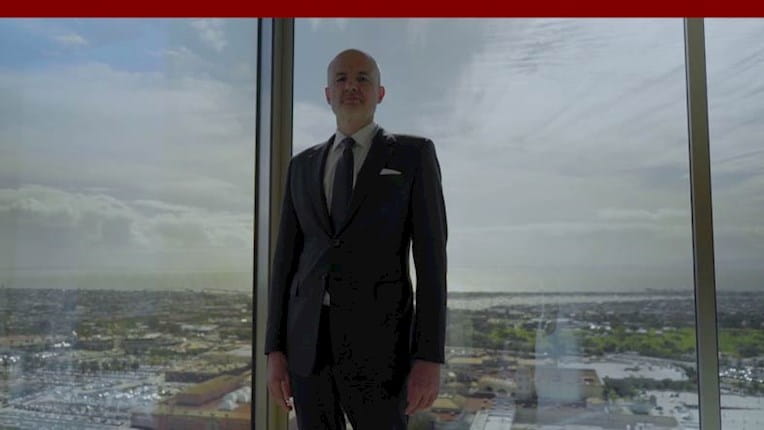

In November 2016, Roman became CEO of PIMCO. His push toward leveraging new technologies and hiring new talent has been a success. Since 2016, the firm’s total assets have increased by $300 billion, including a record $62 billion asset inflow in the second quarter of 2017. The firm’s total assets are at $1.66 trillion today.

During Roman’s tenure, PIMCO has partnered with nonprofits such as the Global FoodBanking Network and Girls Who Invest, as well as with the California Institute of Technology, to establish two fellowships. He also pushed toward technology growth through the decision in 2018 to open a new office in Austin, Texas, where half of the 200 workers will be tech specialists. PIMCO has also partnered with the Center for Decision Research (CDR) at Chicago Booth in support of its behavioral science research. In recognition of this investment in research, the CDR laboratories were renamed the PIMCO Decision Research Laboratories, and will include a new “storefront” behavioral science research lab to foster greater engagement with the public, broaden the labs’ reach, and increase diversity of participants in the research studies.

Roman’s decisiveness and intellectual curiosity continue to distinguish him among his colleagues. A true polymath, he is a voracious reader who has held a board seat at Penguin Random House and acted as trustee of the Paris Review; he is a wine connoisseur, the owner of an extensive art collection, and trustee at the University of Chicago.

“I remember receiving the admission package in the mail in France in 1985 and knowing that I had been admitted, which I could hardly believe, and it feels like yesterday,” Roman said. “This school has been unbelievably good to me.”