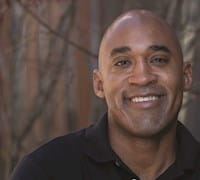

Sherman Williams II, ’12, launched the Academy Investor Network, a New York–based venture capital fund and investment syndicate for US Service Academy graduates, in 2020 with cofounder Emily McMahan. It was the culmination of a journey that included formative stops in Afghanistan and Southeast Asia as a US Naval Intelligence officer, Chicago to earn his MBA at Booth, then New York as an investment banker. It was the Private Equity/Venture Capital Lab at Booth that sparked his interest in investing to make an impact. “I call it the double bottom line,” he said. “I invest not only for the bottom line, but also with purpose.”

It’s an exciting time for AIN, which recently announced that USAA is making an anchor investment into AIN Ventures Fund I. While working at AIN as a full-time investor, Williams also mentors startups through Techstars, a venture capital accelerator program focused on entrepreneurs. His days require that he show up early and stay late.

“I’m in grind mode right now,” said Williams. “I’m at an aspirational point of my life.”

5:15 AM First thing in the morning, I peel off as many emails as I can. I always try to be at Inbox: 0 by Saturday at noon. The trick is to never let it go above 200.

7 AM Every day, I either do yoga at home or walk to the gym. I protect this part of my mornings for my own deep work and health so I can show up fully for my partners and companies for the rest of the day.

8:30 AM I walk three minutes to my office space in downtown Manhattan to begin investor outreach. I’m looking for limited partners who share our vision. This is my top priority, so I block out my calendar from taking any other calls.

I call it the double bottom line. I invest not only for the bottom line, but also with purpose.

— Sherman Williams II

10:30 AM My cofounder, Emily, and I have a standing call to talk about different funds, deals, and admin. I went to the US Naval Academy and bring expertise in investing and vetting startups, particularly in the health-care and tech spaces. She went to West Point, she is an entrepreneur, and she is a veteran in the DC entrepreneur ecosystem. We’re a good team.

11 AM I head into back-to-back Zoom calls with potential LPs or companies that I want to invest in. AIN has two areas of investment focus. The first is veteran-led startups in any sector. The second is nonveteran-led startups within dual-use technology—companies that have both commercial and government purposes. We’re aiming to invest in 10 companies a year.

5 PM Emily and I have another end-of-day check-in with our interns, one of whom is a student at Booth. We discuss our thoughts around a particular deal. I head home after this last call.

6:30 PM I finish any emails and work-related emergencies. Then I try to decompress, either by watching something on TV or calling a friend. Now that I am fully vaccinated, I make it a point to go out to dinner and be around other humans outside of a work setting at least once or twice a week.

10:30 PM Off to bed. My schedule is spartan and regimented right now. But it’s so worth it. We’re building a new venture fund while also cultivating an ecosystem of Service Academy graduates to invest in, and I’m all in. My business is my activism. Investing is my activism. The country has been through tough times over the past year, but AIN is a continuation of my military service, and my way of being part of the solution. It’s my way of giving back and being a good citizen.