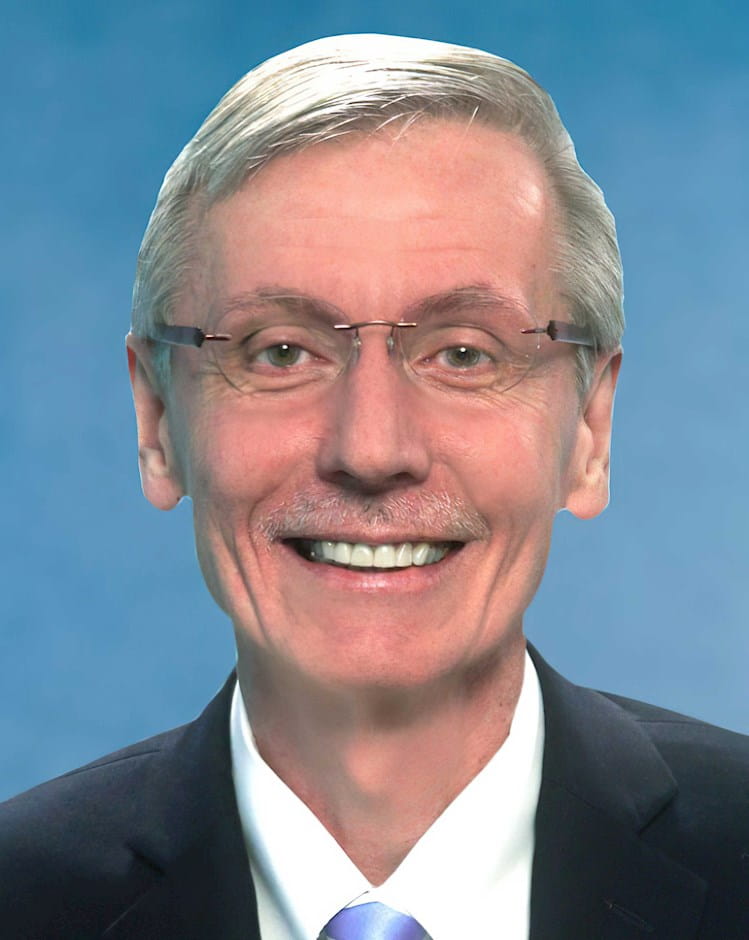

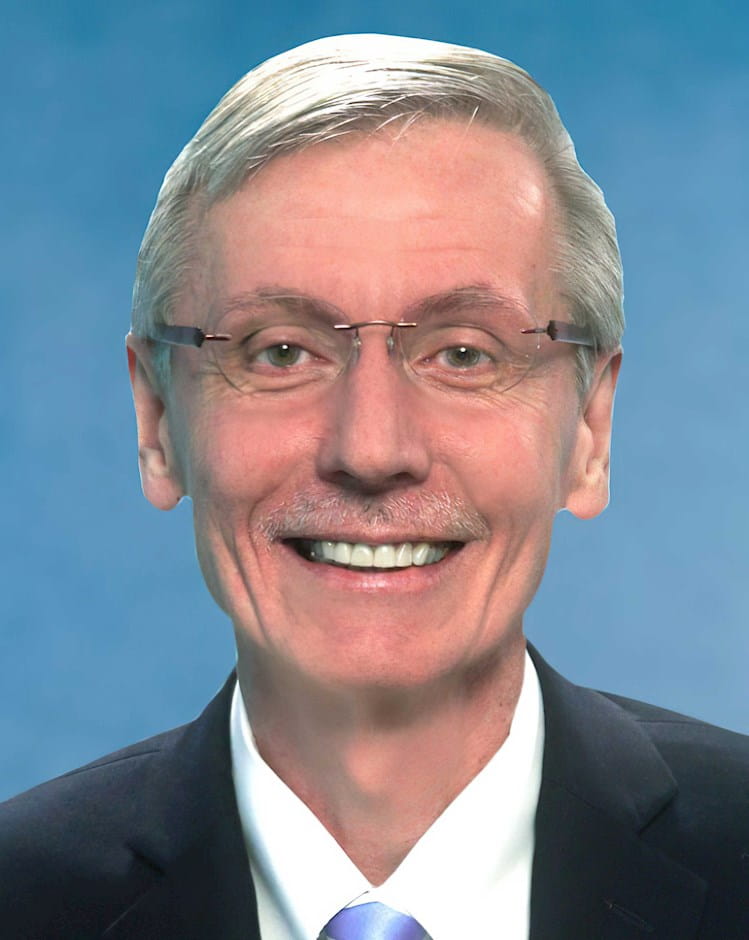

Biography

John R. M. Hand is a visiting faculty member from UNC Kenan-Flagler where he is the Robert March & Mildred Borden Hanes Distinguished Professor of Accounting. At Booth, Dr. Hand teaches Financial Statement Analysis.

At his home institution of UNC Kenan-Flagler, Dr. Hand teaches in the MBA, Masters of Accounting (MAC), Undergraduate, and Executive Development Programs. In 2019 he received the UNC Kenan-Flagler Distinguished Research Award, and in 2013 and 2008 the UNC Kenan-Flagler Weatherspoon Awards for his MAC and MBA Teaching, respectively. Dr. Hand served as associate dean of UNC Kenan-Flagler’s top-ranked MAC Program from 2007-2011. He has 20 years of financial experience in the not-for-profit world as Treasurer of the Chapel Hill Bible Church (1996-2005) and Treasurer of Trinity School of Durham & Chapel Hill (2006-2016). Over the past 20 years he has also served as a key business plan and valuation advisor to, and/or on the Board of Directors of, six NC-based startups, primarily in the medical device area.

Dr. Hand he earned his 1st Class B.Sc. in Accounting at Bristol University, England, his MBA and PhD degrees from the University of Chicago Booth School of Business (formerly GSB), and taught at Booth (GSB) from 1988-1993. With research interests in accounting, finance and entrepreneurship, Dr. Hand’s studies equity analysts’ valuation models, financial statement forecasts, and cost of capital estimates.

Academic Areas

- Accounting

2025 - 2026 Course Schedule

| Number | Course Title | Quarter |

|---|---|---|

| 30130 | Financial Statement Analysis | 2026 (Spring) |