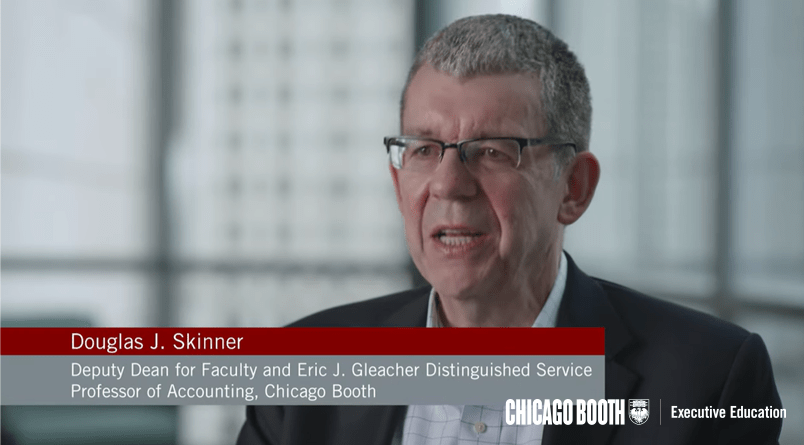

Douglas J. Skinner

Sidney Davidson Distinguished Service Professor of Accounting

Douglas J. Skinner

Next Session

April 20-April 24, 2026

View All Dates

Location/Format

In Person

Gleacher Center, Chicago

Investment Fee (in USD)

$12,500 USD

Questions? Connect with an enrollment advisor.

Next Session

April 20-April 24, 2026

View All Dates

Location/Format

In Person

Gleacher Center, Chicago

Investment Fee (in USD)

$12,500 USD

Questions? Connect with an enrollment advisor.

The Executive Finance Program is designed for executives who seek to improve financial corporate performance through stronger strategic and financial decision-making.

With online preparation completed in advance, this five-day program will deepen your understanding of corporate finance and examines how financial and business strategies intersect to drive value. Through Booth’s rigorous, research-based curriculum, you’ll not only strengthen strategic alignment and support long-term growth, but also gain hands-on fluency in the tools senior leaders use to make financial decisions.

By the end, you won’t just understand the numbers—you’ll know how to use them to drive performance, strengthen alignment, and lead with confidence in the boardroom.

This program serves as an elective to:

By attending, you'll strengthen your ability to:

Financial Statement Mastery:

Valuation & Capital Structure:

Growth and Entrepreneurial Finance:

External Pressures and Real-World Insights:

Mid- to senior-level executives with strategic financial responsibilities—whether in finance or other functions—who manage P&Ls, allocate resources, or shape outcomes.

Download the program brochure for in-depth insights into who should attend, participant profiles, and the ideal candidate.

At Booth, our distinguished faculty exemplify dedication and expertise, bringing deep passion to their teaching. Their steadfast commitment extends beyond traditional instruction, focusing on empowering every Executive Education participant, across all programs and global campuses, to achieve their professional and leadership goals.

Fireside Chat with Industry Leaders

One of the most engaging features of this program is a candid fireside chat with a distinguished guest speaker. This senior leader shares how they have navigated strategic challenges inside their organization, offering you practical lessons that complement Booth’s academic rigor. Past speakers have included senior executives such as:

Download the brochure for additional insights into how this program drives real-world impact.

This program incorporates a value-added pre-program preparation component that equips you with the core concepts and tools needed to maximize your learning experience. By completing this work in advance, you’ll arrive more confident, informed, and ready to apply new insights immediately.

Before stepping into the classroom, you’ll begin with an online learning experience that lays the groundwork for your classroom time at Booth.

Online: 8—12 Hours of Preparation

|

In-Person: 3 Days in the Classroom |

|

Start your journey online—build your foundation through a series of interactive online modules. |

Transition to the classroom and be prepared to go further—applying frameworks and collaborating with peers. |

“The program was not only insightful but truly transformative. It reshaped the way I approach financial strategy and decision-making by giving me practical tools I can apply immediately in my role. What stood out most was the combination of world-class faculty, real-world case studies, and the opportunity to learn alongside other senior leaders from diverse industries. It was absolutely worth the financial and time investment, as the return has been clear in the way I now drive impact within my organization.”

—Tosin Okojie, Board / Founder, Hillside Ventures

“As a scientist transitioning to financing of companies via venture capital, the concepts and more important business thought process and analysis taught during the course will be invaluable.”

—Juan Harrison, Vice President, Takeda Ventures Inc.

We recommend registering at least two weeks before the program start date to allow ample time for pre-program preparation. See Pre-Program Preparation for details.

Program dates are subject to change.

Download the program brochure for in-depth insights on who should attend, a schedule preview, past participant profiles, location highlights, networking opportunities, and what to expect. When doing so, you’ll also receive an editable justification letter to help you make the case to your employer for your attendance.

All fields required.

Inform your peers and coworkers about this program.