Despite improvements in advertising quality, firms haven’t figured out the real impact of their digital advertising dollars.

- By

- December 01, 2015

- CBR - Marketing

Despite improvements in advertising quality, firms haven’t figured out the real impact of their digital advertising dollars.

Check out a pair of shoes online, and you may find them following you around: in a display advertisement parked in the margin of a news story, or in the otherwise minimalist corner of a search-engine results page, or perhaps in the subject line of an email. That’s because digital advertising, and the technology that drives it, is evolving. Advertisements can appear across multiple sites and even multiple devices, and native ads feel more like articles. But more-sophisticated and more-targeted ads don’t necessarily translate to more-effective advertising strategies.

Research suggests that, despite improvements in advertising quality, firms haven’t figured out how to best spend their digital advertising dollars. “There’s a real split between how academics [and advertisers] think about this question” of digital advertising’s return on investment, says Chicago Booth’s Chris Nosko. “If you ask practitioners, they would tell you that these [ad campaigns] are wildly successful.”Not surprisingly, digital advertising is the fastest-growing advertising category, with spending expected to reach $58 billion in the United States this year, a 2.5 percent increase from 2014, according to Strategy Analytics, a market-research firm based in Boston. The mobile segment of the category grew 34 percent in the last year, according to the 2015 Internet Trends report from Mary Meeker, who runs digital investments for the venture-capital firm Kleiner Perkins Caufield & Byers. So what are advertisers getting in return for their heavy investment in digital exposure?

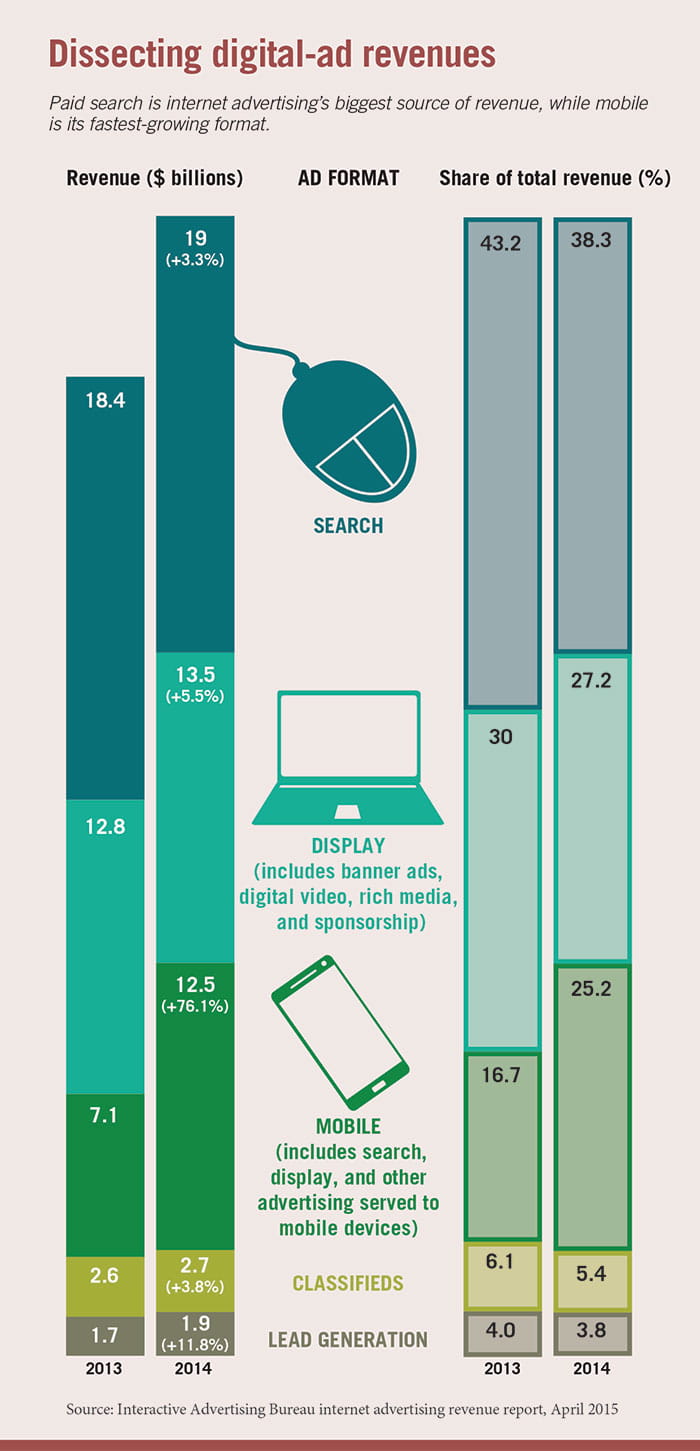

In 2011 Nosko spent the year working at eBay Research Labs, studying, with Thomas Blake of eBay and Steven Tadelis of the University of California, Berkeley, the efficacy of ads that surface in response to user searches on sites such as Google, Yahoo, and MSN. To advertise on most search engines, companies bid on relevant search keywords; when users search those terms, they see a sponsored link to the company, often above or alongside the organic search results. Paid search is internet advertising’s biggest stream of revenue, with nonmobile search alone generating $19 billion in 2014, according to the Interactive Advertising Bureau.

But Nosko’s research indicates that when eBay stopped paying for ads to appear during keyword searches that included its name—for instance, “eBay camera”—it nevertheless retained nearly 100 percent of the click traffic to its site. In the absence of paid ads, consumers could simply click on the nonsponsored search result linking to eBay instead.

Nosko and his team also tested turning off paid search ads for nonbrand searches—searches that didn’t include “eBay”—in some cities, while maintaining a control set in other parts of the country. Their results showed turning off the ads did have some effect on search traffic (a decline of about 2 percent of total clicks), but not much impact on revenue, in part because users could find their way to the site through other means, such as direct navigation. “eBay was spending a lot of money advertising to consumers that were going to come to their site no matter what,” Nosko says.

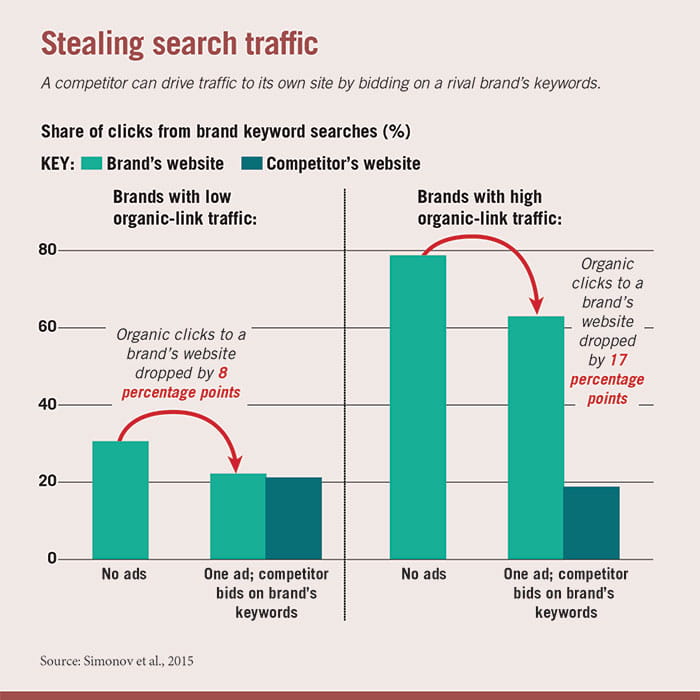

For firms with less brand recognition, spending on search can be a better investment than for firms with already established brands, according to research. Nosko has conducted further experiments showing that smaller firms derive different results from paid search than do large companies such as eBay. Many smaller companies can benefit from investing in paid search advertisements as a means of driving traffic away from top competitors in their field. “For firms that are less well established, advertising on these search engines looks differentially better,” says Nosko, who conducted the research with Chicago Booth PhD candidate Andrey Simonov and Microsoft Research’s Justin M. Rao using Microsoft’s Bing search engine. “Firms with higher brand capital benefit less from bidding on their own brand’s keywords.”

The researchers find that by bidding on competitors’ keywords, less-dominant brands can not only drive traffic to their own site and away from competitors, but also make those keywords more expensive for their competitors to invest in.

In some cases, businesses can benefit from going back to the basics of digital self-promotion. Chicago Booth’s Pradeep K. Chintagunta says that discount emails, one of the original forms of online marketing, can yield unexpectedly cost-effective results compared to other forms of digital advertising. Though discount emails are not technically ads, they can be just as beneficial in a digital environment, he argues.

In a study of 70 offers from a ticket-resale platform offering discounts for specific events, Chintagunta, along with Stanford’s Navdeep Sahni and Booth PhD candidate Dan Zou, reveals that simply sending offers to consumers via email can boost sales, even if recipients don’t take advantage of the emailed promotion. The researchers find that the email offers in the study increased spending by more than 37 percent, or $3.03 on average, though most of the gains were not from purchases of the advertised offers. Rather, they appear to have served as a reminder of the business.

Most companies are aware of how effective emails can be, and tend to offer perks such as store discounts to customers who sign up for their email subscription lists, in part because sending offers via email can be easier and cheaper than condensing the information into a banner ad. Opening an email also implies some initial engagement on the user’s part. “An email is like a magazine,” Chintagunta says. “You only pick up a magazine that you are interested in reading.”

Marketing big-ticket items via email can be especially beneficial because it grabs the user’s attention, he adds. And email offers can have a long-lasting effect: the researchers find that a week after the offers in the study were sent, the resale-ticket platform saw average spending increases of $1.55.

Still, Chintagunta says it’s important to understand how to make this type of email marketing even more productive. He is researching the effect of adding what he calls “noninformative” content to a marketing email. Just adding a user’s or company’s name to the subject line of an email can keep consumers from clicking Delete, he says. He also notes that this type of personalization method can be especially effective for expensive items, where consumers are eager to get special treatment.

The potency of long-established approaches such as email hasn’t discouraged innovation and risk taking as hardware has changed. At MillerCoors headquarters in Chicago, the company has been trying new ways to integrate mobile devices into its marketing strategy. Most users don’t spend much time on search engines when using their smartphones, which has created the need for marketers to rethink the advertising landscape, says Dilini Fernando, digital marketing manager at MillerCoors. “If you go to a bar, the closest thing to a beer is a mobile device,” she says. “We are able to use the mobile device to get closer to the purchase point.”

Fernando heads the brewing giant’s year-old digital incubator, where start-ups experiment with new forms of digital marketing. Employees are encouraged to work on new ideas within the incubator to mitigate the risk of failure. “It’s an ongoing series of experimentation,” she says. “Then we pivot, and scale their ideas across the company.” Last year, about 10 of the 20 projects created through the incubator were implemented company-wide.

For one of the projects, the brewing company worked with free-alcohol-delivery start-up Drizly to target sports fans through Twitter, which MillerCoors customers typically access from their phones. When a consumer sent out a Tweet such as “Go team,” a sponsored Drizly post would offer the Twitter user free beer delivery. Consumers would be redirected to Drizly’s microsite to complete the checkout process on their phones. “How we use mobile is going to be increasingly important, specifically for [targeting] millennials,” Fernando says.

Many companies are already putting some of the best practices into place. Rocket Fuel, a digital-ad-buying platform, can now offer its clients the opportunity to target a consumer across all his devices—phone, tablet, and desktop computer, all of which were considered separate channels with their own discrete marketing plans just a few years ago, says senior product marketing manager Matt Aaronson. “We actually have visibility into when a laptop and a smartphone are a single person whom we are synchronizing our message to,” he says.

And when it comes to purchasing ads, more firms are focused on capturing narrowly defined audiences via a large volume of very specifically chosen websites, rather than relying on a comparative handful of traffic-heavy sites to target broad demographic profiles. “Digital marketers are now buying on millions of websites for a single campaign versus dozens,” says Aaronson.

Even more-traditional advertising channels, such as television, are slowly getting more precise, says Randall A. Lewis, a senior economic research scientist at Netflix who has worked for Yahoo and Google. Imagine watching your favorite cable drama with commercials selected specifically for you, the same way they are on your computer screen. “At some point in the next five years,” Lewis says, “all the same type of highly targeted technology will play out on standard television.”

Part of digital advertising’s appeal is the capacity for data observation, and despite this capacity—or perhaps because of it—understanding the real impact of digital ads can be tricky. Prior to joining Microsoft and Netflix, Rao and Lewis conducted research at Yahoo showing that an internet user’s high level of activity in general can be conflated with the positive outcome of digital advertising. “If a user is active enough to see a given ad or sign up at a given site, she is likely more active than usual and will thus be doing more of everything here, there, and everywhere,” write Rao, Lewis, and their fellow researcher, David H. Reiley Jr.

Some researchers point out that it’s important to focus on the effectiveness of advertising as a whole, not just data on highly trackable digital platforms, to obtain a clear picture of brand capital. For example, anything from print ads to billboards can influence how a consumer first interacts with the brand, but most companies track only how a consumer uses a keyword search rather than conducting a more systematic analysis, says Chintagunta. “There’s an inclination to attribute the outcome—that people reached your site—to search advertising, but it could very well be that that’s not what triggered them to click on the search result,” he says.

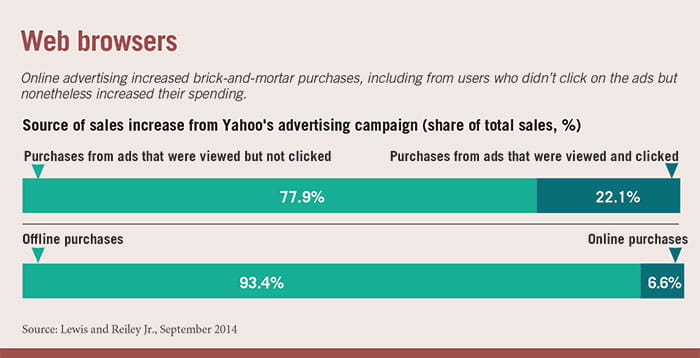

Others stress the importance of connecting online advertising to offline sales in a way that gives a more complete picture of how consumers allocate their spending. In 2007, Lewis and Reiley conducted another experiment while at Yahoo, this time demonstrating that online advertising can increase brick-and-mortar purchases. Tracking more than 1 million Yahoo users who also shopped at a selected anonymous retailer, the researchers were able to show that 93 percent of the lift in sales attributable to the ads came from shoppers buying offline.

In fact, 78 percent of the increase in sales in the Yahoo experiment was from users who never clicked on the ads. “Even though clicks are a standard measure of performance in online-advertising campaigns, we find that focusing only on clickers leads to a serious underestimate of the campaign’s effects,” write Lewis and Reiley in their findings. (The same authors later show, in research published in 2014, that the drivers of these digital-inspired brick-and-mortar sales are users 65 and older; see “Why internet advertisers should target the over-65s.”)

The question of how digital ads affect in-store sales is one more in the host of factors that cloud the picture of digital marketing’s true efficacy. So is the reality that any attempt to measure outcomes has to be undertaken without violating an increasingly large slate of privacy restrictions. But even when the analytical hurdles are low, digital advertisers often invest in puzzling ways.

It’s now been a few years since Nosko’s eBay experiments, but many large companies have been unwilling to test the effectiveness of their own advertising campaigns. “Billions are floating to companies that simply optimize and run campaigns without knowing if they are working,” says Rao—a statement he says is true of advertising in general, both online and offline. The degree of analytical sophistication among digital advertisers, he says, covers a broad spectrum.

It doesn’t help that the most accessible metrics are often also the most imperfect. When they paint a rosy picture of digital advertising’s impact, there could be a disincentive to chase more accurate measures. In other cases, more accurate measures may simply be too elusive. “Most people would prefer not to be held accountable for business metrics over which they have limited control,” says Lewis. “In digital advertising, we have a whole bunch of correlational metrics and a lot of them tell a positive story.”

But despite the challenges of acquiring meaningful data, he says, many advertisers are resisting complacency. “There’s kind of a shifting tide. Advertisers are more excited about [measuring the effects] and demanding more rigorous proof, at least within the digital environment.”

Making truly informed decisions about digital advertising may require more than just better metrics and testing, however. Rao says that search platforms such as Google and Bing have the informational capacity to help advertisers further optimize their campaigns, but it would require those advertisers to give up information on the true value of a click—information they’ve been reticent to give up, in part because of fears the platforms will use that information to raise prices. “Advertisers could share more information to the search engine on the value of sales after clicks, and search engines could share more information to the advertisers, all of which could really change advertising strategy,” Rao says, “but factors around incentives largely prevent it.”

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.