The Big Question: Can Big Companies Innovate Like Startups?

An expert panel discusses the challenges that big companies face in promoting innovation.

The Big Question: Can Big Companies Innovate Like Startups?Oracle CEO Larry Ellison reportedly made $96 million last year, Tesla Motors’ Elon Musk made $78 million, while JP Morgan Chase CEO Jamie Dimon reportedly made just $23 million. The average pay of the chief executive of an S&P 500 company has risen markedly since 1980, reaching about 100 times the median household income by the early 1990s. By 2000, it hit a high of 350 times. Although it is down to 200 today (to about $10 million), that figure still suggests a huge discrepancy in incomes. Perhaps unsurprisingly, two-thirds of respondents to the Chicago Booth/Kellogg Financial Trust Index, a survey of a representative sample of US households, say business leaders receive too much income for the jobs they perform.

But while there is more anger than pity circulating for the corporate elite, Steve Kaplan, Neubauer Family Distinguished Service Professor of Entrepreneurship and Finance at Chicago Booth, is making a sometimes–unpopular but data–driven case in defense of high–earning CEOs. Kaplan has written a string of papers challenging the common views that executive pay isn’t tied to performance, that boards rarely punish underperforming CEOs, and that average CEO pay keeps going up.

Instead, he argues, the market for talent largely determines CEO pay. This view puts him at odds with conventional wisdom, popular notion, and some of his colleagues down the hall. But the debate he is eager to have sheds light on questions about CEO pay, and his research suggests the issue is more complicated than is widely portrayed.

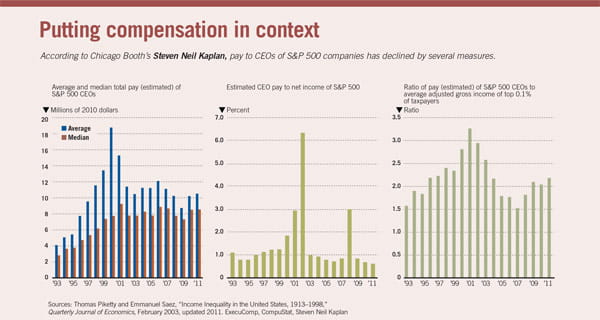

Kaplan, a driving force behind Booth’s Polsky Center for Entrepreneurship and Innovation, notes that the data do not support the popular narrative: in the United States, the pay of CEOs at publicly traded companies went down in real terms by 46% between 2000 and 2011, although it bounced back—as did corporate profits—in 2012, while still remaining well below the 2000 level.

He also notes that comparing those executives’ compensation with median incomes misses that the former have risen and fallen in line with the pay of other highly paid professionals. “CEO pay went up more than it should have in the late 1990s and then came back down,” Kaplan says. “If you look at CEO pay compared to the average pay of people in the top 0.1%, it’s about where it was 20 years ago—in line with [that of] lawyers and private-company executives, and less than hedge-fund managers.”

It is not difficult to see how the widespread impression of roguish CEO behavior has been formed. Consider the options backdating scandal in the United States in 2005 and 2006. The University of Iowa’s Erik Lie discovered that in many cases, companies granted stock options to executives just before their stock prices spiked. The Securities and Exchange Commission and the US Department of Justice subsequently investigated more than 100 businesses, and companies’ own investigations led to dozens of financial restatements and executive dismissals. Although only 12 executives ultimately received criminal sentences, and only five were given prison terms (the others were sentenced to probation), the scandal helped reinforce the notion that CEO compensation often results from underhand means.

The media tend to focus on these titillating scandals of egregious pay, outlandish profligacy, and failures of corporate governance. Such tales make fascinating stories, but they are not the norm, Kaplan says. “There are outliers and bad actors,” he acknowledges. But, “What you’ve seen in the past 15 years is those outliers have come way down. The median CEO pay hasn’t changed much, but the mean is down a lot, so it tells you that the big outliers have come down.”

Research by other Booth faculty takes a different tack. Work by Amit Seru, professor of finance at Chicago Booth, suggests some CEOs manipulate performance measures that are used to determine their pay. In a paper cowritten with Adair Morse, formerly of Chicago Booth and now at Berkeley, and Vikram Nanda of Georgia Tech, Seru analyzed more than 1,000 companies from 1993 to 2003, finding that CEOs influenced measures used to assess their performance. The evidence suggests that powerful CEOs may pressure boards to use gauges that show the CEOs’ performance in the best possible light. CEO compensation correlates well with the better performing performance measure, but only for powerful CEOs (those who chair the company’s board, or appointed a large number of the board’s members).

The researchers cite the case of former Home Depot CEO Robert Nardelli. A footnote in the company’s 2004 proxy statement given to shareholders stated that Nardelli’s long-term incentive pay would be calculated based on the total return to shareholders over three years, compared with a peer group of retailers. “By that measure, Nardelli had bombed,” write the authors. A year later, they point out, the proxy stated that Nardelli would receive incentive pay if the company achieved a certain level of average diluted earnings per share, a measure by which Home Depot looked far more successful.

Up to 30% of the fluctuation of incentive pay based on performance can be explained by rigged performance measures, the researchers estimate. “Incentive contracts are at best only partially effective in compensating for weak corporate governance,” Seru, Nanda, and Morse write.

Kaplan acknowledges that there have been corporate governance failures and pay outliers where managerial power is exercised, but he observes that Seru, Nanda, and Morse’s research suggests that CEO pay should have risen along with increasing corporate profits from 2000 to 2011. Instead, the opposite happened. “The puzzle is that profits have gone up but pay has gone down,” Kaplan says. “Everybody’s complaining that something’s broken, but if you look at those trends, that complaint makes no sense.” Seru, Nanda, and Morse argue that such aggregate trends may mask the cross-sectional differences uncovered in their study. Moreover, they say, some of the patterns they identified in their paper may have been ameliorated after the Securities and Exchange Commission sent several companies letters in 2007, critiquing the disclosure practices of their executive pay contracts.

While Kaplan sees the increasing use of equity-based pay such as stock options and restricted stock in executive compensation packages as a positive development, other Booth faculty argue that stock options can become very valuable even though a company is only performing in line with the rest of its rivals in the same sector. A study by Marianne Bertrand, Chris P. Dialynas Distinguished Service Professor of Economics at Chicago Booth, written with Harvard’s Sendhil Mullainathan, finds that the CEOs of the largest oil companies in the United States received big rewards between 1977 and 1994 for improvements in company earnings and stock returns, even when these increases were caused by factors beyond the CEOs’ control.

Specifically, the authors find that oil bosses’ pay was very sensitive to increases in oil prices, which arguably wasn’t influenced by any individual CEO’s efforts. That CEOs were apparently paid for luck appears to undermine the effectiveness of incentive contracts in tying pay to performance.

Bertrand and Mullainathan find that “pay for luck” is strongest among poorly governed firms, specifically, in companies without large shareholders who own at least 5% stake. In another paper, they find that firms with weak and strong corporate governance reacted differently when several US states in the mid-1980s passed laws that made hostile takeovers more difficult. Antitakeover laws removed an important check on companies, because the threat of a takeover kept managers on their toes, thus giving them an incentive to increase the value of the company.

In firms that had no large shareholders, Bertrand and Mullainathan find that average CEO pay increased after antitakeover laws were passed, suggesting that such laws made it easier for CEOs to pay themselves more. CEO pay in firms with large shareholders did not go up, and, without the discipline offered by the threat of a hostile takeover, shareholders made sure that CEO pay was more strongly tied to performance.

Kaplan is skeptical of the notion that companies with no large shareholders pay their CEOs differently. He notes that Bertrand and Mullainathan’s pay-for-luck research only examined public companies, not private equity–funded ones. Including these data from companies that have one very large shareholder, the private equity firm, challenges Bertrand and Mullainathan’s basic thesis, Kaplan says. “He has one proxy for governance, we have another,” says Bertrand, maintaining that her research finds systematic differences in the level of pay between companies with and without large shareholders.

Instead of bad corporate governance or skewed pay incentives, Kaplan argues that the big paychecks executives receive are mostly determined by the demand for and supply of talent. If the market rate of compensation reflects what a CEO’s time is worth, CEOs are not overpaid but rewarded appropriately—or otherwise punished with a pink slip.

In Kaplan’s view, there are two ways to measure CEO pay, which are sometimes used misleadingly. The first is estimated pay, which includes a CEO’s salary, bonus, restricted stock, and the estimated value of stock options at the time they were granted. This measure is useful for looking at how much boards awarded their CEOs in a given year. The other measure is realized pay, which values options when they are exercised. Realized pay is what the CEO actually took home and is therefore more useful for analyzing whether CEOs are paid for performance.

CEOs may earn a lot, but most of them deserve their pay for increasing the value of their companies, he says. A paper by Kaplan and Joshua Rauh of Stanford finds that the highest-paid CEOs in terms of realized pay—the top 20% out of 1,700 firms—generated three-year stock returns that were 60% higher than those of other firms in their industries. The bottom 20% of CEOs, on the other hand, underperformed other companies in their industries by 20%.

CEOs who don’t perform get fired, and they’re being tossed out more frequently than in the past. Kaplan says that the average S&P 500 CEO today can expect to stay on the job for six years, down from about eight years before 1998. In a paper with Bernadette Minton at The Ohio State University, Kaplan finds that since 1998 about one out of six Fortune 500 CEOs lost their jobs, compared with only one out of 10 in the 1970s.

Bertrand argues that the fact that CEOs stick with their jobs, even though average pay has fallen and employment conditions have become more precarious, indicates that CEOs may have been overpaid. “It’s another sign that you can retain those guys with less pay and on worse conditions, so pay probably was too high,” she says.

She also observes that corporate governance has improved markedly since 2000, in part because of accounting scandals such as Enron. That improvement in governance combined with the increased debate about the subject, Bertrand says, could also be a big factor in helping to explain why CEO pay has dropped in real terms.

One purported reason executive pay has become so fraught is due to the economic downturn and the perception of the growing inequality between the elite “1%” and the rest of society. Policymakers fret about the public’s frustration. The United Nations warned in June that widening disparities in income have created a “disturbing picture” in Europe that’s leading to heightened social tensions.

Kaplan says he shares those concerns, but argues it is not executive pay that causes social tensions so much as high unemployment and a weak economy. “That’s caused by bad government policies,” he says. “Europe has the worst, most rigid labor laws, and therefore you have high unemployment, which causes unhappiness.”

The share of national income held by the top 1% was higher in 1999 than it is today, and income inequality has decreased since 2007. And yet nobody was protesting between 1999 and 2007, he points out, because the economy was growing. People become unhappy when unemployment is high and the economy is stagnant, as became the case after 2007. And data suggest median incomes in the United States have been stagnant for decades. To Kaplan, anger of CEO pay is merely a symptom of this stagnation, aggravated by the economic downturn.

Kaplan is interested in looking at trends in the global labor market. Technological change has shaped the global economy over the past three decades in three important ways, he says. First, it has spurred the growth of corporate profits and benefited the executives who run big companies. Secondly, it has harmed the middle class in industrialized countries, who have seen blue-collar job opportunities diminish. Thirdly, it has pulled millions of people out of poverty in emerging economies.

“Technological advances have allowed lawyers to do more work faster and on bigger deals, investors to trade large amounts more efficiently, and CEOs to better manage large global organizations,” Kaplan wrote in an article this summer in Foreign Affairs. “As firms have grown larger, so, too, have the returns for leading them.”

But the poor, too, have benefited from these changes. “The big beneficiaries of technology have been corporations, the people at the top, and people in countries such as India and China,” Kaplan says. “The people who’ve been hurt to an extent are the middle class in the United States because some of those jobs have gone away. That’s the source of some of this angst, but income inequality is the residual, not the driver. The driver has been technological change and the success of the corporate model in generating value.”

Just as the worries over the fate of the middle class in industrialized economies overshadows the story of the emerging middle class in developing countries, Kaplan thinks the public concern over CEO pay masks a positive narrative about the success of corporations.

“On the one hand, people complain about corporate governance. On the other, they say companies are hoarding cash,” he says. “But how do you get too much cash? By being successful.” The real story, he says, is about the growth in recent decades in labor productivity, the rise in stock markets, increasing corporate profits, and the expanding global economy. Others may see executive pay as a sorry tale of greed and excess. For Kaplan, it is a symptom of a much bigger success story.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.