The tumult of 2020 has prompted many people to look back in time for historical parallels and precedents, from the violent and racially driven US protests of 1968, to the economic pain of the Great Depression, to the flu pandemic of 1918, to the politicization and political upheaval of the American Civil War. What challenges have Americans encountered in the past? How did the country overcome them, or fail to do so?

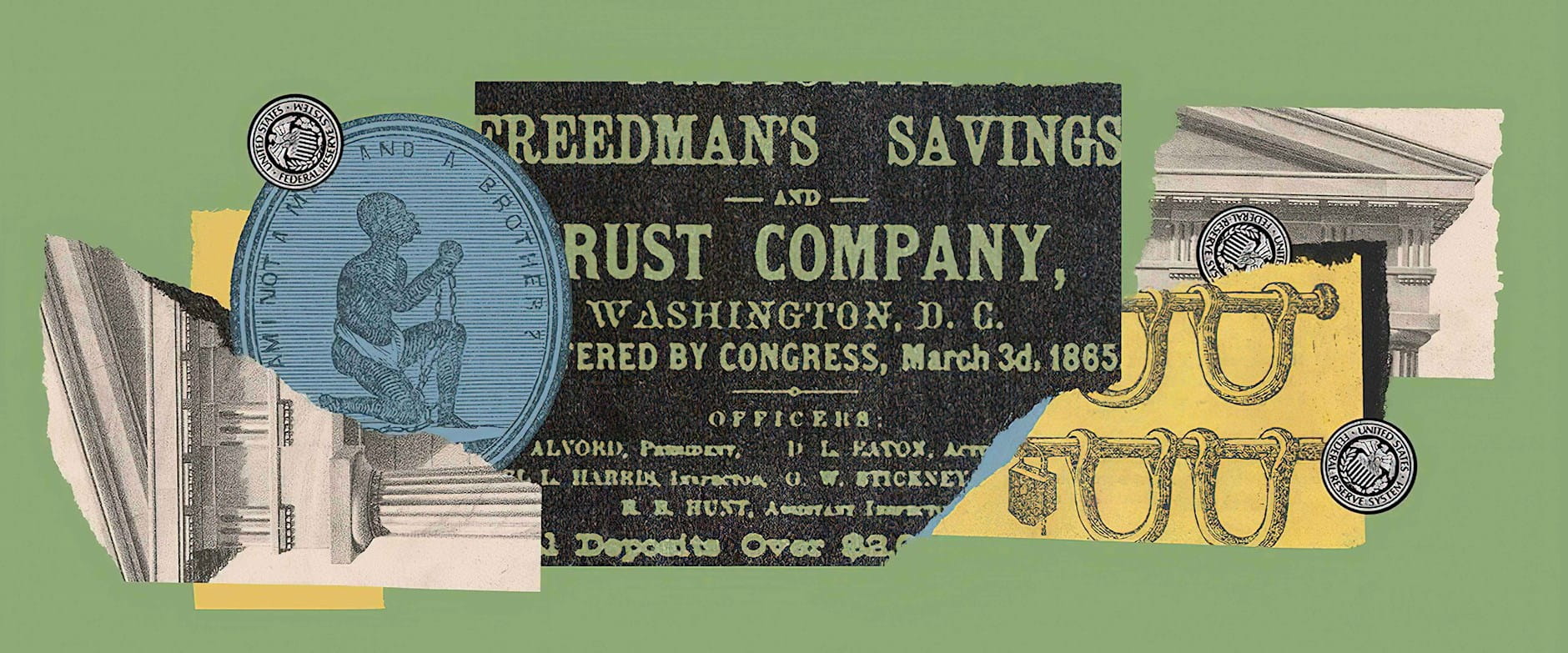

In the vast array of documents, sources, and events to unpack, there is a bank, formed in the waning days of the Civil War, that is getting some attention from researchers. In 1865, the same year it passed the 13th Amendment to abolish slavery, Congress set up a bank for newly emancipated Black Americans—nearly 4 million people freed from slavery—to accelerate their economic empowerment. The Freedman’s Savings and Trust Company opened in New York, and its headquarters swiftly moved to Washington, DC, with a further 37 branches established in quick succession across 17 US states.

Its records are revealing, among other things, lessons about financial inclusion. In the nine years of its existence, the Freedman’s Bank, as it was known, had a measurably positive effect on its customers, suggests research by Babson College’s Luke C. D. Stein and Chicago Booth’s Constantine Yannelis. During a period in US history when the opportunity seemed to exist, at least briefly, for Black Americans to move toward legal equality, Freedman’s Bank account holders were more likely to be literate, attend schools, work, have higher incomes, and own more real estate.

But the bank’s records also highlight the devastating effects wrought by financial failure, and provide a window into the long history of exclusion and racism that culminates in the current wealth gap between Black and white Americans. “The main lesson and takeaway I see is that access to financial institutions is important, but it is unlikely that it is a necessary or sufficient condition to close the racial wealth gap,” says Ohio State’s Trevon D. Logan. “It’s not as if people are unbanked because they have hundreds of thousands of dollars under mattresses. They lack the resources to have a bank account.”

A bank of opportunity

Some of the research into the Freedman’s Bank stems from a visit by Chicago Booth’s Constantine Yannelis to the US Treasury in fall 2018. Due to a temporary security issue, the main entrance was closed, and Yannelis was routed to exit the building via an annex that two years earlier had been renamed “The Freedman’s Bank Building.” Having never heard of the bank, Yannelis looked it up.

The first Freedman’s Bank opened on April 4, 1865. As University of California at Irvine’s Mehrsa Baradaran explains in her 2017 book The Color of Money: Black Banks and the Racial Wealth Gap, the government originally proposed distributing land to people who had been enslaved, but faced a violent backlash from Southern whites. “Instead of land, freed slaves got rights that they could not use due to their economic and political status at the bottom rung of society. They also got a savings bank, which was another form of diversion that would be repeated in the next century,” Baradaran writes.

Black Americans still opened accounts with the Freedman’s Bank at a “phenomenal” rate, according to the US National Archives and Records Administration. Customers, almost entirely newly freed Black Americans, could open an account with as little as 5 cents, and interest was paid on deposits of $1 or more. Most deposits were small, less than $60 on average. More than 100,000 people became customers—farmers, cooks, barbers, nurses, carpenters—many of them likely taking home their first paychecks. Among them, Dilla Warren, a 50-year-old woman from Chowan County, North Carolina, opened an account on November 2, 1869, according to the National Archives’ Prologue Magazine. Warren made a living sewing, knitting, washing, and ironing, and her records list 11 children, all of whom had either died or been sold into slavery. Warren left instructions that on her death, the remaining money in her account should pass to the son of her deceased brother, Andrew, likely because he was her only living or traceable relative.

A 150-year-old bank failure may still be haunting Black communities

In the bank’s archives, Stein and Yannelis saw an opportunity to study the effects of financial inclusion. What happens when a group of people is given access to a financial institution? Some research has asked this through experiments in developing countries, Yannelis says, but the Freedman’s Bank records offered a trove of US data about people essentially granted such access overnight. Moreover, because branches opened at different times, it was possible for the researchers to isolate effects in individual communities.

Stein and Yannelis analyzed surviving account-register records that had been microfilmed by the National Archives and later digitized in CD-ROM format by FamilySearch, a nonprofit genealogy association, obtaining data from 107,197 accounts across 27 Freedman’s Bank branches, totaling 483,082 nonunique individuals—roughly 12 percent of the 1870 Black population in the American South. They lined these records up with a sample from the 1870 census containing information on schooling, literacy, employment, and wealth among Black Americans. (Literacy data was collected by the Census Bureau at the time.)

The Freedman’s Bank, they determine, had a small but significant impact on the economic well-being and outlook of its account holders. An initial regression analysis finds that individuals in households with an account at the bank were 1 percentage point more likely to be literate and to attend schools. The same individuals were 2 percentage points more likely to work and to have higher incomes than their peers.

Being able to bank raised incomes, literacy levels, and landownership through one or more channels, according to the research. Among these, having an account may have allowed individuals to save to make large purchases, such as a plot of land; to invest in workers; or to open a business. It also may have helped them overcome challenges associated with irregular income and shocks, which were often tied to fickle agricultural harvests, by providing a place to make consistent, recurring payments and save up a cash cushion. (Costs associated with withdrawals may have discouraged depositors from taking out money unless necessary, which encouraged saving.)

To test the validity of the findings, and rule out the possibility that people who opened accounts were more financially literate to begin with, the researchers conducted a number of tests, including for people who were illiterate in 1870. “We find strong effects on work, income and real estate wealth for this illiterate sample, consistent with a financial inclusion channel, rather than an educational expansion channel,” they write. They find that while people who lived close to branches saw effects, those didn’t extend to white households, nor to people who lived close to planned-but-never-opened branches. And they find larger effects for people who opened accounts earlier than people who started banking later. “While the time period may seem short, large effects from access to financial services over short time periods are consistent with work in development and household finance,” the researchers write.

A look at historical politics further confirms their results. Southern Democrats were generally hostile to the bank, its customers, and its supporters. Meanwhile, Republicans, who had set up the bank, were overall more supportive of programs such as schools and economic development. So would the data show that Republican control of an area, rather than a Freedman’s Bank branch location there, led to better outcomes for Black residents? The researchers looked at county-level Republican vote shares in the 1868 congressional elections and find what they see as more corroborative evidence that the mere presence of the bank drove better school attendance, higher literacy and property value, and more employment and income.

The access to financial services that the Freedman’s Bank was able to offer to an unbanked population had real impact at the Black American individual and household level, they argue, and this impact extended to the community in terms of its ability to accelerate education and wealth accumulation. An average county near an early bank branch had about 10,700 Black residents and 2,700 account holders, and the analysis suggests financial inclusion boosted school attendance rates by up to 5 percentage points and literacy by up to 18 percentage points, with positive effects on income, employment, and business ownership.

The pain of failure

The Freedman’s Bank was not to last, however. Although set up as an institution strictly dedicated to savings, the bank was soon investing its depositors’ hard-earned savings into risky railroad companies and real estate. Its coffers were largely co-opted by the First National Bank, which offloaded its liabilities onto the Freedman’s Bank books with no objection from the latter’s all-white trustees.

The Panic of 1873 was a death knell, as real-estate prices fell, loans went bad, and depositors demanded their money back. Social reformer, author, lecturer, and statesman Frederick Douglass was elected the bank’s president in a bid to save it, but he quickly became aware of the bank’s dire conditions and turned to Congress. On June 29, 1874, the bank’s trustees voted to shutter it and left more than 60,000 depositors with nearly $3 million in losses. Federal deposit insurance did not yet exist, and while there was some compensation for customers, the fight to make depositors whole continued in Congress for decades, into the 20th century, to no avail. The Freedman’s Bank headquarters was torn down in 1899, replaced in 1919 by what would become the Treasury annex.

How the financial crisis echoed the Freedman’s Bank failure

In the midst of the 2008–09 financial crisis, two government-sponsored enterprises—the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac)—teetered on failure. These quasi-governmental agencies had supported the mortgage market by allowing lenders to offload home mortgage–related risks and make more loans, but they couldn’t withstand plummeting home prices.

The criticism of and reaction to the ensuing bailout had strong echoes of the Freedman’s Bank, finds Grand Valley State’s Daniel C. Giedeman. Both financial failures involved institutions assumed to have implicit government backing, and both had ramifications for Black Americans, he argues.

The Freedman’s Bank was formed after the US Civil War to serve formerly enslaved Black Americans. Per its initial charter, at least two-thirds of its deposits were to be invested in government securities. Congress was free to inspect the books, and passbooks and promotional literature implied government backing and an association with the US government’s Freedman’s Bureau. However, the Freedman’s Bank was technically private.

Fannie Mae and Freddie Mac, for their part, had been government agencies but were privatized in 1968 and 1970, respectively. While private, they benefited from some government provisions that gave them a leg up on competitors, hence their distinction as government-sponsored enterprises.

In the case of both the Freedman’s Bank and these GSEs, the market appeared to believe the institutions had implicit government backing. The assumption was that if they got into trouble, the US government would come to their rescue and prevent a failure.

This view was tested—and, in the case of Freedman’s Bank, was proved inaccurate. At the bank, a change in its charter opened the door to risky loans and speculation mixed with fraud and mismanagement by white officials. After the bank collapsed in 1874, depositors were partially refunded but never made whole, despite attempts to apply federal funds to the losses.

At Fannie Mae and Freddie Mac, the private-public structure created skewed incentives, as management sought to maximize returns while the market, confident in government backing, essentially gave management free rein, Giedeman writes. In September 2008, at the height of the crisis, the US government placed Fannie Mae and Freddie Mac into conservatorship. Both giant enterprises were delisted in 2010, but the government’s action prevented their bankruptcy and bailed out their debt holders for upwards of $150 billion.

Race is a theme in both failures. The Freedman’s Bank served Black Americans at a time when many white Americans were openly racist. Over a century later, many Republicans blamed the GSEs for causing the financial crisis, and “the general argument made is that Fannie Mae and Freddie Mac engaged in risky practices that led to the financial crisis because of government mandates that they provide financing to minorities,” writes Giedeman, citing editorials in the Washington Post and Boston Globe, and on Fox News. “It must be noted that the evidence does not support these claims,” he adds. In comments that surfaced during his 2020 presidential run, former New York mayor Michael Bloomberg in 2008 blamed the financial crisis on the end of redlining and a push for banks “to make loans to everyone.”

While the GSEs were bailed out and the Freedman’s Bank was not, the downfall of both had ramifications for Black Americans, Giedeman concludes. “The failure of the Freedman’s Bank left a bitter legacy not only due to depositor losses, but also because it almost certainly precluded the establishment of other government-sponsored financial institutions that might have benefited former slaves and the under-banked population in general,” he writes. He compares that with the experiences of Fannie Mae and Freddie Mac, whose failures “potentially soured the public’s taste for government initiated financial institutions for the foreseeable future even when such institutions could play a positive role in the financial system.” Such institutions could be used, for example, to help promote homeownership among Black Americans.

The GSEs’ failures were followed by tighter lending standards and far fewer loans made for home purchases. Between 2005 and 2012, home-purchase loans made to non-Hispanic white Americans fell 56 percent, compared with 76 percent for Black Americans, according to a study by the think tank Urban Institute. Another study holds that “since the housing bust and Great Recession, the homeownership gap between black and white households has widened to its largest level in 50 years.”—Emily Lambert

Jung Hyun Choi, Alanna McCargo, Michael Neal, Laurie Goodman, and Caitlyn Young, “Explaining the Black-White Homeownership Gap,” Urban Institute research report, October 2019.

Daniel C. Giedeman, “Fannie Mae, Freddie Mac, and the Freedman’s Savings Bank,” Review of Black Political Economy, June 2011.

Laurie Goodman, Jun Zhu, and Taz George, “Where Have All the Loans Gone? The Impact of Credit Availability on Mortgage Volume,” Journal of Structured Finance, Summer 2014.

While opening Freedman’s Bank branches seems to have generated positive effects, closing them similarly generated negatives ones. “If the government and the philanthropists’ purpose was to teach the freed slaves thrift and responsibility, the lesson they actually learned was to distrust the government and philanthropists,” writes Baradaran.

The research by Stein and Yannelis adds to the argument that the Freedman’s Bank failure did long-term damage to financial trust. When they look specifically at counties that once had a Freedman’s Bank branch, using data from the 2017 Federal Deposit Insurance Corporation’s National Survey of Unbanked and Underbanked Households, they find that Black residents “are more likely to list mistrust of financial institutions as a reason for being unbanked—an association that is not present for white Americans,” Yannelis says. “It seems likely that the collapse of the Freedman’s Bank and the loss of savings has contributed to an intergenerational mistrust of banks.”

Chicago Booth’s Richard Hornbeck and Louisiana State University’s Daniel Keniston are also studying the Freedman’s Bank. They are exploring how the bank’s collapse, including the funds lost by depositors, affected depositor households and their descendants. “This may also provide some insight into how African American families would have fared differently,” Hornbeck suggests, “if those particular families had received some financial transfers in the immediate aftermath of slavery.”

Hornbeck and Keniston are merging several data sets that record how much money people had deposited in the Freedman’s Bank at the time of its collapse and what each family was reimbursed over the following decades. The researchers are tracking depositors in the Freedman’s Bank, and their descendants, from 1870 through 1940, the most-recent publicly available full census data. This project is ongoing.

An unexplored legacy

In the United States today, the racial wealth gap is wide. The net worth of a typical white family in 2016 was $171,000, nearly 10 times the $17,150 average net worth of a Black family, according to the Brookings Institution. In terms of financial services, 18 percent of Black households are without banking services, according to the FDIC, compared with just 3 percent of white households.

It’s hard to draw a direct line from the Freedman’s Bank to today, however, as the line runs through not only the racial backlash of the Reconstruction era but also Jim Crow laws, the Depression, housing segregation and racial covenants, racist federal credit policy, and more examples of institutional racism. If the Freedman’s Bank had stayed solvent, would today’s racial gap still exist? Most likely yes, says Ohio State’s Logan.

Even without banks, Black Americans saved

In 1961, descendants of John Johnson went to court to claim 935 silver coins that were found at a demolition site in Washington, DC. As they explained to the judge, Johnson, a vegetable seller, had buried the coins because he didn’t trust banks. He had lost money in the Freedman’s Savings Bank failure—but that didn’t stop him from saving.

When the Freedman’s Bank collapsed in 1874, it took with it $3 million in savings from 61,000 depositors, many of them formerly enslaved Black Americans. The event did long-term damage and shook Black trust in the financial system, according to such prominent Black Americans as W. E. B. DuBois and Booker T. Washington.

But Black Americans were saving before the bank formed and continued saving after it collapsed, argues City University of New York’s Barbara P. Josiah. “Seeds of thrift sowed during enslavement blossomed and bore fruit and many African Americans bequeathed cash, real estate, and personal property worth thousands of dollars to their families and friends,” Josiah writes.

For almost a century prior to the Freedman’s Bank’s formation in 1865, groups of Black Americans got together to maintain community records, give job training, support people in need, help with burial expenses, and engage in other communal activities. Some also used funds to purchase community property. Such associations were similar to others—known as esusu, susu, partner, box hand, san, or tontine—found in West Africa and African diaspora communities.

When the Freedman’s Bank came on the scene, many of these groups as well as private individuals rallied around the new bank by trusting it with their savings. Josiah’s research focuses on the records from a Washington, DC, branch, which offer glimpses into the lives of various account holders—including Luisa Givens, a hospital cook and mother of four; Mary Baltimore, a widow who had been enslaved; Edward King, an injured Civil War veteran who had been enslaved; and many others.

The bank’s failure in 1874 devastated the account holders, who were never made whole. Johnson, for example, lost money in the Freedman’s Bank and took to burying coins because he no longer trusted banks.

But while the bank’s failure was a setback, Black Americans persevered in saving, according to the research. For example, the Freedman’s Bank failure took with it $1,100 that members of the Metropolitan African Methodist Episcopal Church had saved to put toward a new building. But their fundraising continued, and a new building with capacity for 3,000 people went up in 1886.

“When the bank failed, most depositors, only a few years removed from enslavement and at the bottom of the District’s socioeconomic ladder, did not accept defeat,” Josiah writes. “Some fell back on methods of saving they had utilized during the antebellum period by finding a hiding place for their money.” Indeed, Johnson still managed to leave his widow and other family members 10 houses and $4,400 when he died in 1925.—Emily Lambert

Barbara P. Josiah, “Providing for the Future: The World of the African American Depositors of Washington, DC’s Freedmen’s Savings Bank, 1865–74,” Journal of African American History, Winter 2004.

Logan is studying other aspects of the Reconstruction era, including the effects of Black politicians on public finance, finding, among other things, that exposure to Black politicians decreased the Black-white literacy gap by more than 7 percent.

And there are many other factors at play and still unexplored, even just in terms of financial services, he points out. What were the wealth trajectories for Freedman’s Bank customers? Would banking have made a difference, considering that so much wealth has grown through property ownership rather than liquid bank accounts? Moreover, Black Americans denied access to banks still formed mutual-aid societies and other bank-like institutions. They did so before the Freedman’s Bank was chartered, and they continued to do so after it collapsed. (See “Even without banks, Black Americans saved,” above.) How do these nonbank institutions play into issues of trust and wealth?

It’s true that Black Americans are less likely to be part of today’s banking system. However, that’s a symptom, not a cause, of racial wealth inequality, Logan notes. Banks are important if you need them and don’t have access, but some Black families don’t have the resources to have a bank account. Others may opt to use cash and check cards rather than a checking account.

“As economists, to the extent that right now in the US we are talking about racial inequality, we don’t have in general really good ways of thinking about or analyzing racial issues. We just have not done that particularly well in the past or in the present,” says Logan. The profession currently lacks theoretical tools to study issues of race, he notes, and the scholarly community itself lacks diversity. “We don’t have a lot of knowledge of race and history and the long-term perspectives on race.”

In that sense, research into the Freedman’s Bank represents a hopeful direction, steps taken to better understand the economic legacy of American racism more broadly. Questions about financial inclusion and exclusion are part of that legacy—but just one, small part.

- Trevon D. Logan, “Do Black Politicians Matter? Evidence from Reconstruction,” Journal of Economic History, March 2020.

- Luke C. D. Stein and Constantine Yannelis, “Financial Inclusion, Human Capital, and Wealth Accumulation: Evidence from the Freedman’s Savings Bank,” Review of Financial Studies, February 2020.

- Booker T. Washington, The Story of the Negro, Association Press, 1909.

- Reginald Washington, “The Freedman’s Savings and Trust Company and African American Genealogical Research,” Prologue, June 1997.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.