In Finance, Humans Were the First Machines

A Q&A with Chicago Booth’s Dacheng Xiu on the implications of machine learning for the financial markets.

In Finance, Humans Were the First Machines

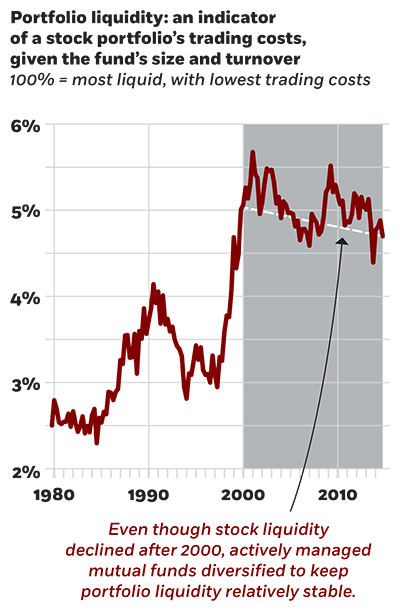

Active-mutual-fund portfolios have become more diversified and index-like

Lubos Pastor, Robert F. Stambaugh, and Lucian A. Taylor, “Fund Tradeoffs,” NBER working paper, December 2017.

A Q&A with Chicago Booth’s Dacheng Xiu on the implications of machine learning for the financial markets.

In Finance, Humans Were the First Machines

Policy makers trying to level the economic playing field need to understand the components of private wealth in order to establish taxes and rates that work as intended.

How Rich Are the Superrich, Exactly?

Why did prices for US Treasurys drop along with stock prices in the spring of 2020?

How Financial Regulation Fed a Treasury Bond CrisisYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.