We live in a world where entrepreneurs and early-stage company participants get taken advantage of so frequently that we hardly notice. Bad equity deals are the rule, not the exception. Fairness is rare. The intent for fairness is there in the way equity is split among business partners, but the practice of fairness is not. This is a correctable problem.

Equity in a start-up entitles the owner to a portion of the company’s rewards, if and when they come. The rewards are a portion of the future profits or the proceeds of a sale. For most start-ups, equity is divided among founders, investors, key employees, and other early stakeholders—usually according to a fixed-split system that virtually guarantees an inequitable and contentious outcome. These stakeholders could divide equity much more fairly if they followed a simple principle: a person’s share of the rewards should always be equal to that person’s share of what’s put at risk to attain those rewards. This principle is at the heart of an equity-split system I call “Slicing Pie.”

When a person contributes to a start-up company and does not get paid for her contribution, she is putting her contribution at risk with the hopes of getting a future reward. And, while the timing and the amount of the future reward is unknowable, the amount of the contributions at risk is knowable. It is equal to the fair market value of the contributions.

Because it’s impossible to know when or even if the rewards will ever come, we can never know how much people must put at risk to get the rewards. Every contribution, therefore, is essentially a bet on the future of the company, and nobody knows when the betting will end.

Blackjack

Think of your start-up as a game of blackjack. You and a partner each bet $1 on the same hand. You have no way of knowing if you’re going to win or even how much you’re going to win, as different hands pay different amounts. The future, in other words, is unknowable. What is knowable is that you each contributed the same amount, and that amount is at risk because you could lose it all.

If you win, you should split the winnings 50/50, which is perfectly fair because you each bet the same.

But, what if the dealer deals two aces? You didn’t expect this, and you want to take advantage of the new opportunity, so you decide to split the aces and double down. (In case you don’t know how to play blackjack, “splitting the aces” means you are turning one hand into two hands and placing another bet.) Unfortunately, your partner is out of money. You aren’t, so you bet $2 more. Again, you have no way of knowing if you’re going to win or how much you’re going to win. What you do know is that you bet $3 and your partner bet $1.

Does 50/50 still seem like a fair deal? Probably not. In this scenario, you deserve 75 percent of the winnings because you placed 75 percent of the bets. If you simply keep track of what people bet, you can calculate exactly what portion of the rewards they deserve. It’s quite simple!

The fixed-split problem

Traditionally, nearly every start-up company uses a prenegotiated “fixed” or “static” equity split. In a fixed split, equity is doled out to participants in chunks, based on their potential contribution. This is kind of like paying someone his annual salary on his first day of work because he told his manager he was going to work hard. If it sounds silly, it is, but it happens all the time because many entrepreneurs believe they can predict the future. In fact, if they didn’t believe they could predict the future, they probably wouldn’t have the confidence to start a company in the first place. Optimism and confidence are important, but they don’t give anyone special powers such as seeing the future.

So, with the best intentions, founders enter into fixed-equity-split agreements loosely based on their predictions of this equation:

Your share % = The value of your contribution/The total value

This is easy if they know what the numbers are. For instance, if you invested $100,000 in a company that has a postmoney valuation of $1 million, you would have 10 percent:

10% = $100,000/$1,000,000

This is perfectly fair. You get a percentage that is in proportion to what you contributed. In most cases, however, we don’t know the values because they are likely to change, so people try to predict, estimate, or guess the variables.

Sooner or later, all splits will need to be adjusted.

Founders have to predict the future value of each person’s contribution (also known as the economic benefit to the firm) and they have to predict the total future value of the firm (because the current value is most likely $0). Both of the answers to these questions will no doubt be based on a complex set of assumptions with virtually no grounding in reality.

Try as they might, they will produce numbers that will be wild guesses at best. At worst, they will be overly optimistic fantasies of a meteoric rise to fame and fortune. It’s impossible to create a fair fixed-equity split. And even if founders could make such a prediction, a split that was right one day will be wrong the next because start-ups always change. It’s such a complicated, emotionally charged discussion that many founders either avoid it altogether or do an even split such as 50/50 or 25/25/25/25.

All splits are dynamic

Sooner or later, all splits will need to be adjusted. In traditional equity models, the split often adjusts—incorrectly—after some kind of founder conflict. The adjustments simply set the team up for another fight later on—I call it the “Fix & Fight” model.

What might change

You may wonder what could possibly change to cause such founder conflict. The answer is everything. Whatever you think you and your partners will commit in terms of time, money, ideas, relationships, facilities, supplies, or anything else will likely be different as the company actually unfolds. When things change, you’ll be faced with one of two realities.

The first possible reality is that your share is less than you deserve:

Your share % < The value of your contribution/The total value

This is probably not OK with you. If you have less than you deserve, it means there is someone out there who has more than she deserves, and she got it at your personal expense. The greater the personal expense, the more upsetting this will be. You might even try to figure out who got more than their fair share and try to get some back with your posse of highly paid attorneys (if you can afford them). This happens all the time.

Even if you agreed to this arrangement in advance, it’s still not fair. The only reason people would agree to this kind of treatment is if they had no other choice or if they didn’t know any better. This, too, happens all the time. Some people have a habit of taking advantage of other people when they sense desperation or ignorance.

If you’ve ever been caught on the short end of this equation (as many of us have), you are probably going to try to avoid this situation in the future by making sure you cover your own butt. The greater the pain you endured, the greater your interest will be in covering your own butt, even if it means someone else has to lose. This leads us to the second reality that is also not fair:

Your share % > The value of your contribution/The total value

In this case you have more than you deserve. In many cases the more money, knowledge, or power one person has over the other person, the greater his share will be at the expense of the other.

Alligator pits

Because fixed-equity splits stop being fair the moment something changes, nearly every start-up has less-than alligators (<) representing people who have less than they deserve, and greater-than alligators (>) representing people who have more than they deserve. Eventually, the less-than people will get upset and want to renegotiate. Everyone becomes poised for a fight. I call these “alligator pit” negotiations.

In a fixed-equity split, every negotiation is an alligator pit because sooner or later something will change and it will stop being fair.

If you want to create a working environment that is dominated by trust, fairness, and cooperation, you’ve got to get them gators out of the equation.

When we approach the alligator pit, we do it with fear, mistrust, and a keen instinct toward self-preservation. These are not the best building blocks for creating an awesome company.

Every time something changes, founders have to jump back in the alligator pit and renegotiate. Things always change, so it’s always a big, bloody frenzy of gnashing teeth and swinging tails. This happens over and over again, and each session in the alligator pit weakens working relationships. It’s a nightmare.

In an effort to protect ourselves from the snarling alligators that gnash their teeth and swing their tails, we invent concepts such as vesting, oppressive liquidation preferences, and the dreaded full-ratchet antidilution. Our attempts to protect ourselves from the alligator pits are expensive and time consuming, and often exacerbate the very problems we are trying to solve.

Get them gators!

If you want to create a working environment that is dominated by trust, fairness, and cooperation, where everyone has aligned incentives, you’ve got to get them gators out of the equation.

Slicing Pie, the model I mentioned earlier, is a way to do that. There are two primary components of Slicing Pie: an allocation framework (which tells us how much each person should get) and a recovery framework (which tells us what to do when someone leaves the company).

The model is dynamic, meaning it changes over time, to keep it fair. Research has shown that companies using dynamic models fare better than those using fixed splits. Some people think fixed splits provide more certainty to participants. The only real certainty you will have is that you will eventually get thrown back into the alligator pit!

Calculating bets

Think back to the blackjack analogy. In order to apply the Slicing Pie model, you have to know how to determine fair market value so you can calculate each person’s bet. This is much easier to do than predicting the future!

For example, let’s say you are an experienced programmer with many successful tech projects under your belt. Your time has a higher value than the time of a young whippersnapper, right out of college with no concrete experience doing anything. Each of you could command a salary on the open market that is commensurate with your skills and experience.

Your respective fair-market–rate salaries would account for expected contributions to a firm’s productivity and would accommodate differences in skills, education, and experience. All things being equal, your ability to add value to a company would be higher, so you could command a higher salary. What you as the experienced programmer can do in a couple of hours might take the recent graduate weeks or months.

If the company pays you your full market rate, you are not putting anything at risk and, therefore, deserve no equity. If the company pays you less than your market rate, you deserve equity in proportion to the amount that you’re not getting paid. The same goes for the recent graduate.

Adjustments

There are two primary types of contributions a person can make to a start-up: cash and noncash. Cash contributions consume a person’s cash, while noncash contributions do not. For example, time is a noncash contribution and an unreimbursed expense is a cash contribution.

In most cases, it is much harder to save money than it is to earn money. A person who is earning $100,000 a year would be hard-pressed to save that amount in a year. Even if she could save all her money, she would be saving after-tax dollars, so a $100,000 annual salary would not mean $100,000 in the bank. The employer would pay employment tax and the employee would pay income tax. Lastly, when people actually buy stuff, they have to pay sales taxes or a VAT tax or other taxes, which further reduces the buying power of money. Therefore, the person who contributes $1 of cash to a company is putting more at risk than the person who contributes $1 worth of time or other noncash contributions.

Slicing Pie accounts for this difference by applying cash and noncash multipliers (aka normalizers). Just think of this as an “adjusted” fair market value.

The Slicing Pie formula

If we substitute the adjusted fair market value (FMV, which is easy to calculate) for future value (which is impossible to calculate), we have a perfect substitute for our calculation.

This:

Your share % = The value of your contribution/The total value

Becomes:

Your share % = The adjusted FMV of your contribution/The total adjusted FMV

In my book The Slicing Pie Handbook, I use the term “slices.” A slice is a fictional unit used to represent the adjusted fair-market value of an at-risk contribution. A slice does not represent equity shares, nor does it have any actual value; it just helps us to calculate the right percentages. The Slicing Pie formula is:

Your share % = Your slices/All slices

Slicing Pie in action

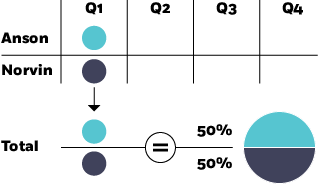

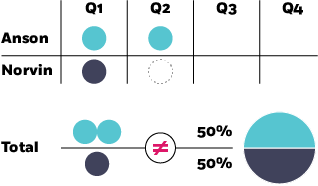

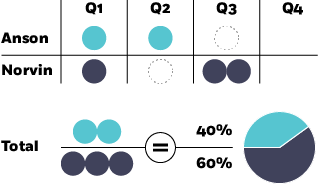

Let’s take a simple example of a fictional company where people contribute money, time, ideas, relationships, and other resources. For purposes of simplicity, we will assume that each contribution has been converted to slices (S). There are two partners, Norvin and Anson. In the first quarter they each invest 100 S (which could be any mix of money, time, ideas, etc.).

It’s logical that they would each own 50 percent of this business. And, because their contributions have been converted to slices, the contribution from Anson is “valued” the same as a contribution from Norvin, even though the company is probably worth nothing at this point. The next quarter Anson invests another 100 S and Norvin invests nothing. Maybe Norvin was busy with his day job that quarter. Here is what would happen if the split were fixed to 50/50:

In a fixed model, Anson would have no incentive to invest the extra contribution because their split would stay 50/50. This isn’t fair. Anson and Norvin would have to jump in the alligator pit and renegotiate their split. In a dynamic model, the split would adjust based on additional contributions:

This is fair, and both guys are happy knowing that they each have what they should. One might argue that earlier contribution is riskier, but measuring risk in a start-up is as impossible as measuring future value.

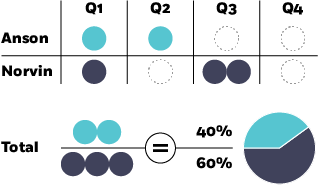

What if, during the second quarter, the company’s main client decides to cancel its contract? This would probably mean that the next round of contribution is actually riskier than earlier contributions. Considering this, Anson is more cautious, but Norvin is not:

The ultimate value of the company is still unknown. All that is known is how much each person contributed relative to the other person. Anson now has a smaller share, but he is comfortable with it because without Norvin’s contribution, the company may have failed. The following quarter neither one contributes anything; the company sells for $1 million.

Anson gets $400,000 and Norvin gets $600,000. This is exactly what they each should have had. Neither of them could have predicted that their company would sell for $1 million in less than a year, but they each invested what was needed to move the company forward. The model was always in balance.

In most cases, people attempt to negotiate, in advance, how much money, time, supplies, etc. they will need. Next, they try to determine what the ultimate proceeds will be. Then they determine a fixed split. It’s a nightmare. Without the dynamic feature, they will be thrown into the alligator pit, forced to renegotiate with gnashing teeth and swinging tails. Nobody wants to jump into an alligator pit.

This excerpt is adapted from The Slicing Pie Handbook: Perfectly Fair Equity Splits for Bootstrapped Startups by Mike Moyer. Mike Moyer is adjunct associate professor of entrepreneurship at Chicago Booth.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.