How Sales Taxes Could Boost Economic Growth

Research suggests higher taxes could help end stagnation in developed economies.

How Sales Taxes Could Boost Economic GrowthTo understand the US economy, you could start by looking at the national unemployment rate, the US Federal Reserve’s target interest rate, or perhaps long-term rates of growth in the GDP.

Or you could look right outside your door: at the bank down the street, the doctor’s office on the corner, or the new car parked two driveways down.

Researchers are interested in huge issues that affect us all, regardless of where we live, but often they’re finding the answers to these big questions embedded within small data sets focused not nationally but rather at the state, city, or even zip-code level. By analyzing variations in local and regional economies, they are increasingly uncovering insights obscured by the big picture.

Within the United States, regions have become “labs of democracy,” as Chicago Booth’s Owen Zidar puts it, enabling researchers to study contrasting approaches to problem-solving.

Why does health care cost so much? Zoom in from charts of national average health-care costs to data on a single patient moving from McAllen, Texas, to Minneapolis, and the factors that raise US medical expenses become much more obvious. Who benefits from tax cuts? To know, you have to understand why Connecticut residents retained more money from high-end tax cuts than did residents of Maine.

Economists derive empirical evidence from these contrasts, which in turn helps them measure the effectiveness of policy. In an age of big data, viewing the world on a small scale reveals a richer story that can challenge our assumptions about how the economy works—and help us navigate it.

![]()

The 2007–10 financial crisis stung individuals across the economic spectrum and around the globe—but some people felt it more acutely than others. Even within the US, certain geographic areas experienced a steeper decline, and were slower to recover, than others. So why did some regions fare comparatively badly? One factor seems to be the ease with which lenders can foreclose on homeowners.

Princeton’s Atif R. Mian, Chicago Booth’s Amir Sufi, and University of British Columbia’s Francesco Trebbi find that certain foreclosure laws help explain regional differentiation in the severity of the crisis—and that rewriting some of them might shorten the next national recession.

Foreclosure laws vary by state and can be divided between those that require lenders to sue borrowers in court before they can sell the foreclosed property—known as judicial foreclosure—and those that don’t. The researchers studied the effect of judicial foreclosure by examining foreclosure activity in zip codes located near each other but in neighboring states with contrasting foreclosure laws. They find that at times of crisis, slowing down the foreclosure process and making it more expensive for lenders made a substantial difference in the rate of foreclosure. “During the heart of the foreclosure crisis in 2008 and 2009, a delinquent homeowner in a non-judicial foreclosure state was more than twice as likely to experience foreclosure on a delinquent home,” they write.

More foreclosures create a more plentiful housing supply, which during a crisis means further downward pressure on housing prices at a time when real-estate values are already falling, the researchers argue. Those declining prices, in turn, can have ramifications for the rest of the economy. During the 2007–10 financial crisis, when mortgage delinquency rates peaked at more than 10 percent, home prices and new-auto sales plunged further in states that allowed banks to foreclose on homeowners without suing them first.

Law of the land

On this chart, larger boxes correspond to higher foreclosure rates per delinquency; dark-blue boxes denote states that require judicial foreclosure. Hover over a box to see that state's specific rate.

![]()

Economic growth may be considered an absolute good, particularly in an election year. But at the local level, not all growth is created equal.

Chicago Booth’s Chang-Tai Hsieh and University of California, Berkeley’s Enrico Moretti examined how economic growth in a metropolitan area contributes to expansion of the country’s economy as a whole. They find that the answer depends on how that local growth is manifested: as a bump in employment opportunities, or as an increase in wages. Cities whose economic gains have been primarily experienced as wage growth, they write, have contributed less than might be expected to the growth of America’s economy in aggregate.

Hsieh and Moretti point to three US cities that have experienced exceptional local economic growth without having had a correspondingly exceptional impact on national growth: San Jose, California; San Francisco; and New York. Wages have risen in these cities relative to the rest of the country, the authors argue, because the marginal product of labor in those cities is higher—an hour of work in New York is, on average, more productive than an hour of work in most other cities, in part because of the industries located there. The local demand for labor, currently being expressed as higher wages, should attract workers from low-productivity jobs elsewhere. More workers in a higher-productivity setting would mean greater gross domestic productivity.

But something is preventing workers from, say, Brownsville, Texas, from moving to cities such as San Jose, where average wages were twice as high as Brownsville’s in 2009. The researchers identify a likely culprit: limited local housing markets caused by overly restrictive land-use regulations.

Scarce housing in high-productivity regions creates an impediment to workers who might otherwise relocate there. San Jose, San Francisco, and New York have housing supplies that rank among the least flexible in the country: San Jose, for example, grew by fewer than 8,000 residences in 2013, as opposed to 51,000 new dwellings in Houston. They also have land-use restrictions that are more onerous than average. By limiting urban density—imposing maximum building heights or minimum lot sizes, for example—these restrictions also create impediments to growth and “de facto limit the number of US workers who have access to the most productive of American cities,” the authors write.

Relaxing some of these restrictions in San Jose, San Francisco, and New York, Hsieh and Moretti argue, would help alleviate the inefficient allocation of labor reflected in those cities’ relatively high wage levels. They calculate the resulting boost in aggregate productivity would give the US economy a welcome jolt, raising the national GDP by 9.5 percent.

![]()

Central banks around the world responded to the financial crisis that began in 2007 with quantitative easing—buying securities, such as government bonds, from banks and other institutions in the hope of encouraging them to make more loans and thereby stimulate the economy.

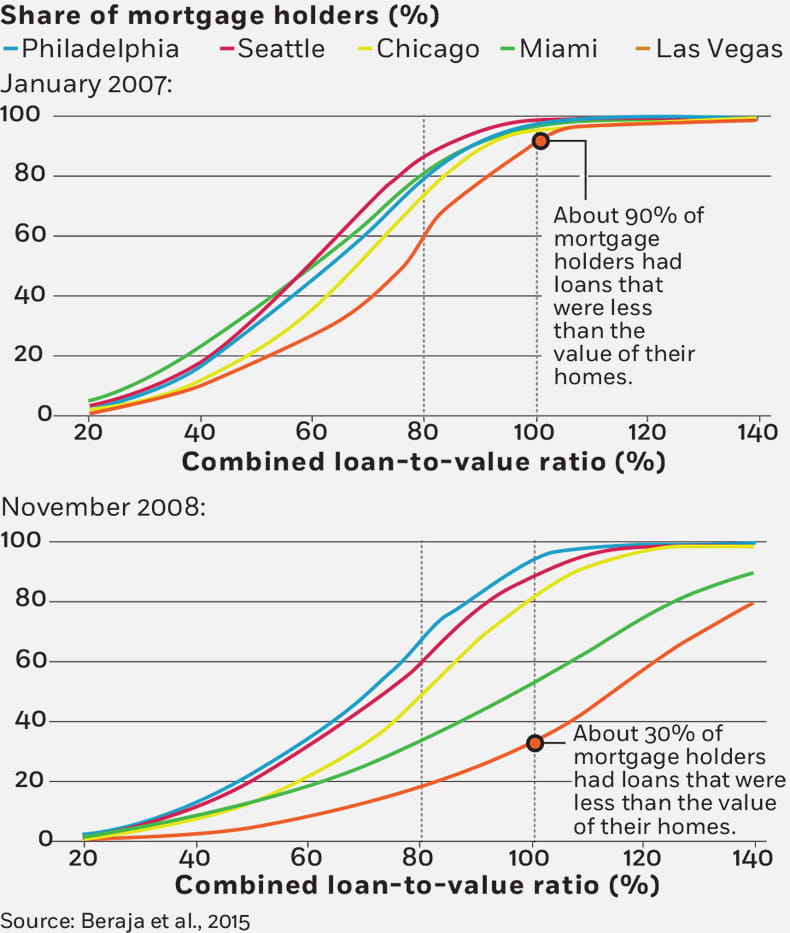

But while quantitative easing may have stimulated national economies, in the US it amplified regional inequality, benefiting the economically healthiest parts of the country more than the hardest-hit regions, according to Martin Beraja, a postdoctoral scholar at Princeton; Andreas Fuster of the Federal Reserve Bank of New York; and Chicago Booth’s Erik Hurst and Joseph S. Vavra.

The researchers analyzed home-mortgage activity and new-car purchases by metropolitan area following QE1, the Fed’s program to buy $600 billion of housing-related securities starting in 2008.

QE1 lowered interest rates and created a boom in mortgage originations, but the policy did not stimulate economic activity evenly across the country, according to the researchers. Almost all the mortgage activity came from refinancing, rather than from people buying and selling homes. These loans sparked consumer spending: new-car sales, a common proxy for consumer spending, rose most in the metro areas where refinancing rates were highest.

Refinancing was out of reach

During QE1, certain cities, such as Las Vegas, had fewer homeowners able to take advantage of lower interest rates.

But refinancing, which often lowers monthly payments and allows people to remove equity from their home, was not uniformly available across the US. Conventional home mortgages typically require loan-to-value ratios below 0.8—a ratio many existing mortgages in hard-hit regions exceeded when home prices fell, leaving the most economically damaged regions with the least amount of home equity to tap for refinancing. Those regions also had the largest declines in home prices and the largest increases in unemployment rates between January 2007 and November 2008.

QE1 exacerbated the disparity between the strongest regions economically and the weakest. The economic benefits of the program flowed mainly to cities such as Boston and Dallas, which fared relatively well in the financial crisis; metropolises such as Los Angeles, Miami, Las Vegas, and Phoenix, which saw housing values plunge and unemployment soar, benefited less.

![]()

Trickle-down economics suggests that tax cuts for wealthy citizens energize ailing economies, as recipients of the cuts use their windfalls to hire workers. And conventional wisdom among policy makers and economists contends that the main beneficiaries of corporate tax breaks are workers, who see wages increase.

But some research suggests that if you want to create jobs, it’s better to cut taxes for the bottom 90 percent of earners.

“People often point to the early 1980s as evidence for trickle-down economics, but there are important confounding factors, such as monetary policy and tax cuts for lower-income groups that occurred at the same time,” says Zidar. “Ultimately, there simply are not that many data points at the national level, so there is an inherent amount of uncertainty in the link between tax cuts for different groups and subsequent economic activity.”

To gauge the effects of tax cuts for the wealthy, Zidar gathered local data such as state-level employment statistics and individual incomes. Using individual tax returns, he analyzed how federal income-tax changes affected individuals of varying income levels as well as the economies of their home states. If tax cuts for high earners sparked economic activity, states with high percentages of high-income taxpayers would grow faster.

“What is interesting is that the state-level results, which are supported by 50 times as much data, are consistent with the national results,” Zidar says. “Both show that almost all the stimulative effect of tax cuts comes from those for lower income groups, and that tax cuts for higher income groups have small impacts in the short to medium run.”

Where the wealthy are

If tax cuts for high earners sparked economic activity, states with high percentages of high-income taxpayers would grow faster. But research finds that tax cuts for lower-income people sparked more economic activity.

Duke University’s Juan Carlos Suárez Serrato, with Zidar, also used regional data to study the effects of corporate tax breaks, such as those designed to convince employers to relocate. The researchers find strong evidence against the traditional arguments for using corporate tax breaks to stimulate economic activity.

Corporate shareholders get more benefit from tax breaks than either workers or landowners do, Suárez and Zidar find, and workers are disproportionately affected by the diminished government services and infrastructure investment that come with the loss in tax revenue. Their study concludes that corporations get roughly 40 percent of the total benefits of state corporate tax cuts; workers, 30–35 percent; and local landowners, 25–30 percent (through rising real-estate values).

The researchers looked at every change in state corporate taxes from 1980 on and measured businesses’ responses to those changes. In addition to county-level data, they used individual-level data from the 1980, 1990, and 2000 US censuses and the 2009 American Community Survey. They created indices of changes in wage rates and rental rates that are adjusted to eliminate the effects of changes in compositions of workers and housing units in any given region.

The findings help explain how certain location-specific attributes, such as availability of skilled workers, can make a higher-tax-rate location more attractive than a lower-rate community for a corporation. Corporations, they find, often choose locations where their businesses are most productive rather than the least taxed.

![]()

In times of economic recession, governments have an interest in democratizing the pain. Within the US, tax collections from healthy areas pay for programs in more-depressed regions. Although these tax policies are often controversial, keeping hard-hit areas from spiraling into intractable depressions mitigates the long-term economic damage for the country as a whole.

Using data from 106 metropolitan areas, economists have uncovered a more subtle way that economically strong parts of the US can, and do, transfer significant wealth to weaker regions. Nationally standardized mortgage rates, they conclude, effectively send billions of dollars from relatively healthy regions to struggling communities during economic downturns.

The researchers—Hurst, Vavra, Chicago Booth’s Amit Seru, and Chicago Harris’s Benjamin Keys—analyzed 18 million individual mortgage loans securitized by Fannie Mae and Freddie Mac, the US government-sponsored enterprises, between 1999 and 2012, as well as metro-regional data on borrowing, such as loan-default rates. Mortgage originators rely on Fannie and Freddie, created to expand the secondary mortgage market, to securitize the vast majority of US home loans, which gives these government-backed entities indirect control over the rules and rates for lending. The researchers also looked at prime jumbo loans, which generally meet the criteria for Fannie and Freddie loans but are securitized privately because of size.

The data provided details on each borrower and property, including credit scores, payment histories, locations, and loan-to-value ratios. With these data, the researchers built a model that displays how the richest regions of the country helped the poorest during the recession.

Specifically, the researchers demonstrate that Fannie and Freddie set a national mortgage interest rate that is artificially high in economically stronger areas and artificially low in weaker areas. Unlike private lenders, the researchers illustrate, Fannie and Freddie do not consider regional risk factors when setting interest rates, even though local characteristics are strong indicators of future default. Instead, Fannie and Freddie charge borrowers with similar characteristics, such as credit scores and loan-to-value ratios, the same rates, regardless of whether their community is booming or devastated.

The researchers’ model suggests that this nationalized mortgage rate had a profound effect on struggling regions during the recession. National mortgage rates allowed individuals who could not afford to pay free-market interest rates to buy homes in depressed areas, and their buying helped stabilize crashing housing markets. Artificially low rates in these regions also meant that more households could subsidize their cash flow with home-equity loans, even as employers cut jobs and banks limited credit.

The model, which accounts for household-behavior changes in response to mortgage-policy changes, calculates that the national rate effectively transferred $20.7 billion from healthy to struggling metro areas between 2000 and 2010, or $1,800 per household from the richest areas to the poorest. By comparison, the authors note that the per-household figure is bigger than the tax rebates the government gave out as economy-boosting tactics in the 2001 and 2008 recessions.

![]()

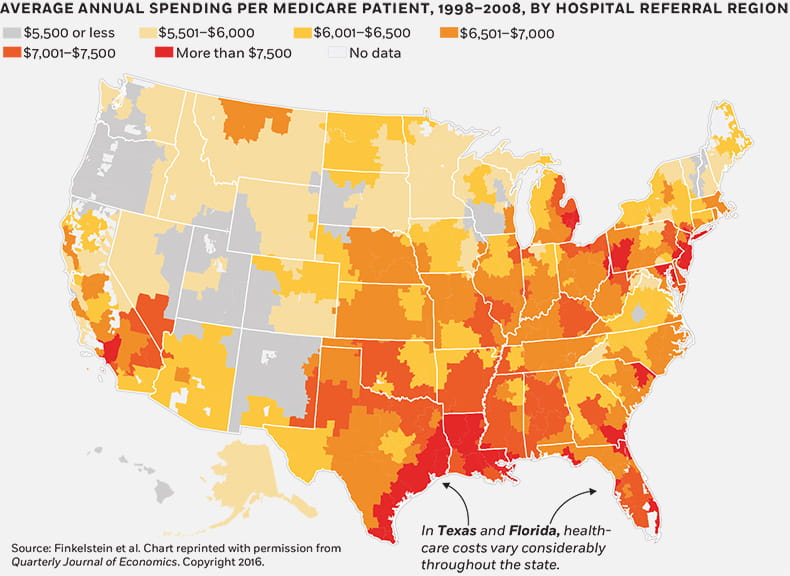

For three decades, the US has spent more money per capita on health care than any other developed country, with increasingly worse health outcomes. Exactly why is unclear, and important to determine.

Conventional wisdom has it that bills are high because doctors order excessive tests and treatments, in which case policies could discourage such excess as a way to cut costs.

But a group of economists—MIT’s Amy Finkelstein and Heidi Williams and Stanford’s Matthew Gentzkow—analyzed individual health-care costs at the local level.

Their results suggest that patients are a bigger factor in high health-care costs than conventional wisdom predicts. Addressing those patient-driven costs could require a different set of policies and incentives.

The researchers observe big differences in health-care costs between US regions. The average Medicare enrollee in McAllen, Texas, spent $13,648 in 2010, while the average enrollee in demographically similar El Paso, Texas, spent about $8,714. A Miami enrollee cost the government about twice as much as one in Minneapolis.

Finkelstein, Gentzkow, and Williams separated physician-driven costs from patient-driven costs in various “hospital referral regions”—zones of care defined by zip code. They used individual claim information from 2.5 million Medicare patients who received benefits between 1998 and 2008—500,000 of whom relocated from one referral region to another, and 2 million of whom did not. The researchers could see medical details such as diagnosis, type and cost of care, and Medicare reimbursement; the data also included patient-specific information such as gender, race, age, and zip code of residence.

The researchers studied this data to compare how patients used health care before and after they moved between high-cost and low-cost zones. They reasoned that if regional variation in spending was completely explained by some areas having sicker patients than others, patients should have no change in health-care costs when they moved. However, if practitioners were one cause of higher or lower costs, the patients’ bills would adjust when they relocated.

Their analysis finds that patients moving from a low-utilization area to a high one reported dramatically higher health-care costs starting in the first year after a move. Similarly, moving from a high to a low area dramatically cut costs starting in the first year. While these changes around the move date were large, they did not bring the newcomer’s utilization up or down to the average utilization levels of the area.

The study estimates that overall, patient-specific factors such as patient health and patient demand (preferences for more intensive care, for example) drive 40–50 percent of the geographic differences in health-care costs, and the remaining 50–60 percent of variation is due to place-specific factors, such as doctor practice patterns and characteristics of health-care organizations.

Where health-care costs really add up

Researchers observe big differences in health-care costs between US regions.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.