What the Latest Nobel Winners Taught Us

Their insights changed the modern understanding of banks.

What the Latest Nobel Winners Taught Us

This website uses cookies to ensure the best user experience.

Privacy & Cookies Notice

|

NECESSARY COOKIES These cookies are essential to enable the services to provide the requested feature, such as remembering you have logged in. |

ALWAYS ACTIVE |

| Reject | Accept | |

|

PERFORMANCE AND ANALYTIC COOKIES These cookies are used to collect information on how users interact with Chicago Booth websites allowing us to improve the user experience and optimize our site where needed based on these interactions. All information these cookies collect is aggregated and therefore anonymous. |

|

|

FUNCTIONAL COOKIES These cookies enable the website to provide enhanced functionality and personalization. They may be set by third-party providers whose services we have added to our pages or by us. |

|

|

TARGETING OR ADVERTISING COOKIES These cookies collect information about your browsing habits to make advertising relevant to you and your interests. The cookies will remember the website you have visited, and this information is shared with other parties such as advertising technology service providers and advertisers. |

|

|

SOCIAL MEDIA COOKIES These cookies are used when you share information using a social media sharing button or “like” button on our websites, or you link your account or engage with our content on or through a social media site. The social network will record that you have done this. This information may be linked to targeting/advertising activities. |

|

Their insights changed the modern understanding of banks.

What the Latest Nobel Winners Taught Us

Data are indispensable to understanding economic outcomes—but they need theory to be made useful.

Purely Evidence-Based Policy Doesn’t Exist

Eugene F. Fama and Richard H. Thaler discuss whether markets are prone to bubbles.

Are Markets Efficient?

I love my work. I have no intention of stopping as long as I'm breathing—and I may even do it after that.

A Brief History of Finance and My Life at Chicago

Many investors hold naive notions about diversification and a pronounced lack of sophistication about portfolio asset selection.

From 2001: Getting the Right Asset Allocation Mix

“Behavioral economics" is still economics, but it is economics done with strong injections of good psychology and other social sciences.

The Evolution of Economics and Homo Economicus

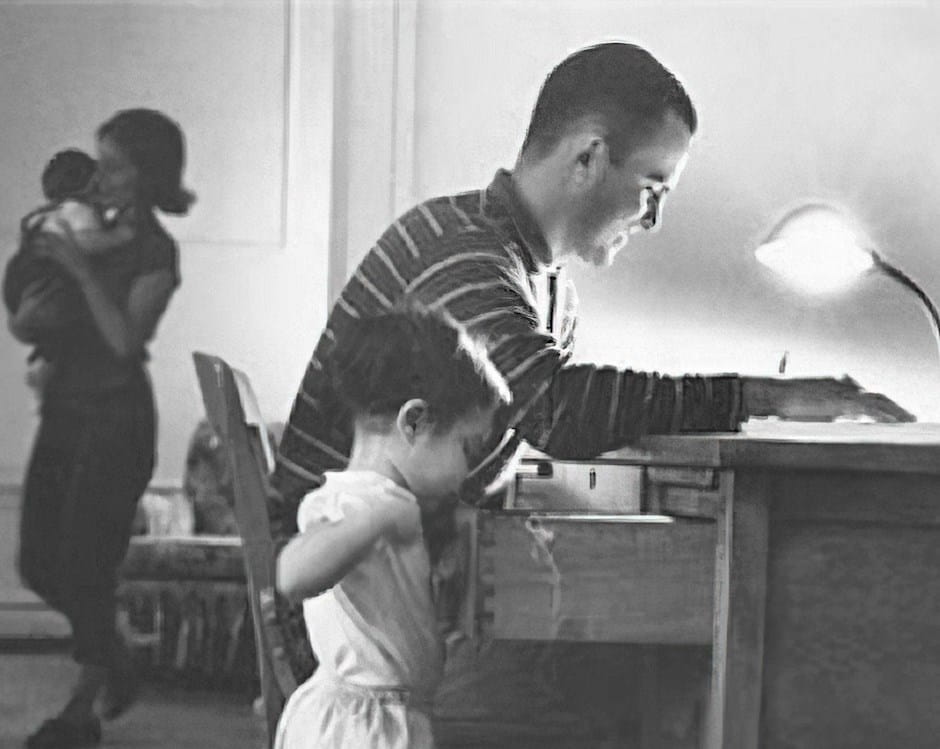

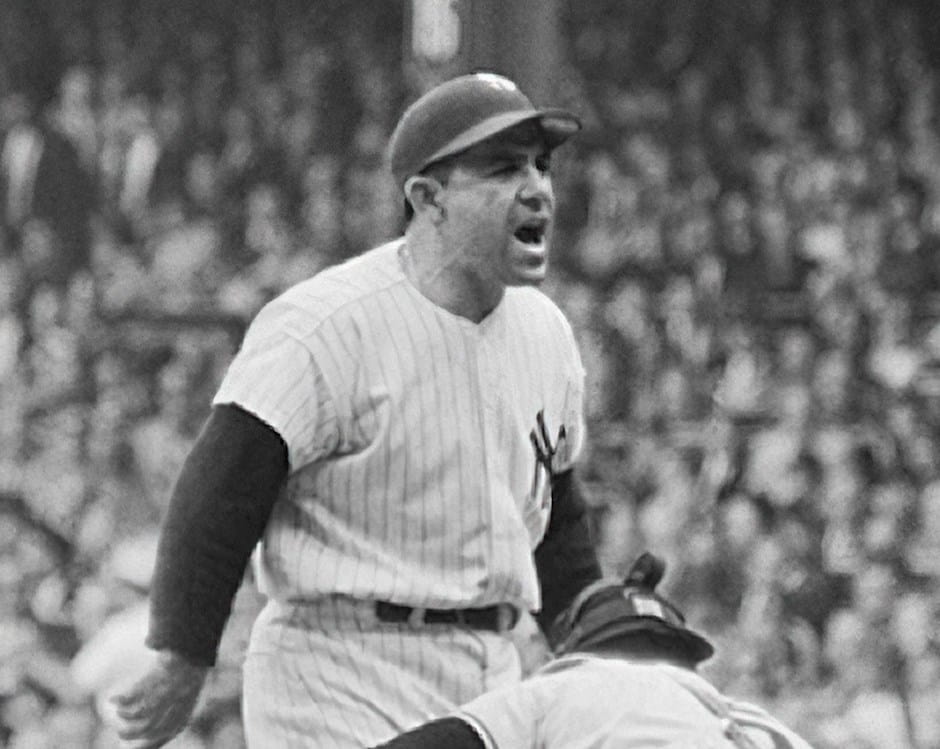

Merton H. Miller liked to tell a joke about Yogi Berra, the famous baseball catcher. Berra once told his trainer that he was particularly hungry, and he instructed him to cut his pizza into 12 pieces instead of six.

Why Merton Miller Remains Misunderstood

Chicago Booth and the University of Chicago’s Lars Peter Hansen and Kevin M. Murphy discuss the challenges of translating academic research into policy advice.

How Should Economics Shape Policy?

When facing a risk of immediate failure, people often avoid it, even if it improves the odds of success.

Why We Avoid ‘Sudden Death’ Situations

We can’t eliminate crises, but we can limit their severity.

Douglas W. Diamond Says the Next Crisis Will Be Different

Some advice from the father of efficient markets.

Embrace Passive Management Already

Does personal freedom beget market freedom, or vice versa?

From 1974: Free Markets for Free Men

What banks demand from corporate borrowers may help explain the length and severity of economic busts.

What Makes Economic Downturns So Long and Painful?

The Nobel laureate is best known for work on efficient markets. But he also helped develop event studies, which have been used extensively in the field.

How Eugene F. Fama Has Left His Mark on Industrial Organization

Once people are participating in a default option, they can stick with it for years.

When ‘Nudging’ Is Forever—the Case of Sweden

In the model, the mismatch between assets (loans) and liabilities (deposits) is simply a liquidity issue, which deposit insurance can help address.

Bank Runs Aren’t Madness: This Model Explained Why

Fundamental economic variables regain importance in explaining risk premiums in stock markets.

A Nobel laureate offers advice on trying new things and creating long-term value.

Words to Live By: Flops, Nudges, and Sludge

The nation’s absorption with what the Fed will and will not do has left institutions guessing about what the future holds, which has caused inaction among investors.

Nobelist Hansen: Overreliance on Fed Leading to Sluggishness

Economic reform tends to be undertaken with no economic knowledge.

From 1964: The Danger of Making Policy Based on Assumption

An abundance of loans can create a debt overhang that causes lenders to pull back—and the ensuing credit crunch can make it harder for businesses to grow, or even to repay their debts.

How Managers Can Dam up Credit Flow

Chicago Booth’s Eugene F. Fama says that the government played a significant role in creating the crisis by insuring risky loans in the hopes of boosting home ownership.

Eugene F. Fama on the Government’s Role in the Subprime Mortgage Meltdown

A look at the ideas that did and did not influence his peers—and posterity.

From 1976: What Were Adam Smith’s Biggest Failures?

There are four essential ingredients to any comprehensive plan to facilitate adequate saving for retirement: availability, automatic enrollment, automatic investment, and automatic escalation.

Behavioral Economics and the Retirement Savings Crisis

When individual banks engage in risky behavior—such as extending credit too readily or taking on too much collateral that cannot be easily liquidated—they can quickly get into trouble.

Why the New Rules on Banks’ Financial Disclosures Aren’t Strict Enough

Mispriced stocks break the rules of efficient markets.

From 2002: Can the Market Add and Subtract?

New evidence on value versus growth.

From 1997: Rethinking Stock Returns

Nudging is often a cost-effective approach to public policy.

Why Policy Makers Should Nudge More

About half the time, a bank monitors a small private company by requesting financial statements, and in other cases it asks for tax returns or proof of creditworthiness.

How Can You Monitor a Borrower without Financial Statements?

An argument for reducing government control.

From 1963: The Limits of What the State Can—and Should—Do for the Economy

Becker’s analysis would extend the reach of economics, and completely reshape the field—and social-science research in general, but it took decades to do so.

How Gary Becker Saw the Scourge of Discrimination

The economics of the war on drugs.

From 2005: Battle Tactics

Gene's bottom line is always: Look at the facts. Collect the data. Test the theory.

Eugene F. Fama, Efficient Markets, and the Nobel Prize

The protests may have failed to overhaul the financial system, but that does not mean that nothing has changed.

What Occupy Wall Street Should Have Said

Americans have been taught by persistent experience to expect great and growing wealth from their economic system—even our paupers are richer in goods than most of the elites of history.

From 1970: Modern Man and His Corporations

Adam Smith was a radical and revolutionary in his time—just as those of us who today preach laissez faire are in our time.

From 1976: Adam Smith’s Relevance for 1976

Longevity gains in developing countries.

From 2006: The Upside of Globalization

Gary S. Becker and Richard Posner call for an end to the policy that dates to 1960.

Is It Time to End the Cuban Embargo?

By carefully studying investor behavior, active money managers can identify profitable clues about what stocks to buy and when.

From 1999: Fair GameYour Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.