Is There a Better Way to Spot Risky Investments?

- By

- December 09, 2013

- CBR - Finance

If there’s one thing most Americans can probably agree on about the financial crisis that began in 2008, it’s that US credit rating agencies made a bad situation worse.

Inaccurate credit ratings on supposedly safe mortgage-backed securities, “introduced risk into the US financial system and constituted a key cause of the financial crisis,” wrote the US Senate’s Permanent Subcommittee on Investigations, in April 2011. A suit filed in February 2013 by US Attorney General Eric Holder against Standard & Poor’s Financial Services (S&P) and its parent company, McGraw-Hill Companies, says S&P falsely represented that some of its ratings “were objective, independent, uninfluenced by any conflicts of interest that might compromise S&P’s analytic judgment.” Within the past year, the US federal government as well as more than a dozen US states and a growing number of private insurers and investors, have filed lawsuits against ratings agencies, seeking billions of dollars in damages. S&P says the lawsuits are meritless.

This has led some to wonder if it would make more sense to listen less to the opinions of the big ratings agencies—Moody’s Investors Service, Standard & Poor’s Financial Services, and Fitch Ratings—and more to what the marketplace is revealing about risk. Three Booth academics have formulated the details of such an approach.

“Our goal is to provide an alternative ratings system that leverages information in financial markets to make ratings more transparent and with a clearer idea for what each rating actually means,” says Drew D. Creal, associate professor of econometrics and statistics, who is leading the research along with Robert B. Gramacy, assistant professor of econometrics and statistics, and Ruey S. Tsay, H.G.B. Alexander Professor of Econometrics and Statistics. Their model, or one similar, has the potential to change the way investors evaluate credit-based investments.

Evaluating credit

Before a bond is issued, the issuing company or municipality obtains the agency’s opinion about the ability and willingness of an issuer to meet its financial obligations in full and on time. Credit ratings can also be issued about individual debt issues.

In general, a high credit rating such as AAA indicates that a bond is more creditworthy and less likely to default. Even though S&P says its ratings are not recommendations, guarantees of credit quality, nor absolute probabilities of default, regulators put stock in the agencies’ opinions: the Securities and Exchange Commission, for example, requires that institutional investors such as banks, hedge funds, and mutual funds hold only assets with high credit ratings. Many investors steer clear of assets with lower ratings, the lowest of which are considered “junk.”

Creal voices some criticisms of this system, many of them widespread. Among them: credit ratings agencies have an incentive to inflate ratings because the agencies get paid by the companies or governments issuing the debt. If their customers do not receive high ratings from one agency, those customers may take their business to a competitor.

Also, the ratings agencies do not reveal in great detail how they formulate ratings, says Creal. While it’s generally understood that an AAA-rated bond is more creditworthy than debt with a D rating, the agencies have not defined exactly what the ratings mean, and guard their methods as proprietary, he adds.

Lastly, the agencies’ ratings are slow to reflect risks caused by larger economic events, says Creal. During the crisis, credit ratings for most companies and their issues remained curiously stable: “When we have a massive financial crisis, the credit ratings for almost all firms should change because the ability of firms to finance themselves depends heavily on the macroeconomy,” he says.

In response, an S&P spokesman says policies and procedures separate employees with commercial and analysis roles. He says that while S&P’s methods are proprietary, they aren’t hidden from view: S&P discloses information about its ratings process on its website, and sometimes solicits public comments before changing ratings criteria.

As for whether its ratings reflect changing economic conditions, the spokesman takes issue with the suggestion that many ratings should have dropped when the 2008 crisis hit, saying high ratings are meant to be stable, not volatile. Cash-rich companies such as Microsoft and Apple shouldn’t be downgraded due to macroeconomic events, he says. “To address the inherent variability of creditworthiness, we maintain surveillance on our ratings. Our approach to changes in creditworthiness is to take prompt rating actions when we believe, based on our surveillance, that an upgrade, downgrade, or an affirmation is appropriate,” the company writes in a white paper posted to its website.

Nevertheless, the Senate subcommittee report that dissected the financial crisis recommended additional oversight and action by the Securities and Exchange Commission for the ratings industry.

Use trading data instead

The Booth research details an alternative to extending regulation: a market-based ratings system. The idea is that markets for stocks, bonds, futures, options, and derivatives continuously reveal information, and prices in those markets can be used to calculate default probabilities for specific firms.

The researchers test this theory using spreads on credit default swaps (CDS). CDSs function like insurance, protecting bond buyers against the risk of default. The size of the premium, or spread, indicates the market’s view of the issuer’s risk of default. Larger spreads mean investors think that a firm is either more likely to default or that the consequences of default are especially bad. When CDS spreads on Lehman Brothers hit record highs in September 2008, it reflected fears that the bank was unstable, as well as fears that the bank’s potential failure could affect the rest of the financial system—which it soon did.

Using data from 2005 to 2011 on swaps and spreads for more than 1,500 companies, the authors also incorporate prices of interest rate swaps, the VIX index (formally known as the CBOE Volatility index), and US Treasuries, as measures of general market conditions. They use standard asset pricing formulas to transform the prices into default probabilities, and use an algorithm they wrote to cluster firms into ratings categories. Each company gets rated on a numerical scale between 0 and 9, with 0 equal to default and 9 representing the safest rating. (These ratings are for companies, not debt issues—for example, the model evaluates the safety of General Motors, not a specific bond issued by General Motors.)

The algorithm also allows the researchers to use two types of ratings: absolute ratings, which assess a company’s creditworthiness at a defined point in time, and relative ratings, which compare the creditworthiness of a company to other companies at that point in time. “During a credit crisis when short-term lending to businesses by banks dries up, it may be that few if any firms are able to attain the highest absolute rating,” the researchers write in a paper outlining their idea. During the same crisis, a company may experience less of a credit crunch than its peers, so it could have a higher relative rating, even as its absolute rating has fallen.

Tsay says the relative ratings address the point S&P’s spokesman made about cash-rich companies. “During a big financial crisis, all companies are affected so that their absolute ratings are likely to drop. However, relative ratings enable users to see the differences between companies,” says Tsay.

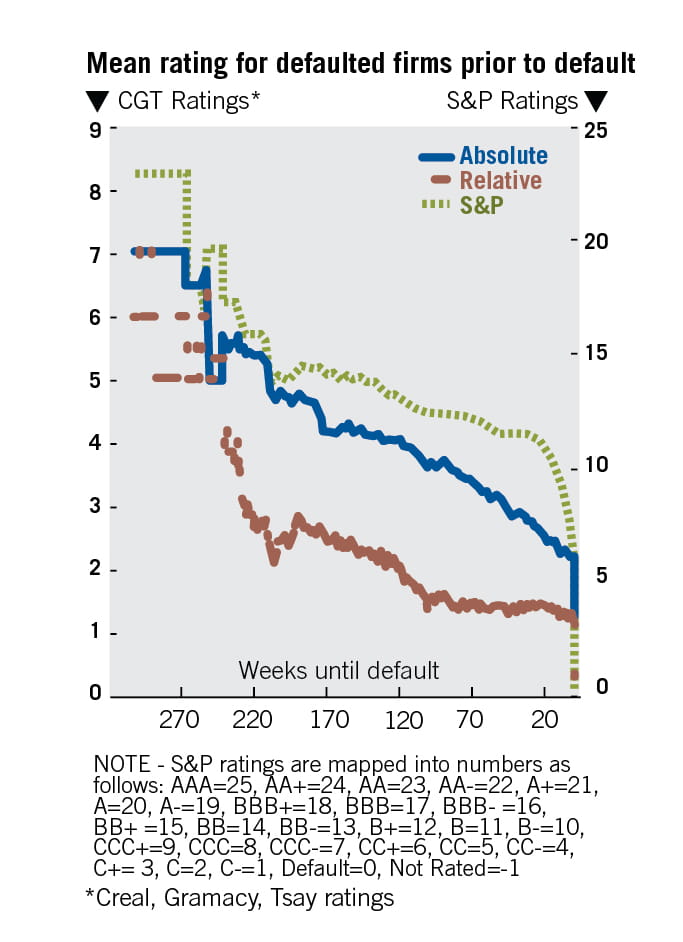

Because the researchers have 10 ratings while S&P reports 25 letter grades from AAA to C, as well as default, it can be difficult to compare the ratings schemes directly. That said, the researchers present the traditional and new alternate ratings that were assigned to four financial companies—Washington Mutual, Ambac Financial, Lehman Brothers, and American International Group—before and during the crisis (see graphic on next page). Hindsight shows that these companies were risky bets: three of them defaulted, while American International Group required a government cash infusion. The researchers’ absolute and relative ratings reflected mounting risks before Standard & Poor’s issued a ratings downgrade.

The risks of market-based ratings

Creal and his colleagues have company in thinking that swaps—which were widely accused of exacerbating the crisis—are a source of useful information. Luigi Zingales, Robert C. McCormack Professor of Entrepreneurship and Finance and David G. Booth Faculty Fellow, and Harvard’s Oliver Hart, suggest in a 2010 paper that the CDS market could be used as an early warning system to alert regulators when large financial institutions are in trouble. “Since the CDS is a ‘bet’ on the institution’s strength, its price reflects the probability that the debt will not be repaid in full. In essence, the CDS indicates the risk that the LFI [large financial institution] will fail,” they write. They propose that when the CDS price rises above a threshold, a regulator should force the institution to issue equity until the CDS price drops below the threshold. (For more, see “What Occupy Wall Street Should Have Said” in the June 2013 issue of Capital Ideas.)

Meanwhile Seton Hall Law School’s Michael Simkovic, and law partner Benjamin Kaminetzy, write in a 2011 article in the Columbia Business Law Review, that CDS spreads could be used to evaluate default risk, in order to inform bankruptcy court trustees. “As credit default swaps mature from cutting edge financial innovations into transparent, standardized, and regulated instruments, they may provide valuable insights to regulators and courts tasked with preventing and managing insolvency,” they write.

Creal sees other advantages to using CDS prices, one being that the resulting ratings would provide more meaning than the current letter grades. He says market-based ratings also address the ratings agencies’ incentive question by providing a transparent method based on publicly available asset prices.

Even the ratings agencies use CDS and market prices in some analysis. But in another online white paper, S&P cautions against relying too much on bond and CDS signals. “Markets capture investors’ emotions with great speed and efficiency and, consequently, can overreact to headlines, creating excessive volatility,” it writes. The agency also argues that traders’ motivations are not transparent, that CDS markets aren’t liquid enough to create reliable prices, and that there simply aren’t enough traded securities to help rate a large swath of the credit market. “Standard & Poor’s rates more than two million corporate, sovereign, and public finance issues globally. By comparison, the global CDS market covers only about 1,000 single names.”

Creal counters that although swap markets still lack transparency and liquidity, they do provide information about investors’ beliefs about a company’s future prospects. “I don’t think of [CDS prices] as a perfect signal of credit quality, but as the markets continue to evolve we should find ways to leverage the information they provide,” he says.

And if a company doesn’t have an actively traded CDS contract or other actively traded assets with prices to feed into the researchers’ model, his solution is to rate a firm that is not actively traded by comparing it to another firm that looks comparable and is actively traded.

Rating companies with multiple sources

Creal says that despite flaws in traditional credit analysis, his proposed alternate ratings scheme isn’t meant to replace the old method entirely. Rather, he says that investors should use both traditional ratings and a market-based model to evaluate investments.

So far, his team has used the model to rate several thousand US companies. The researchers’ plan is to eventually expand their methodology to pull in more information from other sources, including equity prices.

That would require more research and computing power than the researchers are currently dedicating, but the more data the market creates, the better the resulting credit ratings model could be.

- Drew D. Creal, Robert Brandon Gramacy, and Ruey S. Tsay, “Market-based Credit Ratings,” Working paper, July 2013.

- Oliver Hart and Luigi Zingales, “A New Capital Regulation For Large Financial Institutions,” Working paper, January 2010.

- Michael Simkovic and Benjamin S. Kaminetsky, “Leveraged Buyout Bankruptcies, the Problem of Hindsight Bias, and the Credit Default Swap Solution,” Columbia Business Law Review, August 2010.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.