CBR Briefing #52

- April 02, 2018

- CBR - Finance

Why banks pay ever-larger dividends

Investors use the payments as a proxy for financial strength

Paying regular and increasing dividends allows banks to signal confidence about their solvency.

- Dividends are critical for banks, whose opaque balance sheets can make them difficult to analyze. Paying regular and increasing dividends allows banks to signal confidence about their solvency, according to research by Rice University’s Eric Floyd, University of Toronto’s Nan Li, and Chicago Booth’s Douglas J. Skinner.

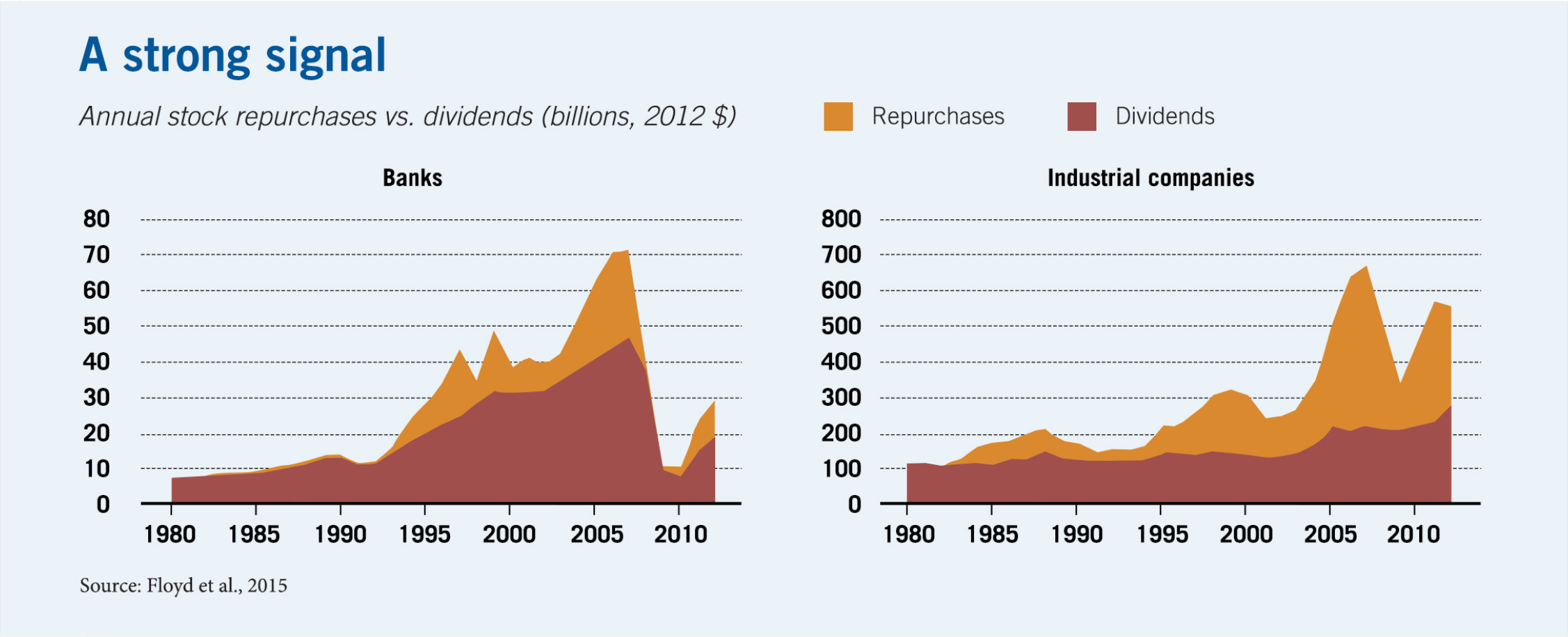

- About 80 percent of US banks have consistently paid dividends over the past 30 years, the researchers find. In 2007, US banks’ total payouts to shareholders peaked at $71 billion, $47 billion of it in dividends (see chart). Most banks cut dividends during the 2007–10 financial crisis, due to government stress tests that put pressure on their ability to pay. Banks have since asked regulators for the right to resume and increase dividend payments, and some have recently won approval.

- US industrial companies, by contrast, mostly pay shareholders in the form of share repurchases, deeming this method a tax-efficient and flexible way for companies to return excess capital. Repurchases exceeded dividends in most years—but as the researchers note, they don’t convey the same message of strength.

Eric Floyd, Nan Li, and Douglas J. Skinner, “Payout Policy through the Financial Crisis: The Growth of Repurchases and the Resilience of Dividends,” Journal of Financial Economics, November 2015. Chart reprinted with permission from Elsevier.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.