CBR Briefing #31

- March 04, 2018

- CBR - Finance

How high-frequency traders get an edge

Ultrafast traders can exploit time delays in postings of company stock filings.

- The US Securities and Exchange Commission (SEC) uses its Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system to make insider-trading filings available to the public. Research by the University of Colorado’s Jonathan L. Rogers and Chicago Booth’s Douglas J. Skinner and Sarah L.C. Zechman suggests that the data have their own set of insiders.

- The researchers find that in most cases subscribers to a direct feed from a private vendor used by the SEC to manage EDGAR are getting Form 4 filings (which disclose trades made by directors, officers, and owners of more than 10 percent of a class of shares) seconds before they appear on the SEC website. The subscribers’ average time advantage is 10 seconds.

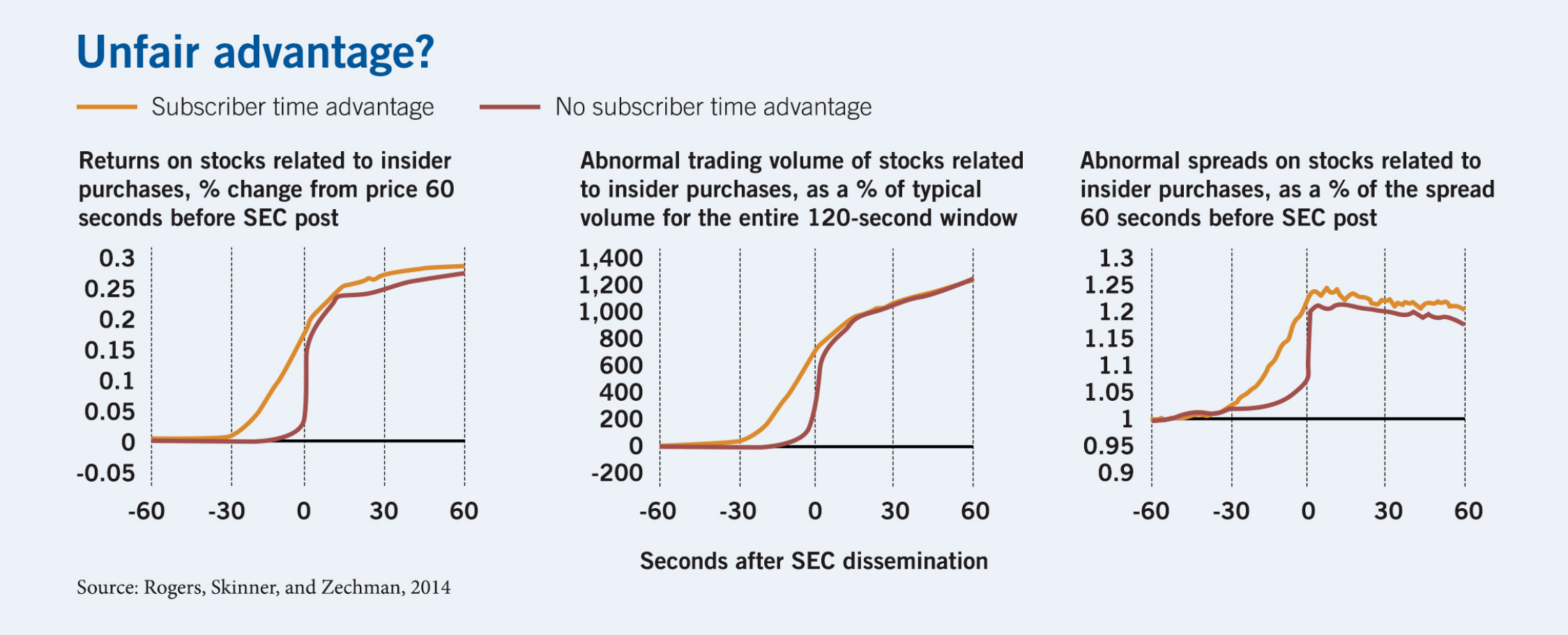

- The subscribers or the clients they sell the information to may be trading on the news before its public release. The researchers find that for filings where a subscriber had an information advantage, prices, trading volume, and stock spreads began to move 30 seconds before the documents appeared on the SEC website (see chart). When there was no information advantage, most of the market response occurred exactly at the time of public posting.

Jonathan L. Rogers, Douglas J. Skinner, and Sarah L.C. Zechman, “Run EDGAR Run: SEC Dissemination in a High-Frequency World,” Working paper, December 2014.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.