The Equation The Benchmark Effect on Stocks

- November 14, 2025

- CBR - Finance

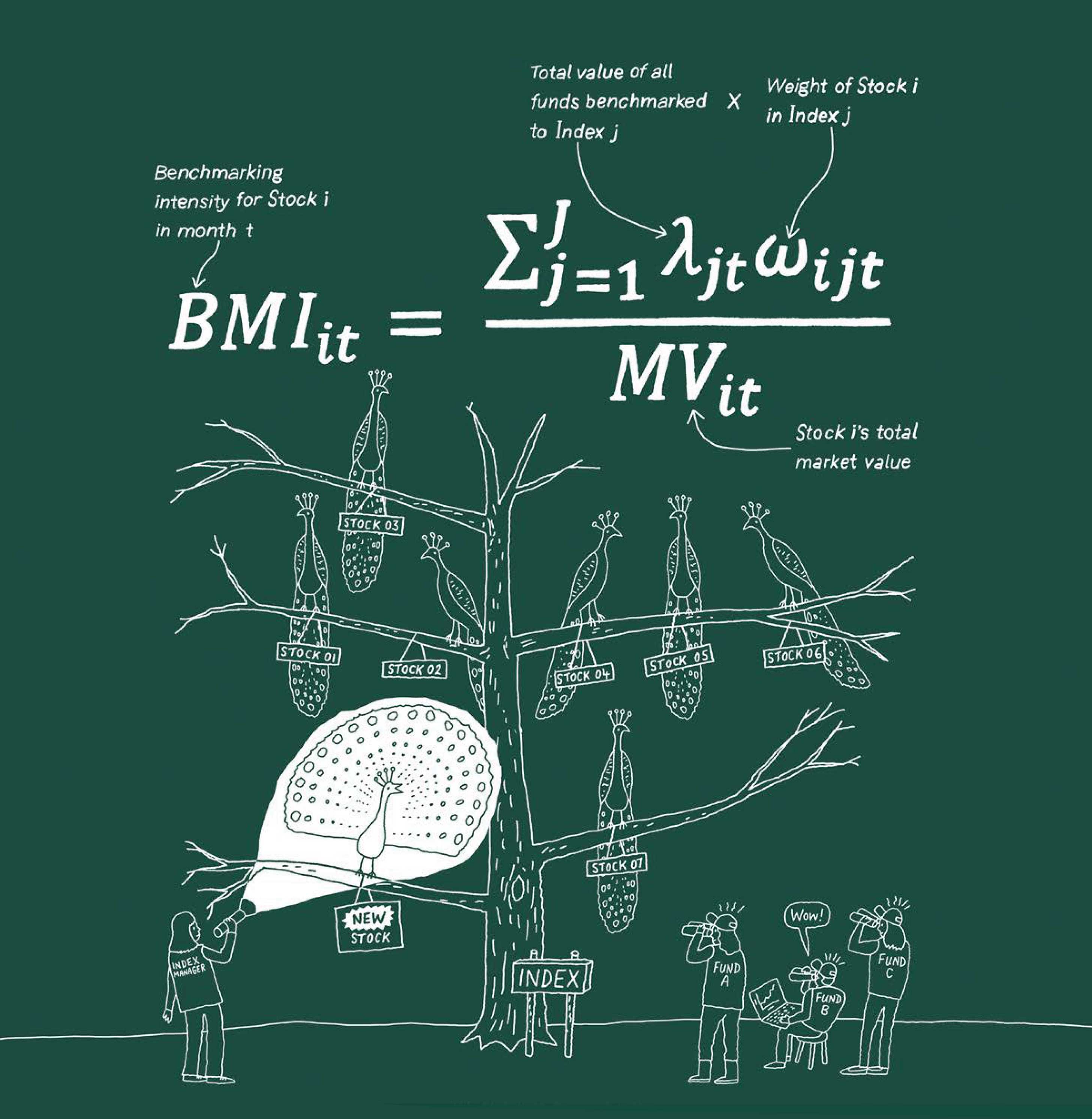

Benchmarking to indexes such as the S&P 500 or the Russell 1000 or 2000 compels passive funds and incentivizes active ones to hold those stocks regardless of fundamentals or price. But when indexes rebalance, the mechanical buying and selling involving trillions of investment-fund dollars has notable impacts on how stocks trade, according to Chicago Booth’s Taisiya Sikorskaya. In particular, when stocks are added to an index and attract more benchmarked capital, they experience sharper price jumps, weaker long-term returns, and higher shorting costs.

To capture this effect, Sikorskaya, along with Anna Pavlova of the London Business School, developed a benchmarking-intensity measure, which indicates how much of a stock’s market capitalization is tied to benchmarked funds. The metric quantifies the extent of a stock’s exposure across all indexes, giving a full picture of how benchmark-driven investing affects stocks. To learn more about how benchmarking relates to securities lending, read “Is Your Retirement Fund Leaving Money on the Table?”

Illustration by Peter Arkle

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.