How Much Does Political Uncertainty in Hong Kong Affect Property Valuations?

- October 16, 2020

- CBR - Economics

Investors widely believe that political and social unrest, including the threat of revolution, drive down asset values. Because so many interrelated economic and social factors are always at play, isolating the influence of political uncertainty on asset prices can be difficult.

Hong Kong, however, provides a laboratory for doing so. Chicago Booth’s Zhiguo He, Booth postdoctoral scholar Zhenping Wang, University of Hong Kong’s Maggie Hu, and Georgia State University’s Vincent Yao, by comparing property valuations before and after the political authority is set to change in 2047, find that rising uncertainty in Hong Kong has significantly lowered property values.

Uncertainty is a feature of life in Hong Kong now because, as the researchers explain, the region, “caught in the middle of the conflict between China and the western world, has become a political battleground for the fate of the unprecedented political experiment ‘One Country, Two Systems,’ especially since its ongoing 2019– 20 social unrest.” In 1997, the United Kingdom transferred the former colony back to China, and both governments agreed to temporarily make Hong Kong a special administrative region that would maintain a capitalist system. That agreement expires in 2047, when the Hong Kong Special Administrative Region (HKSAR) will cease to exist, and Beijing will have authority.

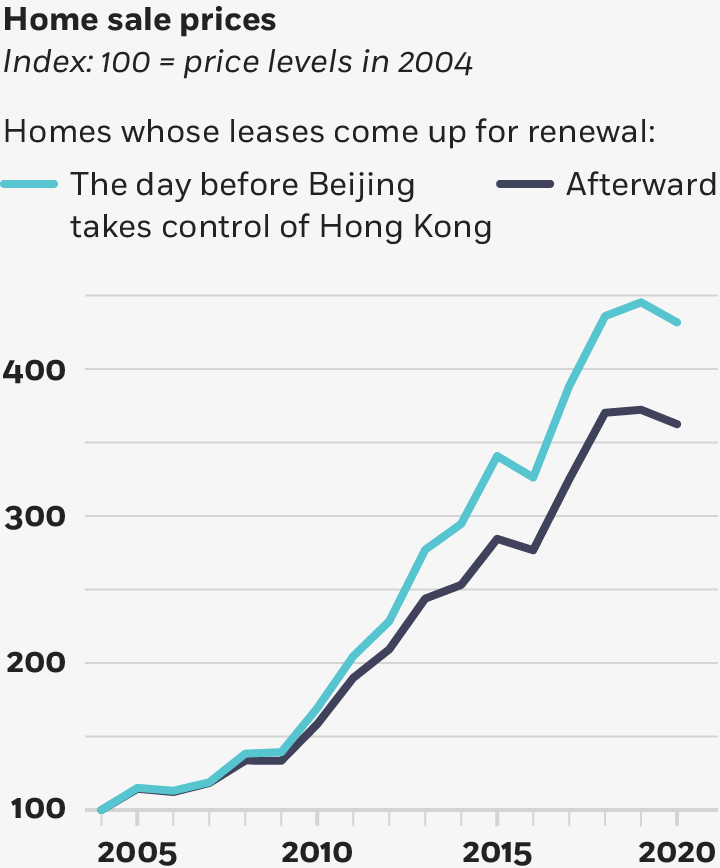

Home buyers hedged against Beijing’s takeover

Buyers paid more for Hong Kong homes whose land leases will become eligible for a 50-year extension before Beijing assumes control of the region in 2047.

He et al., 2020

The researchers seized upon this hard transition date to calculate the effects of political uncertainty on long-term asset values, namely land leases, which lend themselves in this case to a natural experiment. In Hong Kong, land tenure is granted by the government for a fixed term. Leases can be renewed and extended when their terms end, and while an extension is subject to potential additional charges, those are typically low.

What’s more, the leases that have been granted by one government, say the British colonial government or the HKSAR, can be renewed by another, such as the government that takes over in 2047. This exposes many lessees to substantial political risk—namely, will current leases that expire after 2047 be extended with little cost, as has been the case?

He, Hu, Wang, and Yao tracked housing values from January 1992 through February 2020, a period of increasing political tensions. Using public census and sales data from Hong Kong, the researchers built a model for property values on the basis of the 2047 transition date and created two measures of uncertainty sentiment. In Hong Kong, the colonial government owned all of the land, leasing out the rights to use it under long-term contracts, a practice that the special administrative region continued. The researchers used land leases that expire before 2047 as a control group and measured whether those properties traded at a premium compared with real estate that had later expirations.

“We exploit a unique feature in Hong Kong’s housing market: Land leases expiring on June 30, 2047, have been promised a 50-year extension protection, while those expiring immediately after that date are left unprotected legally,” the researchers write. When it comes to leases that expire after the transition to mainland law—say in 2050 or 2055—the government may extend those leases under the current terms, change the terms, or not extend them at all.

By tracking real-estate transactions, the researchers demonstrate that housing with land leases that expire immediately after June 30, 2047, sold at a 8 percent discount compared with properties whose leases can be extended until 2097. They also find that properties that still have land leases granted by the British colonial government sold at a further discount of about 8.5 percent compared with similar leases granted by the successor Hong Kong government. Moreover, the discounts appear to have widened since 2004, as confidence in Hong Kong’s future as an autonomous region has declined.

Recent demonstrations and controversial moves by the mainland government affected housing values, as Hong Kong’s political and social future are top of mind for residents, including recent migrants from the mainland. The researchers’ data, running through February 2020, don’t include the effects of Beijing’s imposition of a national security law in June 2020 that expanded government powers and limited civil rights.

“Political uncertainty regarding the fate of Hong Kong has been lingering throughout society” for decades, the researchers write. “But its severity and gravity have been evolving over time and often manifest more significantly when public sentiment rises.”

Hong Kong’s near- and long-term futures will tell a social and human-rights story that will resonate worldwide. For now, they also provide a rare glimpse into how political unrest can interact with asset valuations. And the finding that uncertainty has a measurable cost on asset prices may apply more broadly as social unrest and ideological divisions intensify in many parts of the world.

Zhiguo He, Maggie Hu, Zhenping Wang, and Vincent Yao, “Valuation of Long-Term Property Rights under Political Uncertainty,” Working paper, August 2020.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.