A Plain Way to Cut Smoking Rates

- By

- July 23, 2019

- CBR - Marketing

Tobacco has been a known carcinogen for more than 50 years, yet cigarettes continue to attract new smokers to the harmful, addictive habit every day. Research suggests that marketing, including package labels and brand logos, plays an important role in encouraging young people to take up smoking and legitimizing the habit for many smokers who are trying to quit—and that policy makers may have a way to change that.

In recent years, some 120 countries have added mandatory pictorial health warnings to packaging, and a handful have passed plain-packaging laws. These efforts to discourage new smokers and reduce tobacco-related disease and deaths appear to be working. Australia, the first country to implement a plain-packaging mandate, in 2012, saw monthly cigarette sales decline after the mandate was introduced, according to research from Chicago Booth’s Pradeep K. Chintagunta, Deakin University’s André Bonfrer, University of New South Wales’s John Roberts, and University of South Australia’s David Corkindale.

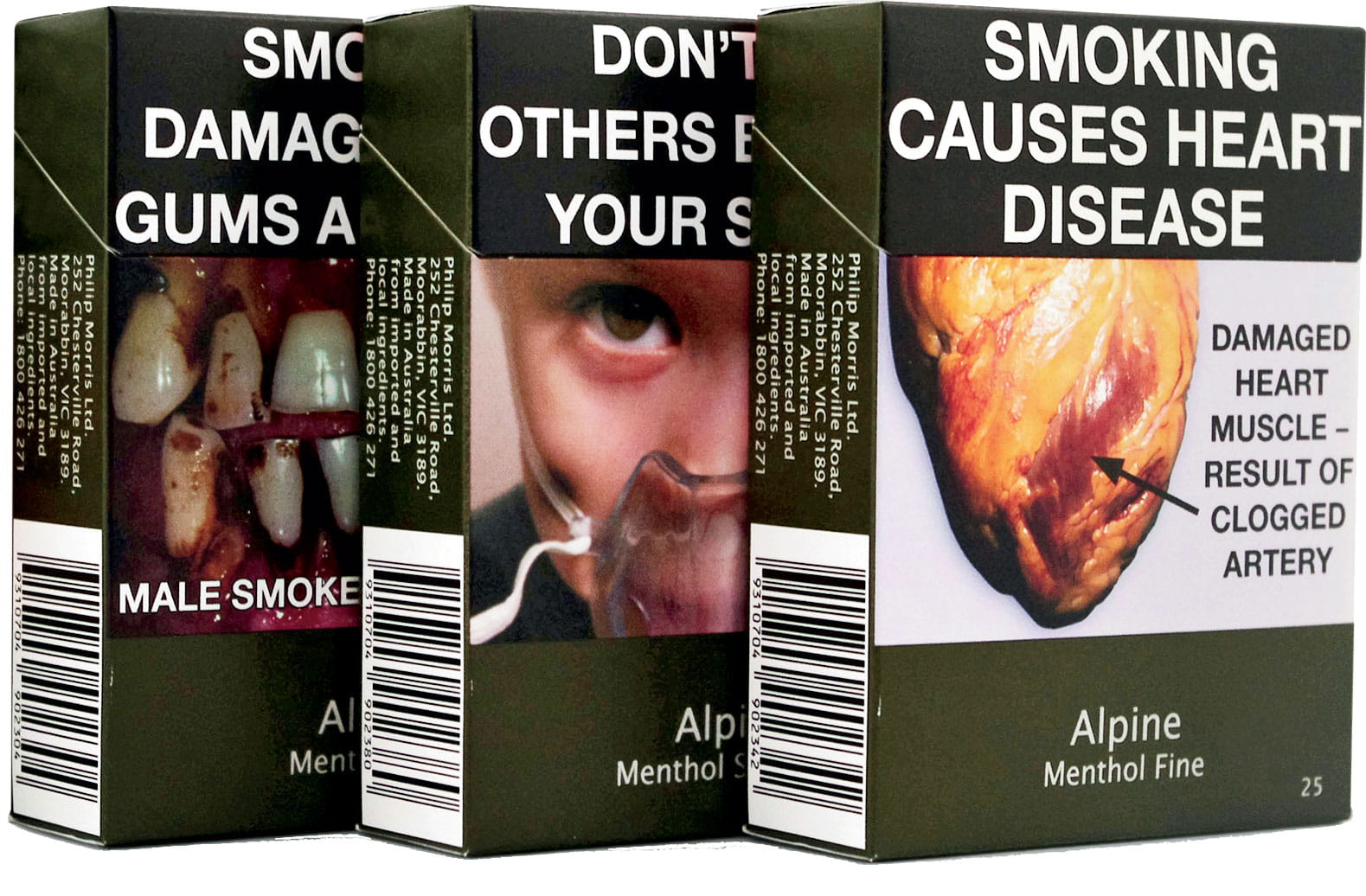

Packaging on cigarettes under Australia’s plain-packaging mandate

Packaging on cigarettes under Australia’s plain-packaging mandatePhotograph courtesy of David Hammond, University of Waterloo

The researchers analyzed sales data from before and after Australia implemented the plain-packaging mandate and compared these with data from New Zealand, where the mandate hadn’t yet been imposed (but was in 2018).

Across the world, tobacco products are subject to strict marketing and advertising regulations, but tobacco marketers still control packaging design in most respects. Australia’s plain-packaging mandate presented the researchers with an opportunity to study the role this packaging plays in influencing product sales.

Cigarette packages that were previously colorful and adorned with prominent brand names and visuals were required, under the new mandate, to use a brown background and standard font, as well as a graphic health warning that covered 75 percent of the package. “With plain packaging, the number of touch points with the company’s branding elements reduces dramatically,” the researchers write.

They studied retail transaction sales from the two largest distribution channels—grocery stores and convenience stores—between January 2011 and December 2013. The mandate reduced monthly sales by 7.5 percent, they find.

When branding is minimized

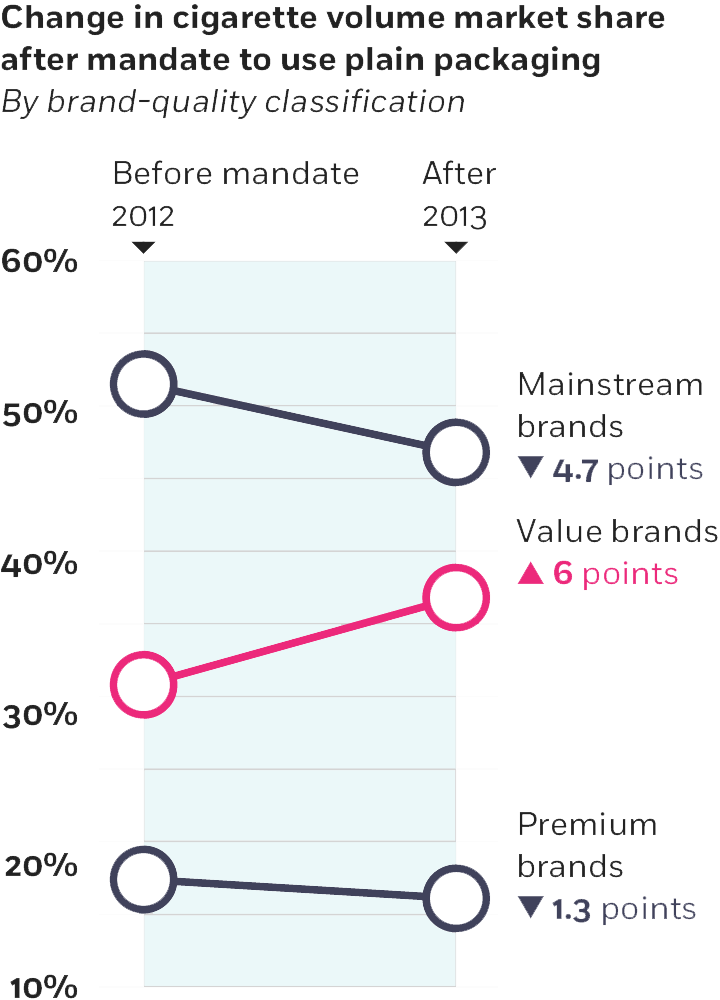

After Australia forced cigarette marketers to use plain, mostly uniform product packaging, higher-quality brands lost market share to lower-tier competitors.

Findings from the data are consistent with differentiation among brands declining following the mandate, and consumers becoming more sensitive to the product’s price in many parts of the market. The researchers compared data across 16 brands, which they classified using three quality tiers consistent with the cigarette industry’s quality classifications: value, mainstream, and premium. Market share declined among premium and mainstream brands, but increased for value brands. Accompanying the declines in market shares, price sensitivity increased for mainstream and value brands across both grocery and convenience channels, according to the research. The only exception was short-term price sensitivity for premium and mainstream brands in the convenience channel, which was observed to decline following the mandate.

Prior to the introduction of the mandate, premium and mainstream brands had distinct packaging and brand-name recognition, which made them more socially valuable among smokers—even those who wished to quit, the research suggests. Those same marketing advantages had also attracted new consumers to take up smoking. “Given the addictive nature of cigarettes, once consumers enter the market, it’s difficult for them to leave,” the researchers write.

But stripped of those packaging advantages, premium and mainstream brands may have become less attractive—as may have been the case for smoking overall. These findings can provide insight for policy makers and regulators tasked with determining the effectiveness of potential and existing public-policy interventions.

Pradeep K. Chintagunta, André Bonfrer, John Roberts, and David Corkindale, “Assessing the Sales Impact of Plain Packaging Regulation for Cigarettes: Evidence from Australia,” Marketing Science, forthcoming.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.