This essay is adapted from Thaler’s address given at the 2018 Chicago Booth Graduation Ceremony this past June.

Commencement speeches have multiple goals: entertain, inspire, instruct, and give people something to remember—all in 10 minutes. And at the University of Chicago, we also try to be substantive. So, here goes, starting with a bit of personal history and moving to some thoughts about corporate responsibility.

When I was young, one of my heroes was Dick Fosbury. When he was in high school, Fosbury had the tall and lanky build necessary to succeed in his favorite sport, the high jump. But there was a problem: he stunk. As a sophomore, he couldn’t make the varsity team because he couldn’t clear the qualifying height of 5 ft.

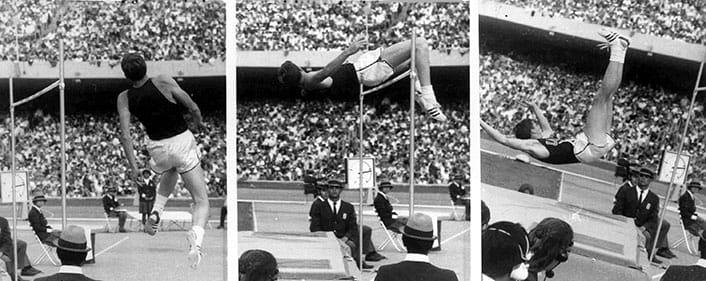

At the time, there were two techniques that were widely in use for high jumpers. One was the scissors style, where the jumper would essentially hurdle over the bar feet first with his butt down. The other was called the Western Roll, in which the athlete jumped over the bar one limb at a time, with his head facing down after crossing the bar. Neither method worked for Fosbury. So he experimented with an alternative approach that came to be known as the Fosbury Flop and was highly counterintuitive. Fosbury would run in a curve toward the bar, and when he took off, his body rotated so that his head went over the bar first, looking up at the sky. His feet cleared the bar last, and he landed more or less on the back of his neck.

I’m sure the first time people saw him try this method, the most common reaction was a combination of hysterical laughter and fear for his safety. Luckily for him, track-and-field stadiums were in the process of replacing sawdust landing pits with 3-ft. rubber cushions—or this story may never have been told. Eventually, Fosbury got the technique to work well enough for him that he went on to become a high jumper at Oregon State. People stopped laughing when, as a junior in college, he won the gold medal at the 1968 Olympics, clearing a height of over 7 ft., 4 in. Today, virtually all high jumpers use a version of the flop.

Like Fosbury, I was not a quick starter in my chosen field of study, economics. When my thesis advisor, Sherwin Rosen, was asked by a New York Times reporter to describe my graduate-student career, he was candid: “We did not expect much of him.” In order to become a successful economist, I had to figure out a different way of doing economics, one that suited my own way of thinking. Many thought my initial efforts were, like the Fosbury Flop, both backward and hysterically funny. Some still do.

Dick Fosbury performing the Fosbury Flop (Associated Press)

What’s the moral of this story? Surely, the lesson should not be to invent your own wacky way of doing everything. For example, at least in this country, it’s still a good idea to drive on the right-hand side of the road. Standard operating procedures and societal norms usually exist for good reasons. But of course there can be exceptions. When you suggest trying a new approach to some problem, and you’re told that you can’t do it that way, you’re entitled to ask “Why not?” If the only answer you hear is “That’s the way we’ve always done it,” you might want to push back. Just because your idea seems weird and dubious to most people, it’s not necessarily stupid.

Imagine Lin-Manuel Miranda pitching his idea for a new play and saying, “It’s about the country’s first secretary of the treasury, with hip-hop lyrics.” At least occasionally, ideas that seem destined to flop can turn out to be winners.

And now for the promised substance: Should corporations simply maximize profits and let the invisible hand do its wonders, or do they have an obligation to be good citizens as well? A lot of confusion has been created on this score by what I consider a misreading of the late Milton Friedman, Chicago’s most deified and vilified former professor. “In a free society,” Friedman said,

There is one and only one social responsibility of business: to use its resources and engage in activities designed to increase its profits, so long as it stays within the rules of the game, which is to say, engages in open and free competition without deception or fraud.

Unfortunately, the important qualifiers at the end of this passage are often forgotten. Friedman urges companies to “stay within the rules of the game” and avoid “deception or fraud.” I’d like to push back a little on those who take the truncated version of Friedman’s tenets too far.

Consider this example: a young bank employee, Chris, comes up with a clever way to increase profits. It’s a refinement of an existing policy, which stipulates that when a customer makes a purchase that exceeds the limit on his or her credit or debit card, the bank allows the purchase to go through as a “courtesy”—a courtesy that happens to cost $35, which is also the price of additional grants of courtesy.

Chris’s brainstorm is that when a bunch of charges come in on the same day, say when a customer is shopping at the mall, and these charges will together put the account into the red, the bank will process the most expensive purchase first. Notice how this policy puts the customer over the limit as quickly as possible, enabling the bank to charge a $35 fee for that sandwich at the fast-food joint, and another for a coffee at Starbucks, and so forth. Pure genius. When asked, Chris says, no, he doesn’t think this policy should be made public.

So here’s my question: If Chris’s idea is legal and profitable, is that a sufficient reason for the bank to adopt it? More generally, is any way of making money acceptable as long as it is both profitable and legal? There’s an interesting irony here. Those who would favor this narrow definition of corporate responsibility are typically skeptical of governments, and especially of regulators. Yet, in their own worldview, they’re delegating to the government the job of deciding the limits of what a company should do. They’re saying that if the government has not declared an activity to be illegal, no matter how unsavory or unscrupulous it might be, companies aren’t merely allowed to pursue it; it’s their corporate responsibility to do so.

What would Professor Friedman say about this if he were still alive? His rule was that to be responsible, a practice must avoid deception. Would you consider Chris’s idea deceptive? I hope so. But the policy I described is one that was used by many banks, which were later fined by regulators but did not admit to having done anything wrong.

Financial institutions don’t have a monopoly on questionable business practices. For example, at most airline websites, when you’re ready to buy a ticket, you are offered something euphemistically called “trip insurance,” although it of course does not cover rain, mosquitoes, or quarrels with your traveling companion. Yet before buying a ticket, customers are sometimes required to indicate whether they want to buy trip insurance—with the “yes” box helpfully prechecked and labeled “recommended.”

Disturbingly, trip insurance is even recommended for fully refundable tickets, for which the product is worthless. And to add insult to injury, the insurance is more expensive in that case, because it turns out that the price of trip insurance is proportional to the price of the ticket.

Ten years ago, my friend Cass Sunstein and I wrote the book Nudge, in which we advocate using what we call choice architecture, such as the design of websites, to help people make what they judge to be better choices. Automatically enrolling people in the company pension plan qualifies as a “nudge” because most people want to join, but some never get around to it.

I have a different term for practices such as processing the bills from a debit card from large to small and hawking expensive trip insurance: “sludge.” Unlike a nudge, which is designed to make it easier to make wise choices, sludge does the opposite—it makes wise choices more difficult.

In your job, if you work for a corporation, you will have a duty to your shareholders, but you may also want to sleep well at night. Strategies that enrich shareholders at the expense of customers, employees, neighbors, or the environment demand scrutiny. The bottom line should not be the only line to consider. This train of thought leads to some advice. First, before taking some action, consider whether you would be willing to publicly announce the policy. If not, don’t do it. Also, instead of encouraging employees to find creative new ways to hide fees and lay traps, concentrate on finding ways to deliver a high-quality product at competitive prices, and compete by developing a reputation for fair dealing. Trust can be a company’s greatest asset.

In the short run, you may lose some customers to competitors who create the false impression that their prices are cheaper, because the full prices of their products are shrouded. But in the long run, you may be able to make a profit by creating loyal customers, who are confident that their pockets aren’t being picked when they’re not paying attention, and loyal workers, who know that the company has their back. Companies that fail to take this advice shouldn’t be surprised to observe an increase in regulatory scrutiny. As a matter of logic, if the only standard you’re willing to live by is the letter of the law, you should expect that the more sludge you emit, the more regulations you will face.

To sum up: if the usual techniques are not working for you, don’t be afraid to try something different, even if it makes you look foolish when you flop. But try to have a soft place to land. And create organizations that customers, employees, and neighbors can trust. A trustworthy company can earn a good profit without emitting any sludge. Indeed, it can nudge for good.

Richard H. Thaler is Charles R. Walgreen Distinguished Service Professor of Behavioral Science and Economics at Chicago Booth and was the recipient of the 2017 Nobel Prize in Economic Sciences.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.