Book-to-market has been a staple of value investment strategies since at least 1934, when the late Benjamin Graham and David Dodd published the classic text Security Analysis. But research by Chicago Booth’s Ray Ball and Valeri Nikolaev, Dartmouth College’s Joseph J. Gerakos, and University of Southern California’s Juhani T. Linnainmaa suggests that the underlying reason investing in high book-to-market stocks earns higher returns on average is not that those stocks are undervalued. The researchers’ interpretation of the data is that book-to-market is actually a good indicator of profitability, and hence of factors, such as risk, that affect both profitability and average stock returns.

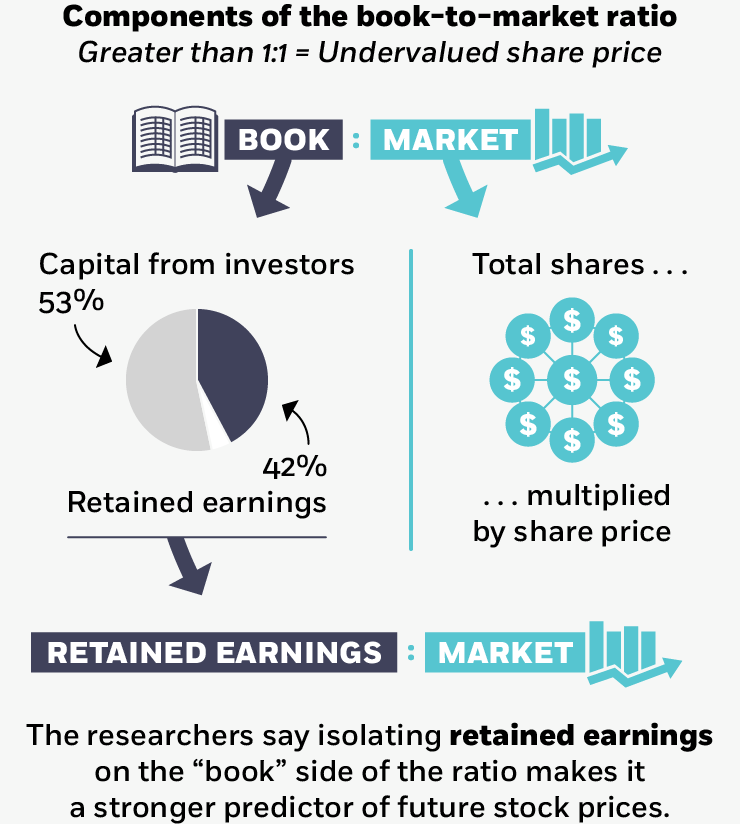

In a traditional book-to-market price ratio, “book” is made up of two components: retained earnings and contributed capital, which is essentially the total value of stock that shareholders have directly purchased from the issuing company. Book, the numerator, is divided by market value (the number of shares outstanding multiplied by the stock price). In the simplest of value-strategy screens, if the ratio is above 1, the stock is believed to be undervalued and could represent a good deal. If the ratio is less than 1, the stock is thought to be overvalued.