Miller’s irrelevance theorems—developed with fellow Nobelist Franco Modigliani—were the basis of the hunt for what parts of finance were relevant in firm valuation.

- By

- June 15, 2015

- CBR - Finance

Miller’s irrelevance theorems—developed with fellow Nobelist Franco Modigliani—were the basis of the hunt for what parts of finance were relevant in firm valuation.

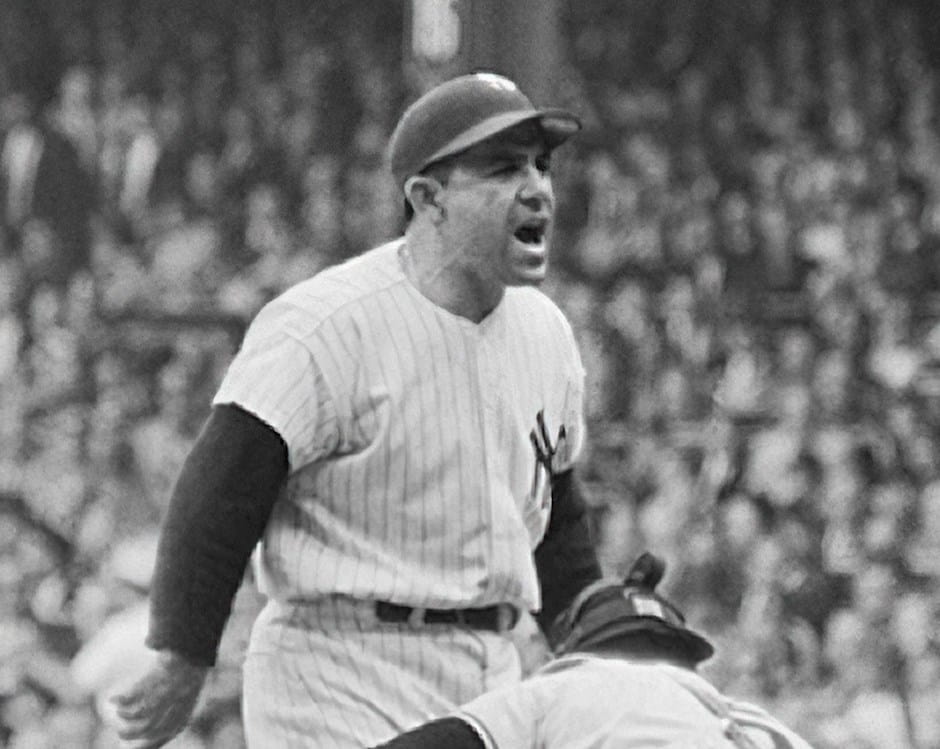

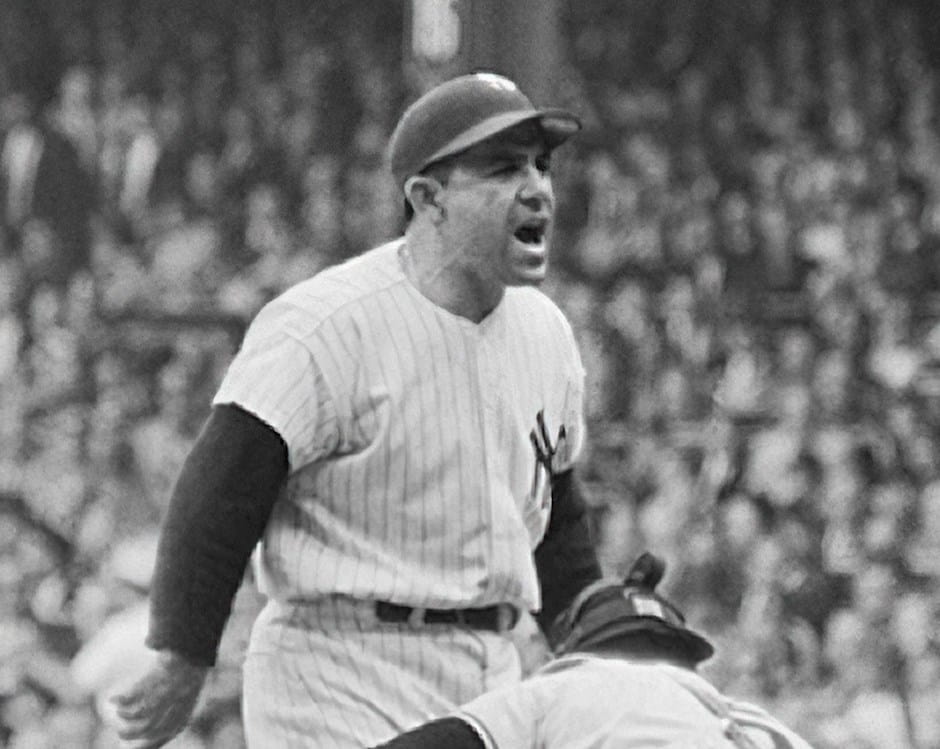

Merton H. Miller liked to tell a joke about Yogi Berra, the famous baseball catcher. Berra once told his trainer that he was particularly hungry, and he instructed him to cut his pizza into 12 pieces instead of six.

The quip illustrated vividly the celebrated theorem about capital structure that Miller devised with MIT’s Franco Modigliani and published in 1958. As every finance student is taught, the Modigliani-Miller theorem states that a firm’s value is independent of how it is financed, much like the size of a pizza is independent of how you slice it.

The two researchers published another landmark paper three years later, the same year in which Miller—who would go on to win the 1990 Nobel Memorial Prize in Economic Sciences—moved to the University of Chicago Graduate School of Business (now Chicago Booth). “Dividend Policy, Growth, and the Valuation of Shares,” which appeared in the Journal of Business, told essentially the same story as its predecessor paper but using a different mechanism.

The second paper—which, unlike their first, featured Miller’s name before Modigliani’s—challenged the prevailing wisdom that dividends were crucial to the value of a firm, arguing that they’re irrelevant. The Miller-Modigliani model innovatively identified the factors to hold constant in order to isolate dividend policy: the cash flows coming into the firm and the real investments being made. That left a gap, which is a constant amount once these are fixed. However, the dividend payout could be larger or smaller than this amount because the firm could issue or retire shares. This rendered dividends (given investment policy) irrelevant to the value of the firm except in cases where dividends revealed information or had tax implications (such as the retained earnings tax that the United States had in the 1940s, which made paying out cash a sensible investment policy). Taken together, the two models are known as the MM irrelevance theorems.

If the second theorem is less remembered than the first, it is perhaps because it lacks an accompanying joke such as the Yogi Berra anecdote. Although it was even more straightforward than Modigliani-Miller—having no implications for corporate bankruptcies—Miller-Modigliani was easier to misinterpret. That is a pity, since the paper encapsulates Miller’s style of research. He was a laser-clear thinker who always expressed his idea simply and precisely, both in speaking and in writing.

The initial reaction, from both academics and the financial world, was that the paper was simply wrong. The prevailing view at the time was that firms had a “right” amount of debt, and dividend policy was critical to their value. If they paid out too much in dividends, they wouldn’t have any cash left to invest; if they paid out too little, their stock prices would fall as income-seeking investors looked elsewhere for returns.

This notion had not been subjected to rigorous theoretical analysis. In setting out their approach, Miller and Modigliani noted “an absence in the literature of a complete and rigorous statement of those parts of the economic theory of valuation bearing directly on the matter of dividend policy.”

Not that their idea was obtuse: it was a first-order notion that had been lying in plain view. As the authors put it, “Like many other propositions in economics, the irrelevance of dividend policy, given investment policy, is ‘obvious once you think about it.’”

At its heart, the paper was about how to assess the value of a firm. Was the value of the firm the present value of its earnings or the present value of its future dividends? At the time, people were asking, “Which is the right one?” Miller and Modigliani showed that these things are the same if the right factors are held constant (for example, the firm’s value in terms of earnings is the present value of earnings minus expenditures on future investment). This was a significant contribution to the field of finance, and their insights motivated much of the work that Miller would later undertake, including the classic book The Theory of Finance, with Eugene F. Fama, Robert R. McCormick Distinguished Service Professor of Finance at Chicago Booth and 2013 Nobel laureate.

My explanation of what Miller and Modigliani show is as follows: once a firm chooses its real investments, how the firm finances its dividends does not matter. Companies decide how to make real investments with their cash—which includes choosing how much to put into a plant, equipment, marketing, and payroll. If a firm is going to pay out a bigger dividend while generating the same profits and making the same investments, the money funding the dividend has to come from somewhere. The firm could pay a larger dividend and finance it by issuing stock. Alternatively, the firm could pay a smaller dividend and use the remaining cash to repurchase stock (a share buyback). The equations in Miller-Modigliani allow the net issue of new shares to be either positive (new share issues) or negative (share buybacks). Modigliani-Miller, the 1958 paper, discussed issuing stock to pay dividends, but the text did not mention share buybacks. The likely reason is that such share buybacks were hardly ever done before 1984 in the US. In 1984, the Securities and Exchange Commission’s “Safe Harbor” Rule 10b-18 made clear that such repurchases would not be considered as manipulating the price of the firm’s own stock.

The Miller-Modigliani theory remains elusive to many, however. The idea is clearly explained in standard textbooks such as Corporate Finance by Stanford’s Jonathan B. Berk and Peter M. DeMarzo. Yet, the Journal of Financial Economics published a paper in 2006 to clarify or correct what the authors Harry DeAngelo and Linda DeAngelo, of the University of Southern California, believe are some misinterpretations of what the Miller-Modigliani theory holds constant. In my view, this paper simply restates what Miller and Modigliani said in the first place. The paper criticizes Miller and Modigliani, arguing that if a firm retains extra cash on its balance sheet, this can change its value to investors. On this point, I am sure that Miller and Modigliani would have agreed: they would say that retaining the extra cash is a real investment decision (by choosing to invest in cash rather than other projects). The paper also suggests that Miller and Modigliani seem not to consider share buybacks as the alternative to dividends, but I do not agree (buybacks are implicit in their equations and are mentioned explicitly in Fama and Miller’s The Theory of Finance, as pointed out by the University of Melbourne’s John C. Handley in a paper published in the Journal of Financial Economics in 2008).

Some of the misunderstanding of Miller and Modigliani’s work may arise from a misunderstanding of what the authors were trying to achieve. They were not trying to write the last word on actual dividend policy. They instead wrote the first analysis, which was fully correct under its assumptions. Miller and Modigliani constructed a set of assumptions that would render dividends irrelevant in valuing a firm. They showed what would need to be held constant—and what assumptions would need to be made—to do so. The point of both of Miller and Modigliani’s most important works was to say, “Here’s where it doesn’t matter, so you can look for where it does.” The irrelevance theorems were thus the basis of the hunt for what parts of finance were relevant in firm valuation.

Consequently, Miller spent some of his subsequent career showing why dividends did or did not matter. In 1978, he coauthored a paper with Myron S. Scholes, who was also at Chicago Booth (then GSB) at the time and is now a professor emeritus at Stanford, as well as a 1997 Nobel laureate. In their paper they examined how, if dividends were to be taxed more heavily than other investment income, investors could get around it by holding assets in tax-sheltered entities and using tax deductible borrowing against their taxable equity portfolios to offset the taxes on dividends.

In a 1985 paper with Kevin Rock, clinical professor of finance at Chicago Booth, Miller examined the informational value of dividends. The paper noted that if a firm were to choose to pay a bigger dividend and invest less, or pay a smaller dividend and invest more, that could signal some information to the market about how profitable the owners of the firm thought their investments were, which could move the stock price. This potential to signal can lead to distorted investment decisions.

The dividend issue is particularly germane today, when activists are pressing companies such as Apple, Microsoft, and Cisco Systems to return some of their cash to shareholders. What’s often misunderstood in this discussion is that this is less an example of a dividend policy than of an investment policy. As Miller-Modigliani showed, it’s less that such companies are cutting dividends, and more that they are investing in cash. For investors, the obvious question is whether such an investment policy is wise. They have Miller and Modigliani to thank for helping them to formulate that query.

Douglas W. Diamond is Merton H. Miller Distinguished Service Professor of Finance.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.