Why Did the Financial Sector Get So Big? Ask Your Adviser

- By

- December 01, 2014

- CBR - Finance

Individual investors helped raise the US financial sector’s profits, wages, salaries, and bonuses to about eight percent of US gross domestic product in 2012, from just two percent in the 1940s, even as technology and other cost-saving efficiencies shrank other sectors’ share of the economy. The enormous growth has both infuriated industry critics and perplexed economic researchers, who wonder why consumers continue to fork over money to active-investment managers despite many studies arguing they could get better net returns in passive investments.

To critics, it looks like a naive public irrationally built up the financial sector. But research by Chicago Booth’s Robert W. Vishny and his colleagues, Universita Bocconi’s Nicola Gennaioli and Harvard’s Andrei Shleifer, suggests there may be a more nuanced reason for the trend: the industry is helping preserve a rising amount of financial wealth.

According to the researchers, trust between financial advisers and investors is a key variable that determines both individual and financial-sector fortunes. Trust reduces savers’ anxiety about taking investment risks, which increases the fees the adviser collects, as investors invest more money generally, and invest more in riskier instruments that have higher fees. For many savers, the peace of mind gained from this trust relationship is far more important than picking investments with the highest returns.

The research disputes the assumption by many economists that most individual savers could get at least market-matching investment returns without help. Many would-be investors hire investment advisers because they lack the knowledge and the confidence to invest on their own, even in the index funds that finance professors and economists see as so easily purchased. Without a professional adviser, the research contends, these savers would simply leave their money in the bank. Although the returns they collect after paying advisory fees are often subpar to index funds, they typically beat the near-zero returns generated by bank savings accounts.

Vishny and his colleagues compare the relationship between individual investors and money managers to that between patients and doctors. Investors don’t want to leave a trusted investment manager, just as they wouldn’t want a different doctor, even if they were to find an equally qualified one that charges less. The trust relationship limits ordinary market competition.

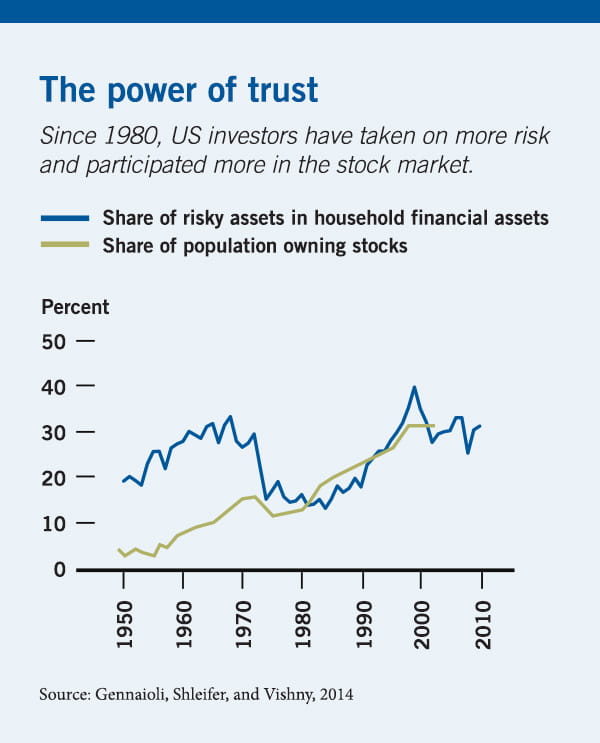

The increasing level of trust between investors and financial advisers has been expressed in the rising rate of stock-market participation since the Great Depression in the 1930s. This growing trust helps explain several counterintuitive phenomena concerning the financial sector and markets.

For example, while fees for any given financial product appear to have fallen as a result of better technology and increased competition, aggregate fees paid as a proportion of assets have not fallen. Vishny’s research proposes that increased trust has also increased investors’ appetite for risk, which in turn has led to more fees for advisers. He and his coresearchers demonstrate the phenomenon by showing that US households increasingly dedicated more of their portfolios to risky assets over the past decades, except at times when broader economic conditions eroded the trust relationships. Not only do investors take more money out of the bank to invest when they trust advisers, they also take on riskier products such as hedge funds, which carry higher fees.

The research also offers some explanation for the lackluster relative performance of financial professionals as a group. The need to nurture the client’s trust supersedes the goal of obtaining the highest returns. For example, an adviser might pander to a client’s investment ideas—perhaps it’s buying into popular public offerings of hot technology companies—even when the manager recognizes that these assets are overpriced. There’s little incentive to execute contrarian strategies when the client is happier doing something else.

- Nicola Gennaioli, Andrei Shleifer, and Robert W. Vishny, “Finance and the Preservation of Wealth,” Quarterly Journal of Economics, September 2014.

- __________, “Money Doctors,” Journal of Finance, forthcoming.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.