The ‘future you’ can help you be wealthier, healthier, and more generous in the present.

- By

- December 10, 2015

- CBR - Behavioral Science

The ‘future you’ can help you be wealthier, healthier, and more generous in the present.

Visit Merrill Edge’s Face Retirement website, and you’ll be confronted by your future self. The site invites you to take a photo with your webcam and input your age. Then facts about retirement and savings flash on the screen—“46 percent of Americans have saved less than $10,000 for retirement” reads one—while the program digitally “ages” your photo, and you are soon staring at a slightly animated, nodding, blinking, more wrinkly version of yourself. Merrill Edge is betting that the statistics alone won’t scare you into saving, but being confronted by an older version of yourself will. “That’s not a stranger you’re saving for,” reads the site, “it’s the future you.”

In a commercial put out by Prudential, a cartoon version of a man sits side by side with an older version of himself. “This is you,” says the spokesman. “This is you in 40 years . . . you like you, right?” It continues, “One-third of you aren’t saving enough for the older you. But why is that?”

The retirement industry would like to know the answer to that question. In the United States, the savings rate has fallen to less than 5 percent. Putting aside money for long-term goals such as retirement or the kids’ college education can slip down the priority list, replaced by more immediate needs, such as paying the mortgage or buying school supplies, or wants, such as celebrating a friend’s birthday or taking a vacation.

For much of the past decade, firms have been trying various ways to convince people to think about the future, and in particular about the people they will become. That tactic makes sense: behavioral scientists are learning that how you think about the “future you” can influence your decisions and behavior in the present. As this science progresses, researchers are developing a more refined understanding of when and how the future self wields its influence. Under the right circumstances, your future self may inspire you to save—and it could, in fact, help you make a host of wise decisions.

The financial industry has always wanted people to think to the future, but in a particular way: more often than not, retirement brochures encourage you to think about all the money you will enjoy one day if you just save. One path to attaining that pile of cash, you’re often reminded, is to cut out small indulgences in the present, such as that daily Starbucks habit or visits to the local pub. Several financial self-help authors argue that cutting down on little things—lattes, bottled water, magazines, and so forth—can over time generate hundreds of thousands of additional dollars (or the currency of your choice) in savings.

The logic is beautifully simple and seemingly sound. But for many people, following this advice proves difficult. The problem is that while waiting in line for coffee, you’re simply not thinking about the future—much less about your future self. You’re only concerned about the present. The future self seems like an intangible, impractical concept to bring into a coffee shop, or for that matter anywhere.

The idea of the future self struck Chicago Booth’s Daniel Bartels as fairly conceptual when he was in graduate school taking philosophy classes that introduced him to the concept. He says his courses covered a lot of “very abstract stuff,” including theories of identity by thinkers such as Oxford’s Derek Parfit, a celebrated philosopher who has suggested that people should feel disconnected from their future selves, and that sense of disconnection should lead them to behave with an eye more toward the present than the future. These ideas seemed somewhat compelling to Bartels, and this philosophical theorizing stuck in the back of his mind as he pursued a career in behavioral science.

What triggered his academic interest in the topic was an acquaintance of his, a young man whose family had a genetic disposition to Huntington’s disease, which causes the breakdown of nerve cells in the brain. The friend had a greatly increased chance of developing Huntington’s at some point in his future, but he didn’t want to be tested. “He put it off, because he didn’t want to live life with the knowledge that he might develop it,” says Bartels. “He said that if he did have the test and it came back positive, he’d then live his life with reckless abandon. He pictured the future version of himself in a wheelchair—but he felt that that’s not really him.” Knowing that this person was contemplating his potential future self, and was at times feeling disconnected from that self, Bartels started thinking that there may be a practical application to all those philosophical musings.

Bartels began studying the topic in the lab, partnering with Lance J. Rips of Northwestern University on studies that looked at people’s relationships with their future selves. The pair found some preliminary evidence suggesting people feel less and less connected to their future selves the farther out in time they think about them—but those who naturally feel more connected are more apt to want to sacrifice money in the present for money in the future.

They also explored whether events can make a person feel more or less connected to the future. The researchers asked people to read stories about fictional characters who experienced life-changing events—for instance, being momentarily buried by an avalanche without suffering any long-term repercussions. Study participants, the researchers found, felt more connected to characters before they experienced events that could change them. In the case of the avalanche, participants were more likely to say they would do nice things for the characters before, rather than after, they had been through their ordeal. But the researchers wondered whether what’s true for fictional characters is also true for the self. If you feel more connected to your future self, are you more likely to do it favors in the present?

To find out, Bartels teamed up with his Chicago Booth colleague Oleg Urminsky. They approached seniors from University of Chicago a week before graduation, prompting some students to think about being connected to the people they’d be in a year, and reminding others that they could become very different people. Then they entered each participant in a lottery, in which participants had the possibility of winning a gift card worth $120 in a week’s time—or one for $240 that was redeemable only in a year’s time. The experiment controlled for participants’ incomes and future resources.

People who felt close to the people they would be in a year were more likely to be patient and wait a year for a possible reward, but the others wanted the money sooner, presumably while they were still people they would recognize. “They were less connected to their future selves,” says Bartels, and therefore “they were much more impatient.”

Financial sector, take note: if you can make people feel more connected to their future selves, you may help them make better financial decisions in the present and improve their personal savings rate. Just reminding people to think more about their future selves should help them trade today’s small luxuries for more money in retirement—but again, sometimes that isn’t enough. “There’s a difference between knowing and caring,” says Bartels. When you’re in line for a latte, you have to not only think about your future self, but also care about that future self. Only then will you think about the purchase of the coffee as a trade-off between your present and future selves.

“You have to think about the trade-off inherent in choices that you’re making, and you have to care about the future self that stands to benefit.

To tease apart that difference between knowing and caring, Bartels and Urminsky conducted an experiment in which participants used online surveys to rank categories, such as debt repayment and entertainment, in terms of importance. Those who were induced to believe that people’s identities don’t change much over time said they’d spend more money on the categories they had ranked as more important. But for the others, who were induced to think that the future self changes a lot over time, even a subtle reminder about the importance of various categories didn’t do any good; those people spent their money less wisely, by their own definition. This dichotomy suggests there are indeed two parts to the process: if you care about your future self and are reminded about what’s important, you’ll sacrifice for it. But reminders don’t do a lot of good if you don’t care in the first place. “You have to think about the trade-off inherent in choices that you’re making,” says Bartels, “and you have to care about the future self that stands to benefit. It’s about making people aware of a trade-off and making them care. If you do one or the other, it’s not as effective.”

The results also held true for decisions in the field, tested in a coffee shop. College students surveyed by the researchers ranked the importance of spending categories, such as buying coffee, saving money, and paying rent. When also prompted to think about the stability of the self over time, the participants spent less on their coffee-shop purchases.

“Making people think about and value the future didn’t simply make them stingy; it caused them to spend more wisely—to make better financial decisions by focusing their spending on only what was really important to them,” says Bartels.

“There’s an element here that’s fuzzy,” says Chicago Booth’s Ed O’Brien. “What does it mean to feel connected to our future selves? If I said I felt connected to some public figure, you’d have a tangible sense of what I meant—the looks, traits, or values I share with this other person. But what about my future self? Who is that person?”

O’Brien became interested in the future self from a psychological perspective. Studies have found that people spend a lot of mental time somewhere other than in the present—“Whether time is running short, or we’re planning future events, or thinking back on old memories, we’re often jumping around in time,” he says. “It seems like most of our time is spent thinking of things that aren’t actually in front of us.”

Whatever or whoever we’re thinking of, O’Brien concluded, we tend to take a rosy view. From the ancient Greeks forward, philosophers have observed that most people are indelible optimists who think they’ll improve with time, becoming smarter and more rational. In fact, Plato and Aristotle wrote about reason being the defining characteristic of humanness, whereas emotions were a disruptive part of the human experience. According to O’Brien, a lot of people today would say the same. “The future self we picture is the economist’s dream: ‘I won’t eat cake. I’ll always eat salad. I’ll use reason!’ We think we’re going to turn into clear thinkers who are largely rational and unmoved by emotions.”

O’Brien’s research has found that as people believe they’ll be more rational in the future, it’s possible to use that belief to improve someone’s self-discipline. O’Brien asked people to rate how they thought they would react to various emotionally charged situations—ranging from being stung by a bee to craving favorite foods to fighting with a friend—in the past and the future. He also asked people how they would react to more rational situations. As Aristotle might have predicted, respondents reported they would have reacted more powerfully to emotional situations in the past, whereas they would expect to react more strongly to rational situations in the future.

“Responses to emotional events, from being stung by a bee to enjoying leisure, seem more intense if we imagine them happening to our past self than to our future self,” says O’Brien, “but responses to rational pursuits, like needing to exhibit self-control, seem better handled by our future self than our past self.”

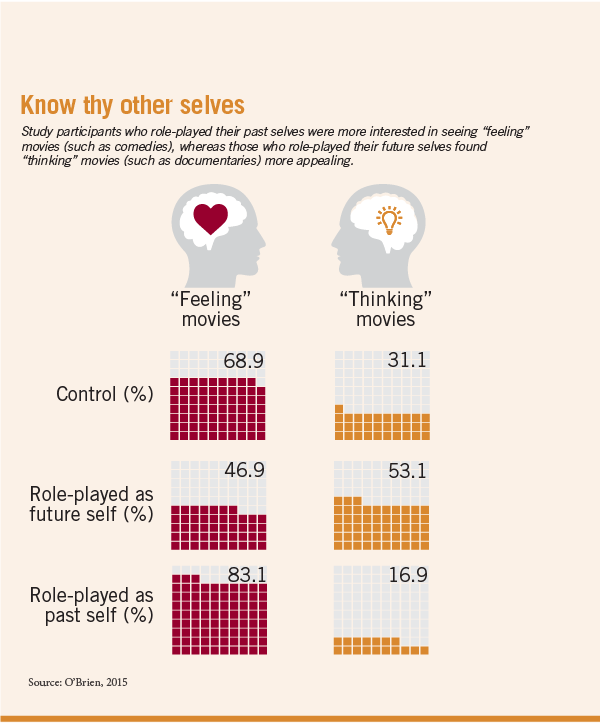

O’Brien was able to play around with the effect. When people role-played either their past or their future selves, those playing their past selves became more interested in seeing emotional movies, while those playing their future selves preferred more rational movies, such as documentaries. He was also able to use the future-self phenomenon to actually boost performance on tasks involving cognition and self-control. In one experiment, he asked study participants to persist in a taxing task for as long as they could, which involved making a number of short but strenuous calculations one by one. Participants who were instructed to use their future selves as a role model proved able to persist longer. In another experiment, participants were asked to immerse their hands in painful ice-cold water for as long as possible, a classic measure of willpower. Again, participants who first thought about their future selves were able to immerse their hands for longer.

You should, however, harness the influence of the future self with some caution. The future self can help you be more rational, and perhaps increase your self-discipline while you are preparing a big project at work or trying to stick diligently to a diet. (You might ask, “What would my future self do?”) But it can also have an impact on your ability to appreciate emotional experiences. “Enjoying these emotional experiences is not what that rational future person does. He doesn’t take time to smell roses,” says O’Brien. But sometimes we need to stop and smell the roses, he adds. (“What would my past self do?”) Perhaps the Greek philosophers, though wise, should have given a little more credit to the emotional side of the psyche, and spent some more time wandering through the garden.

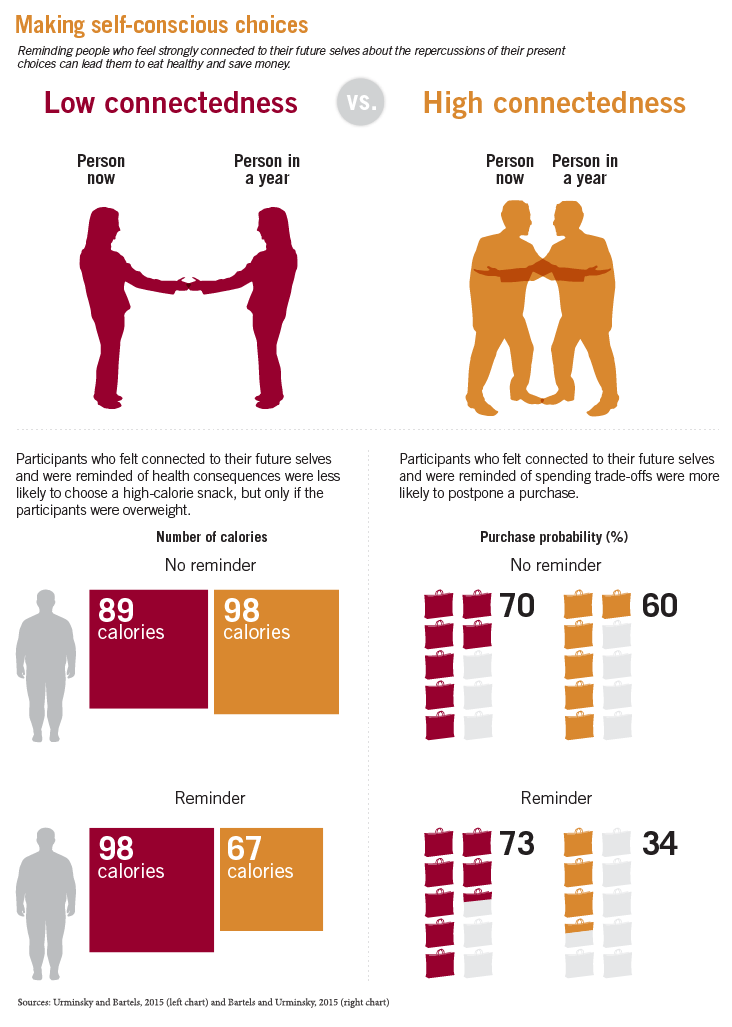

Urminsky is doing work that further highlights pursuits involving the kind of self-discipline many people lack, especially when it comes to diet and exercise. Urminsky and Bartels find that when people are prompted to care about their future selves and think about present-future trade-offs, they’re also likely to choose and stick to long-term New Year’s resolutions and make smart health choices whose results may be felt only later.

In one study, the researchers asked visitors at a museum to fill out a survey into which were embedded unrelated questions designed to remind them about the future consequences of unhealthy eating. The survey also asked for each participant’s height and weight. Afterward, the participants were offered a choice between two snacks as a thank-you for participating. People who had been prompted to think about being connected to their future selves and reminded to consider the repercussions of unhealthy eating chose the healthier snack option. But it was only the overweight people who were affected. Those who were not overweight were more likely to choose the less healthy option, regardless of connectedness or healthy-eating reminders.

The fact that only overweight people were affected by the prompts suggests that when we know something needs to change, such as body weight, being nudged to simultaneously think about it and care about the future self can make a difference in these moment-to-moment choices. Similarly, Bartels and Urminsky found that overweight undergraduates who naturally felt more connected to their future selves frequented the gym more often throughout the academic year than those who felt less connected.

The future itself could also help, in a different way. Chicago Booth’s Eugene M. Caruso has found that people perceive the future differently from the past. In a series of studies published in 2013, he and his co-researchers had participants rate whether a given distance in time (one week, one month, or one year) seemed closer in the past or the future—and the future, approaching days always seemed closer than the past, receding ones.

Just as you can connect with your future self, you can also distance yourself from your past self and an undesirable side of you. Want to quit smoking? Focus on this, says Caruso: your fast-approaching future self is smoke-free, while your increasingly remote past self is the one with blackened lungs. “It’s helpful to see that past me as ancient history,” says Caruso. “Distancing yourself from undesirable past selves can be motivating in the present, too.”

If you’re looking to get lighter, you could, as a starting point, empty your pockets. Bartels and his collaborators Trevor Kvaran and Shaun Nichols from the University of Arizona looked at how our relationship with our future selves works in philanthropy. They find that the future self can inspire generosity.

The researchers asked people how much they felt they would change over the next year, and how much of a theoretical bonus payment they’d want, one year into the future, to donate to the Save the Children foundation.

People who predicted a lot of personal change were more charitable with funds they would receive in the future than people who felt they’d be largely the same. In these studies, people who read about studies that suggested a lot of personal change over the course of a year also acted more charitably. “If I think I’m more connected to some entity now than I am to myself in 30 years, then I’ll be more likely give more to that entity now,” says Bartels, adding the entity could represent any person, societal or environmental issue, or charity worthy of attention.

However, as was the case for college students in the coffee shop, people were also inspired by reminders of what they considered important. “You probably would like to help starving kids,” says Bartels, “but you may not think about them all the time because you have rent, your own bills, and other commitments. But if you get your self out of the way a little bit, this changes. When you feel as if your future self is not fully you, then you actually give more.” In the study, people who were prompted to feel disconnected from the people they’d be in a year, and who were making decisions about what to do with money they wouldn’t receive until next year, gave the most.

So here, your future self isn’t inspiring good behavior through connection but rather disconnection. Believing you will change inspires you to act better—toward other people—in the present. Dialing down the connection you feel to your future self can make you act more charitably toward others.

The people most concerned with your generosity are, of course, in the philanthropic field. (For more on the art of raising money, read “Beyond the Ice Bucket Challenge” in the December 2014 issue.) Bartels feels it would be unethical for charities to try to convince people they’re going to change a lot over time, but he says charities could instead simply place donation commitments farther out into the future. “Just putting commitment off in time, and reminding people how much they care about others, may work well,” he says.

As we live our lives and focus on the present, we often fail to consider our future selves enough, says Urminsky. If we thought about the future more consistently, we might achieve many goals that seem insurmountable.

But how do you get yourself to think about your future self and connect to it? How do you trick yourself into thinking about present and future trade-offs? That is unlikely to be on your mind when you’re waiting in line for a coffee, or web surfing, or planning a vacation.

It may be that organizations with a product or idea to sell you will try to put you in a particular frame of mind. Charities trying to raise money may dabble with the notion that the future self is changing—or at least encourage giving in the future, rather than the present. An advertiser may want to inspire thoughts of the past self to sell more-emotionally-tinged products such as vacations or greeting cards. Asking consumers to harken back to a time when life was simpler and sweeter may make them more apt to purchase products or services that help them feel this way in the present.

People designing public-health initiatives may wish to embrace the future, but need to be careful about how it’s done. Smoking cessation campaigns sometimes use the future as a warning, by showing what can happen to a body over time. But if you see that future person as fundamentally different from who you are now, it may not have much of an effect. “Anti-cigarette ads talk about all the things smoking will do to you down the road, how you’ll barely recognize yourself,” says Urminsky. “It’s scary, and could actually be distancing. The message shouldn’t be that you’re doing this to some distant version of yourself; it’s that you’re doing it to yourself now, or at least to some closely related version of yourself.”

The ultimate place to remind people about the future self is in the retail setting, but retailers could be less than enthusiastic about this idea, since it would mean we’d be more reluctant to spend our money today.

Banks and investment companies, in the business of getting you to put aside money for the future, have taken on the hefty job of reminding us of our future selves when we’re going about our daily lives while trying to withstand the siren call of Starbucks. Prudential made its ads with help from Harvard’s Dan Gilbert, to get people to confront biases that get in the way of saving. A spokesperson for Bank of America, which owns Merrill Edge, says since its Face Retirement tool launched in 2012, almost 1 million people have uploaded photos. “We know that people who are brave enough to take a look into the crystal ball are much more likely to take control of their retirement planning,” she says. Imagine what else your future self could teach you.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.