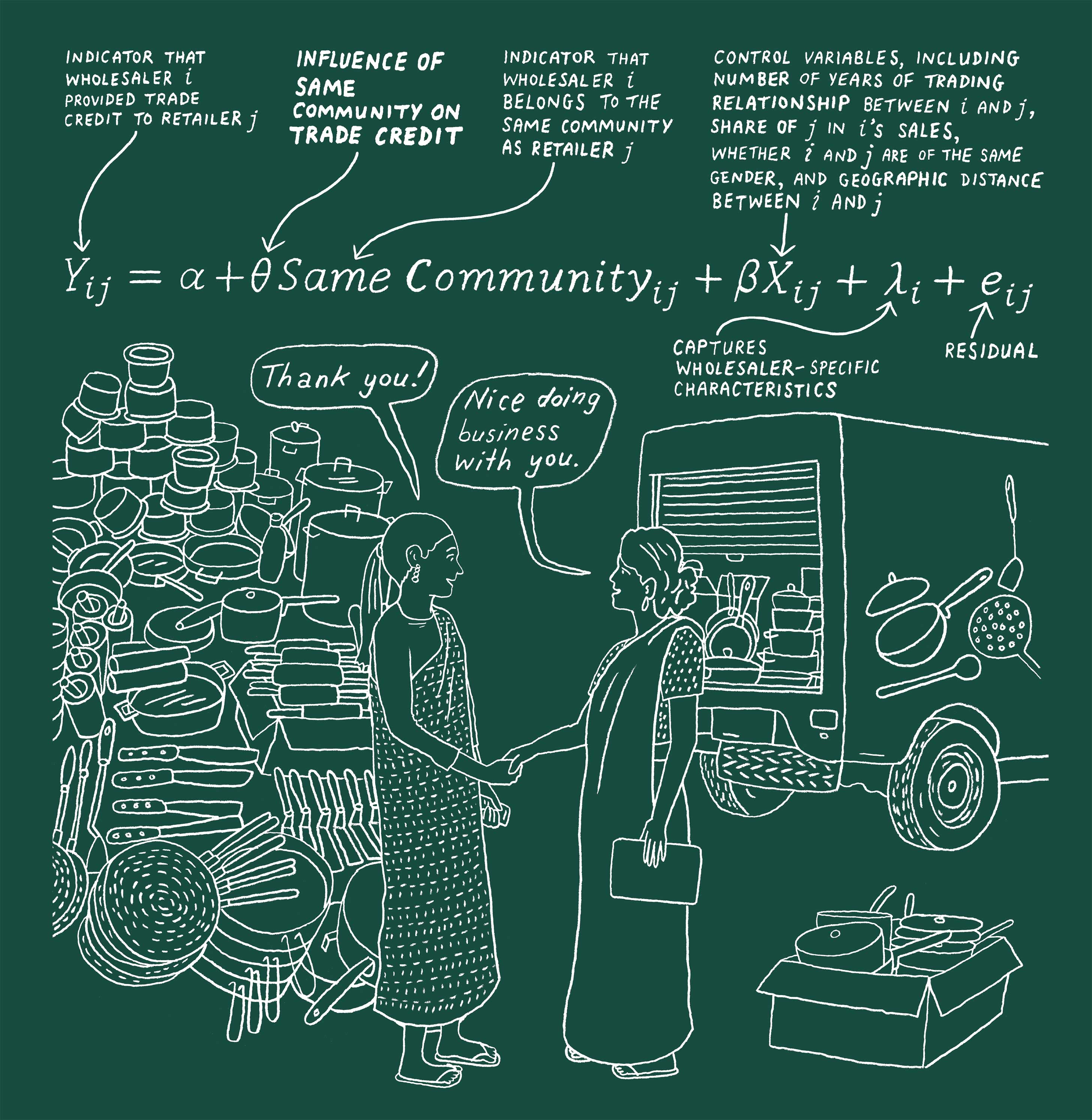

In bustling Iewduh, one of the largest and oldest bazaars in northeast India, small retailers typically don’t have access to formal sources of financing, nor do they have enough cash up front to pay wholesalers for the merchandise they sell in their stores. These small enterprises thus rely heavily on trade credit—and whether a wholesaler awards it in any particular case depends, among other factors, on the community to which a retailer belongs, according to Chicago Booth’s Rimmy E. Tomy and University of Southern California’s Regina Wittenberg-Moerman. Iewduh’s wholesalers and retailers mainly come from nine communities and vary in their shared languages, cultures, and places of origin. The researchers collected data on Iewduh’s traders and find that wholesalers were 12 percent more likely to provide credit to retailers from their own community. To learn more about why these ties play an important role in Iewduh and similar markets, see our article “In Some Places, Community Is Key to Who Gets Commercial Credit.”

Illustration by Peter Arkle

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.