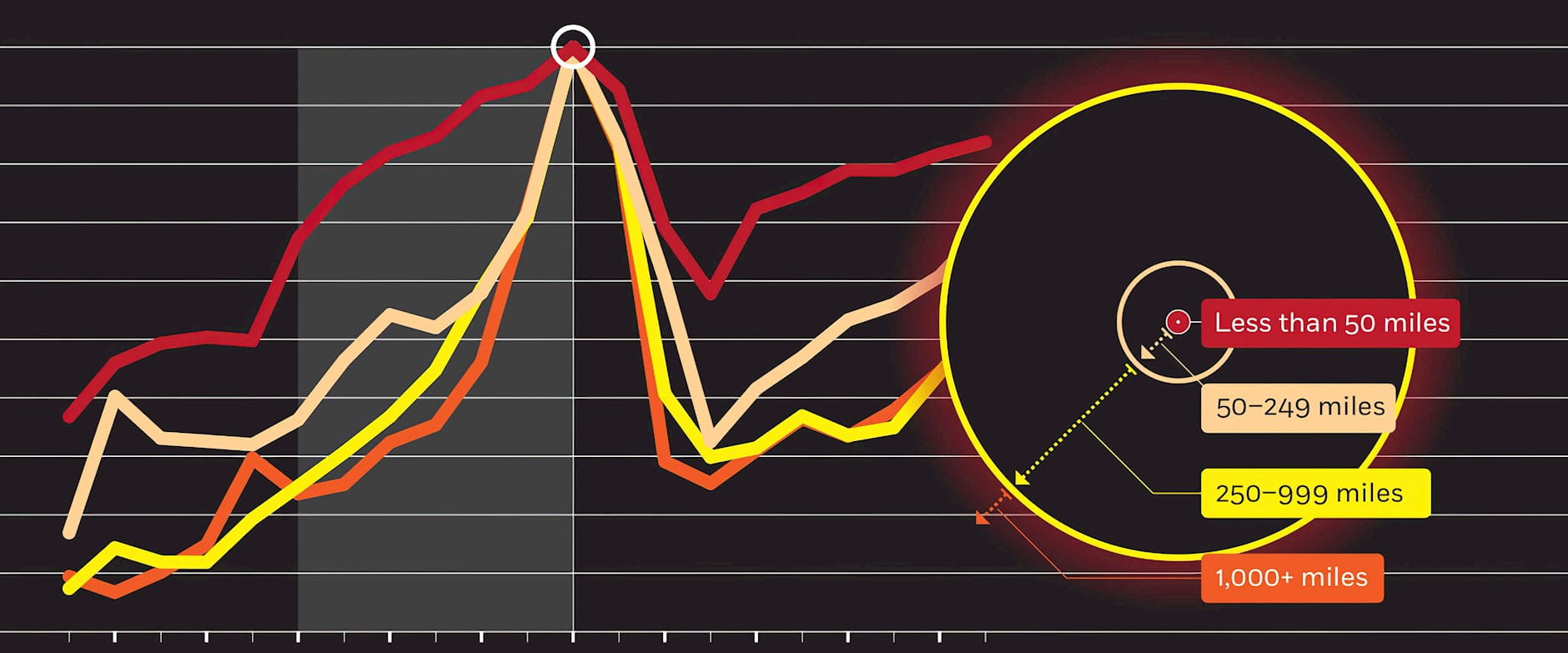

During periods of economic expansion, the average distance grows between a US bank branch and its small-business borrowers, according to research by Chicago Booth’s João Granja, Christian Leuz, and Raghuram G. Rajan. But when the economy constricts, banks lend closer to home, they find.

That raises a question: in the COVID-19 crisis, when the US government wants to encourage banks to lend to small businesses to promote economic growth, will businesses farther from banks be left behind?

Distance between lenders and borrowers

Granja et al., 2019

The researchers tapped a number of data sources to correlate the number and size of small-business loans originated by county and financial institution with the locations of bank branches, also inputting information on loans and borrowers themselves. They find that between 1996 and 2016, in good economic times, banks offered loans farther from home. In the three booms years before the 2008–09 financial crisis, the average distance between a lender and small-business borrower rose from 175 to 350 miles.

Total dollar amount of US small-business loans

Grouped by distance between lenders and borrowers

Granja et al., 2019

However, when bankers went farther from branch offices, the loans they made defaulted at much higher rates than loans to businesses closer to branches. And when crisis and recession hit, banks contracted to focus on local lending, dramatically shrinking their lending territories. The average distance between branch and borrower “quickly slipped back to approximately 200 miles following the 2008 financial crisis,” the researchers write.

For the current crisis, the findings suggest that “there are areas that might not be that well served by banks that work with the Small Business Administration,” says Granja. “These areas might have difficulty reaching out and getting this access to credit, which makes me worried about access to the stimulus package.”

It’s possible that financial-technology companies may jump in to service under-banked areas and help deploy stimulus, he allows. Future research will help determine if that is the case.

João Granja, Christian Leuz, and Raghuram G. Rajan, “Going the Extra Mile: Distant Lending and Credit Cycles,” Working paper, October 2018.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.