How Piketty Is Wrong—and Right

- By

- March 12, 2015

- CBR - Economics

Inequality may be the economic issue of the moment, but the theme has long preoccupied economists. In 1919, Irving Fisher, a giant in early 20th-century economics, warned of “a bitter struggle over the distribution of wealth until a . . . definite readjustment has been found.”

Simon Kuznets (who went on to win a Nobel Memorial Prize in Economic Sciences in 1971) took a more sanguine view in 1954, during the post–World War II boom. He found that economic growth reduced income inequality in rich countries, but had the opposite effect in poorer countries.

The 2007–10 financial crisis and the economic downturn that accompanied it focused attention on longer-term trends in wealth and income inequality around the world. The debate intensified following the publication last year of Capital in the Twenty-First Century by Thomas Piketty of the Paris School of Economics. The dense, nearly 700-page tome quickly became a global publishing sensation, spending almost six months on the New York Times best-seller list and being named business book of the year by the Financial Times.

The debate has drawn in a host of world-class economists, among them Chicago Booth faculty Kevin M. Murphy, George J. Stigler Distinguished Service Professor of Economics, and Robert H. Topel, Isidore Brown and Gladys J. Brown Distinguished Service Professor; and Claudia Goldin and Lawrence F. Katz of Harvard.

The data clearly indicate that the divide between the wealthy and everyone else has greatly increased over the past four decades. In 2012, the top 1 percent of US households took in 22.5 percent of household income; in 1979, they got a mere 10 percent of the pie, according to the Pew Research Center. The research group noted in December 2014 that the typical upper-income US household now holds nearly seven times the wealth of a middle-income household—the largest gap in 30 years of available records. (Upper-income households are defined as having income of at least $132,000 for a family of four, while a middle-income household is defined as having income of $44,000 to $132,000 for a family of four.) Meanwhile, by one measure, real median household income, around $51,900, is about where it was in 1995, according to the Federal Reserve Bank of Saint Louis.

Middle-class incomes have stagnated in many developed countries. A study by the Organisation for Economic Co-operation and Development finds that income inequality increased in 17 of 22 members, mainly developed countries, between 1985 and 2008.

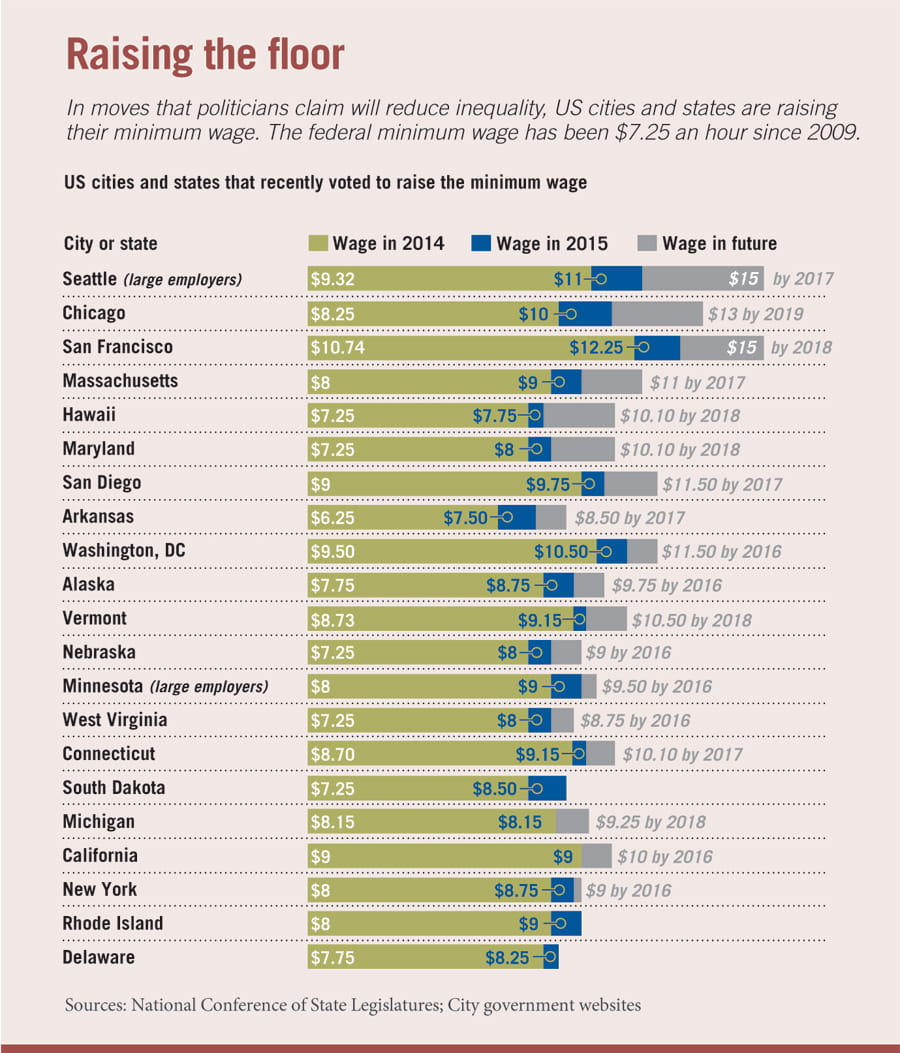

That widening gap between rich and poor has become a hot-button political issue. Over the past two years, more than a dozen US cities and counties, including Chicago; San Diego; San Jose, California; and Washington, DC, have hiked their minimum wages in the belief that such policies would reduce income inequality. Seattle and San Francisco will raise their base wages to $15 an hour by 2018.

Does capital outpace income?

Beginning in the 1990s, Piketty, Emmanuel Saez of the University of California, Berkeley, and others have assembled a formidable set of tax and income data for more than 20 countries, which has helped them trace patterns in income inequality going back 100 years.

Piketty’s central idea is simple: the rich get richer while the poor stay poor. “Money tends to reproduce itself,” he writes in Capital. According to his argument, inequality expands when capital—the combination of physical assets such as land, factories, and equipment, and financial assets such as profits, dividends, and interest—grows faster than the underlying economy that supports it. He argues that these conditions held in the 19th century, and he predicts they will return in the 21st.

Piketty, who often criticizes American economists’ reliance on equations, expresses that dynamic in simple algebra: r>g, where r is the return on capital and g is economic growth. Piketty pegs the historical return on capital at 4–5 percent a year and growth at 1.5 percent per annum, a figure he believes won’t increase much because of low population growth.

“In a quasi-stagnant society, wealth accumulated in the past will inevitably acquire disproportionate importance,” he writes. “Decreased growth—especially demographic growth—is thus responsible for capital’s [dominance].” Piketty’s equation implies that under these circumstances, nothing can stop even greater income inequality—nothing save government intervention, which he advocates via a global wealth tax.

He believes that the class and wealth division in society now “appears to be comparable in magnitude to that observed in Europe in 1900–1910” and might one day approach the disparities of the early 1800s. That was when great writers such as Jane Austen and Honoré de Balzac, whom Piketty cites frequently in Capital, poignantly depicted their characters’ desperation to attain titles and income from inherited wealth far beyond what they could earn at a trade or profession.

It is, at heart, a pessimistic view of the free-market system, reminiscent of the inherent “contradictions” that Karl Marx believed would destroy capitalism. (Piketty frequently criticizes Marx, but his title is an homage to the revolutionary economist’s own unfinished Das Kapital.)

Is Piketty right? Does the nature of capitalism itself doom us to perpetual inequality? Or do the roots of inequality lie elsewhere, so that it might be possible to raise the income of the many rather than merely tax away the wealth of the rich?

A contest of skills

Over the past decade, Murphy and Topel, collaborating with researchers such as the late Chicago Booth Nobel laureate Gary S. Becker and others, have given an alternative explanation for the income divide, one also based in the free-market system. Their debate with Piketty is a classic and often spirited battle of ideas, but Murphy and Topel’s research suggests solutions with which, surprisingly, even the French economist might agree.

In their most recent paper on inequality, Murphy and Topel first demonstrate that “in the US, wage growth of low-skilled individuals stagnated after the mid-1970s . . . while individuals near the top of the wage distribution enjoyed rapid and sustained wage growth.” To explain why this happened, they focus on “human capital,” the combination of skills and training that individuals bring to the labor market.

Murphy and Topel argue that “market fundamentals favoring more skilled workers are the driving force behind rising inequality.” Those fundamentals are the basic supply and demand for skilled workers. The growth in demand for skilled labor has far exceeded the growth in the number of skilled workers, Murphy and Topel note, so that the relative price of skilled labor has risen. The result: rising relative incomes for highly skilled workers.

For example, US doctors’ median wage nearly quadrupled from 1983 to 2012— the largest increase of any occupation—according to an analysis of data from the US Bureau of Labor Statistics. Medical doctors, surgeons, and specialized dentists were among the 10 highest-paying occupations in the United States in 2012.

Technological innovation and globalization in particular have pushed up demand for highly skilled knowledge workers, especially in service industries, and that has “increased the advantage of people with greater human capital,” Murphy said in a 2007 interview with Capital Ideas.

The most highly skilled, such as top software developers, command huge premiums as firms compete for their talents with large signing bonuses, stock options, and lavish perks.

Rare individuals such as Bill Gates, Mark Zuckerberg, Alibaba founder Jack Ma, and Google’s cofounders Larry Page and Sergey Brin have created technological breakthroughs and huge markets that didn’t exist before. Those few highly skilled innovators are rewarded with vast fortunes generated by consumers’ demand for their products and investors’ desire to own shares in their companies. “The top group in the income distribution is the most skilled group,” Topel says. “The skills command a much higher premium. The skills we need are very expensive.”

But it’s not just these exceptional cases. In general, the supply of highly skilled workers is limited, and the rate at which these skills are rewarded increases the higher you go on the ladder.

Topel and Murphy show that US income inequality is increasing across the whole income spectrum, not just between the very rich and the poor. “The trend toward rising wage disparities was not unique to the top or bottom of the distribution, but occurred at all skill levels for both men and women,” they write. They note that wages for US earners at the 99th percentile increased relative to those at the 95th, but point out that was also the case for the wages of those at the 60th percentile relative to the 50th and at the 20th percentile relative to the 10th.

If the supply of skills does not increase at the same pace as the needs of technology, then groups whose training is not sufficiently advanced will earn less.

The income gap, Murphy and Topel argue, is primarily a skills gap, or a gap in the supply of human capital. “The failure to produce a sufficient number of high[ly] skilled workers has contributed both directly and indirectly to the observed rise in inequality,” they write. This shortage prompts employers to hike wages for people who have the skills they need. But, Topel and Murphy claim, it also gives individuals an incentive to increase their own skills and enhance their human capital. By boosting their own earnings power, these highly skilled workers exacerbate overall income inequality.

In this economy, the haves are the educated—and the more education, the better—while the have-nots are those who didn’t finish college or only graduated high school. The “college premium” is well known, and for many families justifies going deeply into debt to get that degree. Goldin and Katz, in their book The Race Between Education and Technology, estimate that from 1973 to 2005, the education premium accounted for 60 percent of the rise in wage inequality in the US.

In a 2007 study, Murphy and Becker estimated that since 1980 the pay premium for a college degree over a high-school diploma had doubled to roughly 60 percent. The wage advantage of earning a graduate degree over graduating high school almost tripled, to more than a 100 percent premium.

According to the Economic Policy Institute, in 2013 graduates of US colleges earned 98 percent more per hour than their counterparts with only high-school diplomas.

The median income for US adults aged 25 to 34 with a master’s degree or higher was 27 percent more than for people the same age with only a bachelor’s degree. Topel and Murphy argue that difference is mainly because of the supply of people who earn college and postgraduate or professional degrees.

Some 21 million people attended a US college or university in 2014, 5.7 million more than in 2000. Much of that rise is due to a big increase in women matriculating at all levels. They made up 57 percent of US college students in 2014. Meanwhile, male college enrollment has stagnated, Murphy and Topel find in a 2014 study. “For [American] men, the college completion rate peaked at 33 percent for high-school cohorts of the mid-1960s . . . but the male completion rate has not been substantially above 30 percent since then,” they write. “In contrast, college completion rates for [women] continued to grow . . . and have exceeded men’s completion rates since about 1980.”

Not only have many men found it difficult to accumulate the educational credentials and human capital they need to be competitive in today’s knowledge economy, men further down the income ladder also have been in the crosshairs of globalization and technological change.

In a 2002 study, Topel and Murphy, along with Chinhui Juhn of the University of Houston, find that less-skilled males in the US have suffered the brunt of the big declines in the relative and absolute wages for lower-skilled jobs since the 1970s. Technological changes, changing patterns of international trade, and competition from abroad also have reduced the earning power of low-skilled workers while benefiting those with greater skills and education.

Back to school

Murphy and Topel’s thesis that income inequality is driven by the supply and demand for skills appears to contradict Piketty’s hypothesis that the income gap is caused by inevitably higher returns to accumulated wealth and capital when population growth is low. Murphy and Topel argue in a working paper from last year that their findings “undermine ‘theories’ that attribute rising inequality to an outbreak of self-dealing conspiracies or rent-seeking among the very rich, while wage growth for everyone else languished.” (Separately, Topel argues that by measuring capital by its market value, Piketty conflates the quantity of capital with its price, skewing the rate of return on capital that he calculates.)

In other ways, the researchers are less far apart. At first, Piketty, who focuses on the traditional notion of capital, dismisses the whole concept of human capital. “Some people think that capital has lost its importance and that we have magically gone from a civilization based on capital, inheritance, and kinship to one based on human capital and talent,” he writes.

He initially brushes aside the idea of a “race between education and technology” (Goldin and Katz’s book title) as a theory that “does not explain everything” and is “in some respects, limited and naive.” He also declares that “it does not offer a satisfactory explanation of . . . wage inequality in the United States after 1980.”

Piketty argues that economists who focus on skills often overlook other factors, such as social norms, that could partially explain why incomes have rocketed higher for “supermanagers” in the US and UK since the 1970s. These trends have not taken hold to the same extent in other developed countries, such as Japan, Germany, and Sweden, even though the benefits of technological advances have spread worldwide.

But Capital eventually acknowledges Goldin and Katz’s (and Murphy and Topel’s) points that education and technology are crucial. “As simple and simplistic as the theory may be,” Piketty notes, it does emphasize “the supply and demand of skills.”

“If the supply of skills does not increase at the same pace as the needs of technology, then groups whose training is not sufficiently advanced will earn less and be relegated to devalued lines of work, and inequality with respect to labor will increase,” Piketty writes. “Over the long run, education and technology are the decisive determinants of wage levels.”

Piketty sees a clear difference between the US and Western Europe, particularly his native France. He calls the US “a very inegalitarian society, but one in which the peak of the income hierarchy is dominated by very high incomes from labor rather than by inherited wealth.” He adds, “the unprecedented increase of wage inequality explains most of the increase in US income inequality,” but he asserts that this finding “does not mean that income from capital played no role.”

Piketty’s acceptance of the central role skills play in driving income inequality leads him to policy prescriptions that would be familiar to his American colleagues. “To sum up: the best way to increase wages and reduce wage inequalities in the long run is to invest in education and skill,” he writes.

Murphy and Topel agree. “Solutions to the inequality problem lie on the supply side, specifically in policies that encourage or enable the acquisition of skills or encourage the immigration of highly skilled individuals,” they write.

Thus Piketty and Topel and Murphy reach similar conclusions—that countries should invest in human capital, improve people’s skills, and encourage higher education. Of course, how to achieve that goal is contentious. US education reform provokes fierce debates over issues such as charter schools, which have more flexibility than traditional public schools, and Common Core standards, the uniform academic standards adopted by most US states.

Nevertheless, improving education policies could help attain the goal of a better-skilled workforce and stanch the growing inequality that has alarmed Piketty and renewed the search for solutions.

- Gary S. Becker and Kevin M. Murphy, “Inequality and Opportunity,” Capital Ideas: Selected Papers on Price Theory, May 2007.

- Claudia Goldin and Lawrence F. Katz, The Race between Education and Technology, Cambridge: Belknap Press of Harvard University Press, 2008.

- Simon Kuznets, “Economic Growth and Income Inequality,” American Economic Review, March 1955.

- Kevin M. Murphy and Robert H. Topel, “Human Capital Investment, Inequality, and Growth,” Working paper, February 2014.

- “The Changing Nature of Unemployment,” Capital Ideas, February 2005.

- Thomas Piketty, Capital in the Twenty-First Century, trans. Arthur Goldhammer, Cambridge: Belknap Press of Harvard University Press, 2014.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.