Haresh Sapra on the dangers of forcing companies to report financial information too frequently

- By

- June 20, 2014

- CBR - Accounting

Haresh Sapra on the dangers of forcing companies to report financial information too frequently

Investors demanded more transparency and accountability after Enron-era accounting frauds, but they weren't totally reassured by new annual and quarterly reporting mandates. That impatience has translated into constant pressure on public company executives to provide frequent earnings guidance and to report positive results as often as possible.

But is too-frequent reporting negatively affecting long-term investor returns? That's the contention explored in a working paper by Chicago Booth Professor Haresh Sapra and colleagues from the University of Illinois at Urbana-Champaign and the University of Minnesota. The authors conclude there's a happy medium between not enough disclosure and too much information delivered too often.

"Since markets are forward looking, any actions that favor the short term at the expense of greater long-term value creation would be effectively punished by lower capital market prices," according to the paper's authors. Overreporting can be costly and may end up a self-fulfilling prophecy, magnifying the attraction to do anything to produce quick profits. "Such pressures disappear when reporting frequency is decreased," the authors report.

Sapra and his colleagues cite anecdotal evidence along with empirical evidence they produced with a model that uses probability theory to analyze real cash flow returns to an investment by a publicly traded firm. Under the model, an investment decision is made under one of two conditions: good or bad. An executive chooses to invest after getting a signal, a particular piece of information such as a change in business conditions that helps him or her decide whether to make the investment and what type of investment to make.

The researchers' results show that long-term projects consistently have a higher present value of expected future cash flows (generally assuming a dollar today is worth more than a dollar tomorrow). A short-term project often looks attractive because it has a higher probability of producing larger cash flows in early years but that advantage diminishes over time. In other words, short-term investments that flatter the bottom line may appear beneficial, but in the long term they add less to shareholder value. The authors show long-term projects decisively beat short-term projects in the long term under both good and bad investment conditions.

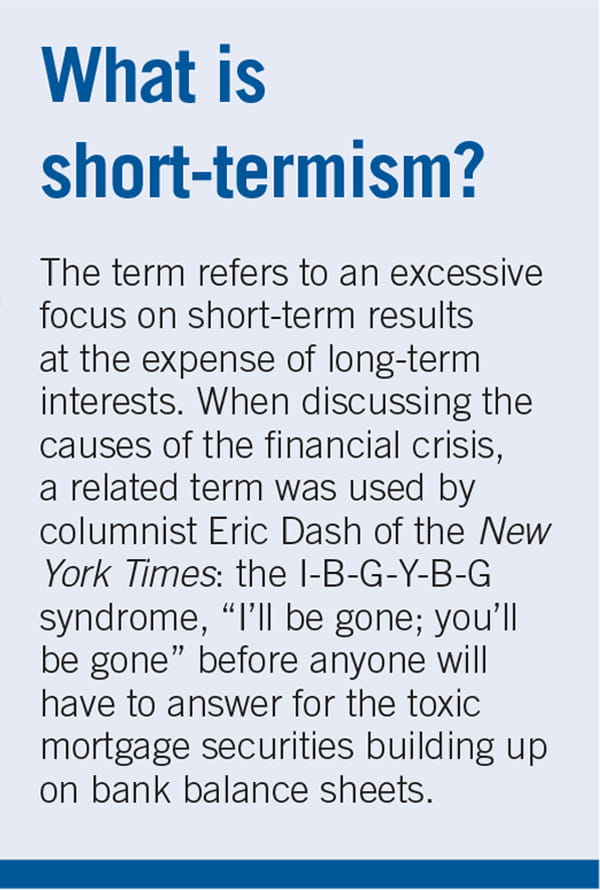

So how does this impact the way publicly traded companies decide to report? Should companies be reporting any more than is absolutely required, given the feedback loop and short-termism that develops? The research shows that the more frequently companies report, the more investors expect to see positive results. The split between long-term investors and those looking for early cash flows is constantly changing in large public companies, and executives can't please everyone all of the time. The research conclusion: investors' short attention spans hurt long-term returns when company executives react to the clamor for short-term results by reporting too frequently and then attempting to meet heightened expectations by any means possible.

Frank Gigler, Chandra Kanodia, Haresh Sapra, and Raghu Venugopalan, "How Frequent Financial Reporting Causes Managerial Short-Termism: An Analysis of the Costs and Benefits of Reporting Frequency," Working paper, April 2013.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.