CBR Briefing #8

- February 23, 2018

- CBR - Accounting

How banks monitor borrowers without financial statements

When financial statements aren’t mandatory in small commercial loans, banks also look to reputation, collateral, and tax returns to keep tabs on borrowers.

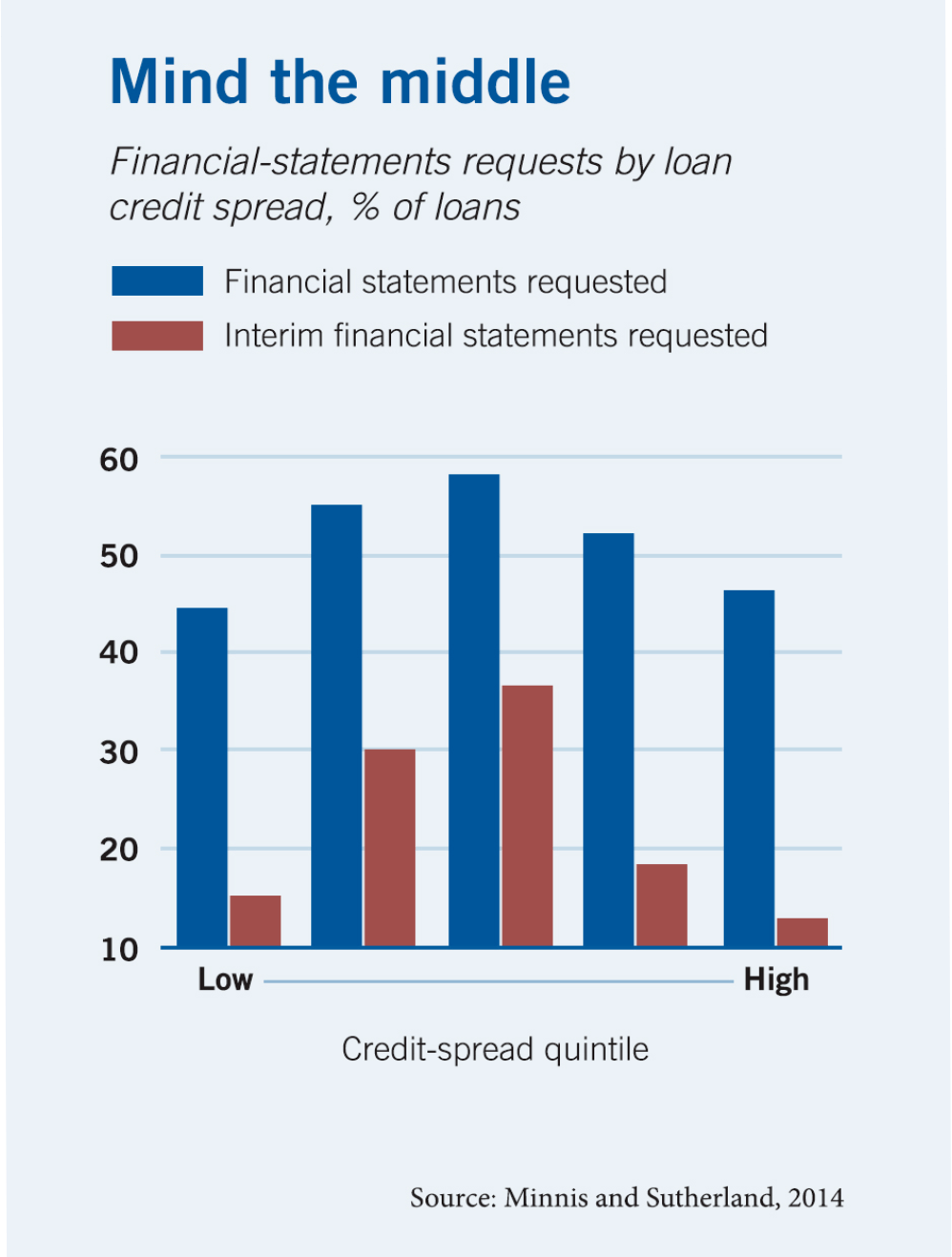

When lending to smaller companies, banks are 25% more likely to ask for financial statements from those whose risk is in the middle quintile.

- Banks request financial statements to monitor loans made to small private companies only half the time, according to a research paper by Chicago Booth’s Michael Minnis and Booth PhD student Andrew Sutherland. How often banks request financial statements when borrowers aren’t required to report them is the result of a cost-benefit negotiation between the bank and borrower.

- The longer a bank’s relationship with a borrower, the less likely the bank is to ask for financial statements. However, the more loans a borrower takes out, the more often the lender will request financial statements.

- Banks request financial statements equally often for smaller companies whose credit risk is in the top and bottom quintiles, as measured by the credit spread. But their propensity to request financial statements is about 25% higher for companies whose risk is in the middle quintile (see chart), where the net benefit of intense monitoring is highest, supporting theory.

- Collateral causes banks to request interim financial reports more frequently, to ensure the collateral is intact and hasn’t been transferred to another party.

- Tax returns can substitute for or complement financial statements. Banks tend to request both if their relationship with a borrower is shorter, more complex, or when a borrower has middle-tier credit risk.

Michael Minnis and Andrew Sutherland, “Financial Statements as Monitoring Mechanisms: Evidence from Small Commercial Loans,” Working paper, February 2014.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.