CBR Briefing #7

- June 17, 2017

- CBR - Strategy

How stock-options awards prompt executives to take on more debt and risk

The grants cause greater risk-taking, but not to the extent that one popular narrative suggests

A 10% increase in the value of new options granted leads to a 2%–6% increase in the annualized volatility of daily stock returns.

- Stock-options awards have been blamed for inducing executives to take excessive risks, but Chicago Booth’s Kelly Shue, in a research paper with Richard Townsend of Dartmouth College, argues that options grants only have moderate effects on risk-taking and may be an effective way to encourage risk-averse executives to take bigger gambles and to gain tax benefits from increased debt.

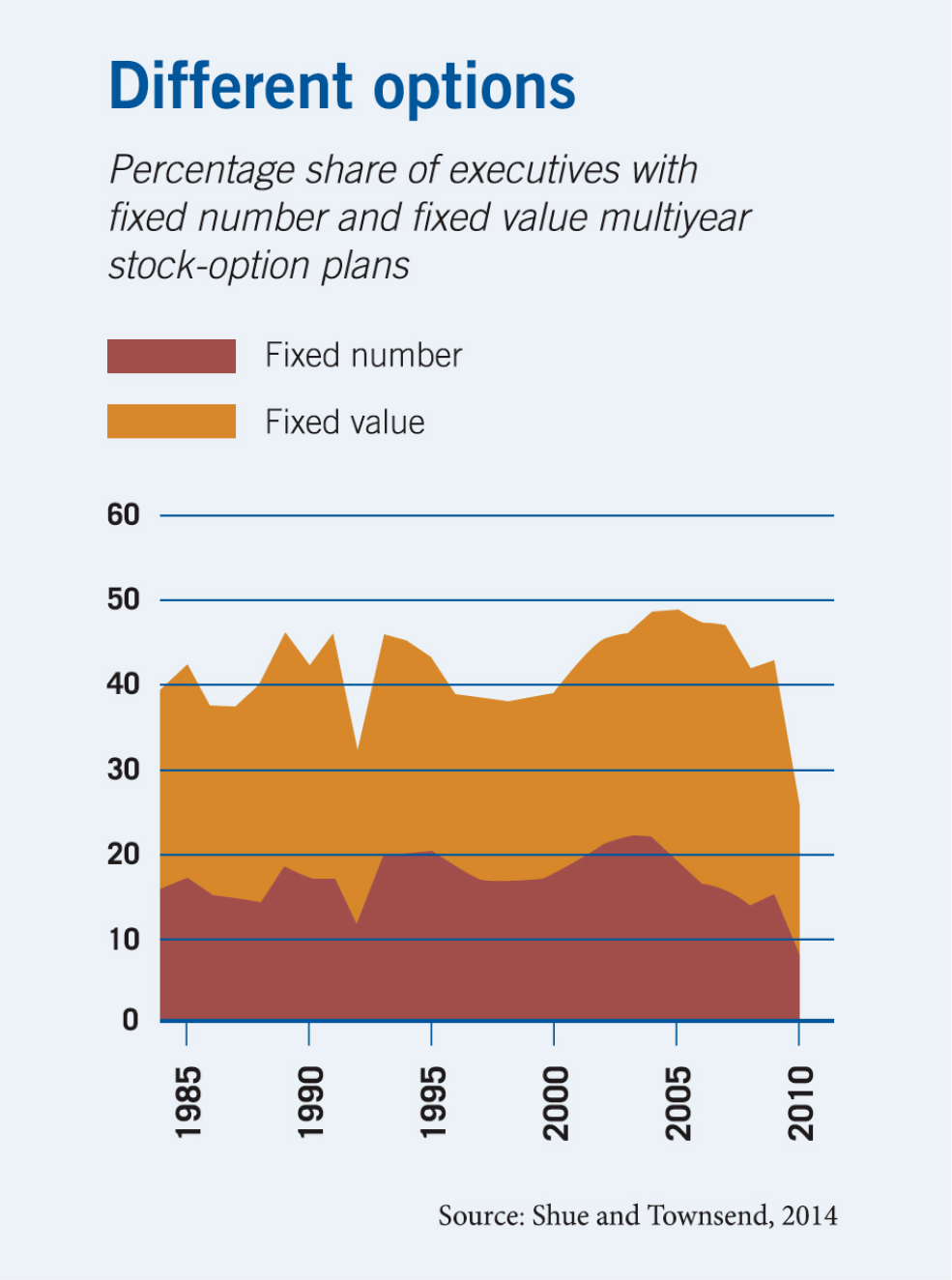

- The authors compared companies that base options grants on the number of options, whose value changes with stock-price movements, with those that base them on the total value of the options, where value is fixed over a two- to three-year window (see chart).

- A 10% increase in the value of new options granted leads to a 2%–6% increase in the annualized volatility of daily stock returns—the researchers’ measure of risk—in the year following the grant date.

- A 10% increase in the value of new options awards also leads to lower dividend growth.

- The effect of options awards on risk-taking is greater in the financial and technology sectors. This may be because executives have more ability to take on risk by using derivatives and pursuing products that are riskier to develop.

Kelly Shue and Richard Townsend, “Swinging for the Fences: Executive Reactions to Quasi-Random Option Grants,” Working paper, February 2014.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.