CBR Briefing #61

- April 02, 2018

- CBR - Finance

One reason CEO pay has skyrocketed

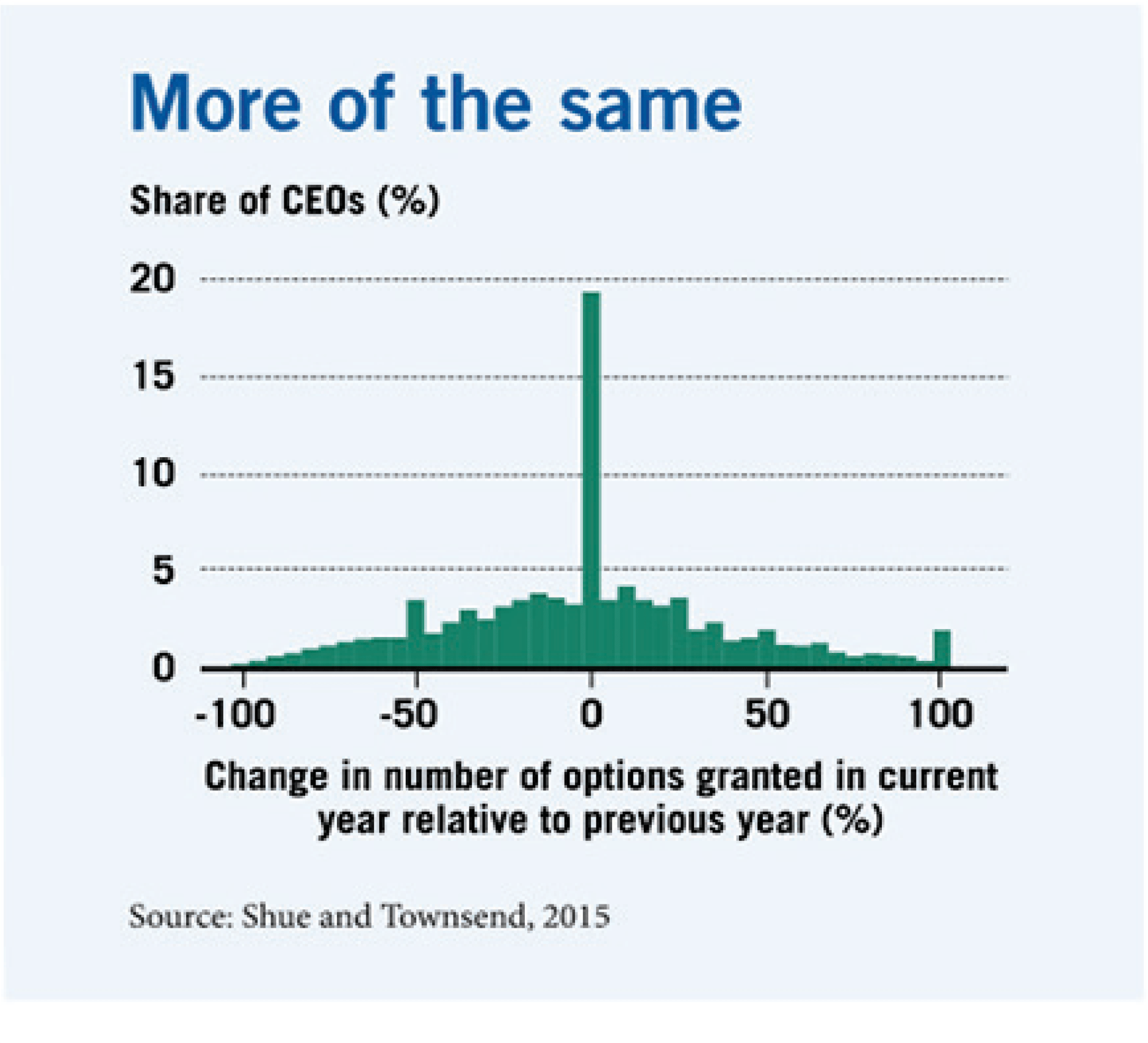

Companies tend to grant the same number of stock options every year, regardless of their value.

About 20 percent of new grants contained the same number of options as the previous year’s grants.

- CEO pay at big public companies tripled between 1992 and 2001. This pay jump is largely because companies consistently grant executives the same number of options, regardless of how much those options are worth, according to research by Chicago Booth’s Kelly Shue and Dartmouth College’s Richard Townsend.

- The researchers looked at executive compensation at S&P 500 firms from 1992 to 2010. They find that many companies granted executives the exact same number of options year after year— about 20 percent of new grants contained the same number of options as the previous year’s grants (see chart). When companies changed the number of options granted, it was often to a number that is a multiple of what it had been.

- Because stock prices grew rapidly during this period, the value of the options awards shot up at each grant date. Although CEOs’ options grants became increasingly valuable, the data suggest boards did not adjust other compensation to offset the growth.

- The researchers argue that boards may have suffered from “money illusion,” a mistake in which people value options compensation in number rather than dollar values. Companies that voluntarily expensed the dollar value of options grants were less likely to award the same number of options every year. When regulators in 2006 began requiring companies to expense the grants, number rigidity declined.

Kelly Shue and Richard Townsend, “Growth through Rigidity: An Explanation for the Rise in CEO Pay,” Working paper, December 2015.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.