CBR Briefing #53

- April 02, 2018

- CBR - Finance

How investors act like speed daters

Investors contrast earnings announcements with the prior day’s earnings surprises

If yesterday’s earnings announcement was especially bad, today’s news will seem more impressive by comparison.

- When speed dating, men exhibit a psychological bias known as the contrast effect. If in a previous round of speed dating a man sat in front of a particularly attractive woman, he will likely view the next woman he sees as less attractive than he would have otherwise. If the previous woman was not very attractive to him, the next woman will appear even more beautiful by contrast.

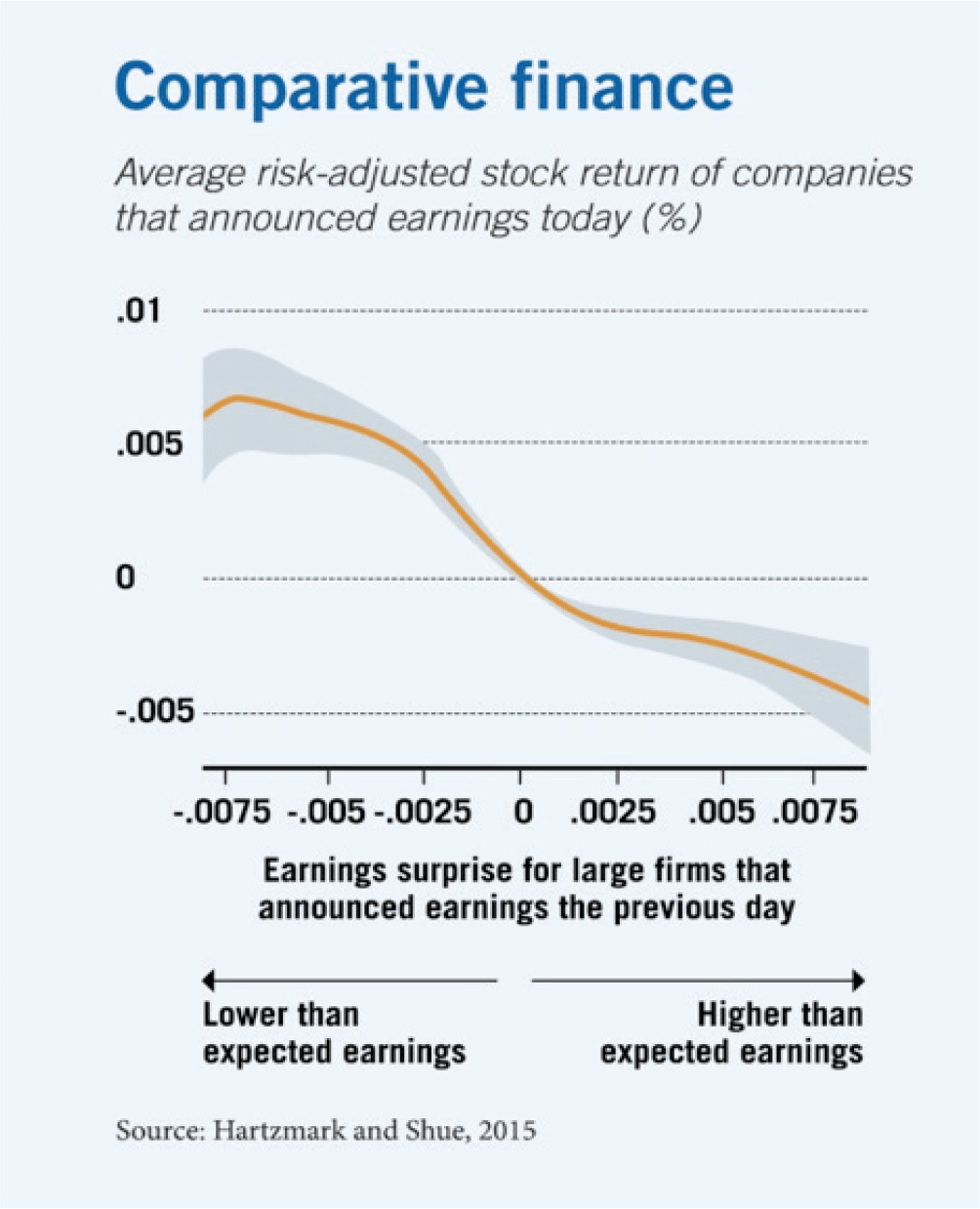

- Investors in the stock market exhibit the same bias when responding to earnings announcements, according to research by Chicago Booth’s Samuel Hartzmark and Kelly Shue. If a large company announced earnings yesterday that greatly exceeded forecasts, today’s earnings announcement by another company will seem less impressive than it would have otherwise. Conversely, if yesterday’s earnings announcement was especially bad, today’s news will seem more impressive by comparison.

- The data show a signifi cant inverse relationship between yesterday’s earnings surprise and the market’s perception of today’s earnings reports (see chart), even though yesterday’s earnings surprise does not provide information about companies announcing the following day. The difference between yesterday’s very good and very bad news leads to a 43 basis-point difference in the return response to today’s earnings announcement.

- The researchers work suggests that even in a highly competitive and sophisticated equity market, such as that in the United States, the underlying psychology of investors plays a critical role.

Samuel Hartzmark and Kelly Shue, “A Tough Act to Follow: Contrast Effects in Financial Markets,” Working paper, June 2015.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.