CBR Briefing #39

- March 04, 2018

- CBR - Accounting

What would happen if the Big Four became the Big Three?

Less competition among global auditing firms could mean higher costs for companies.

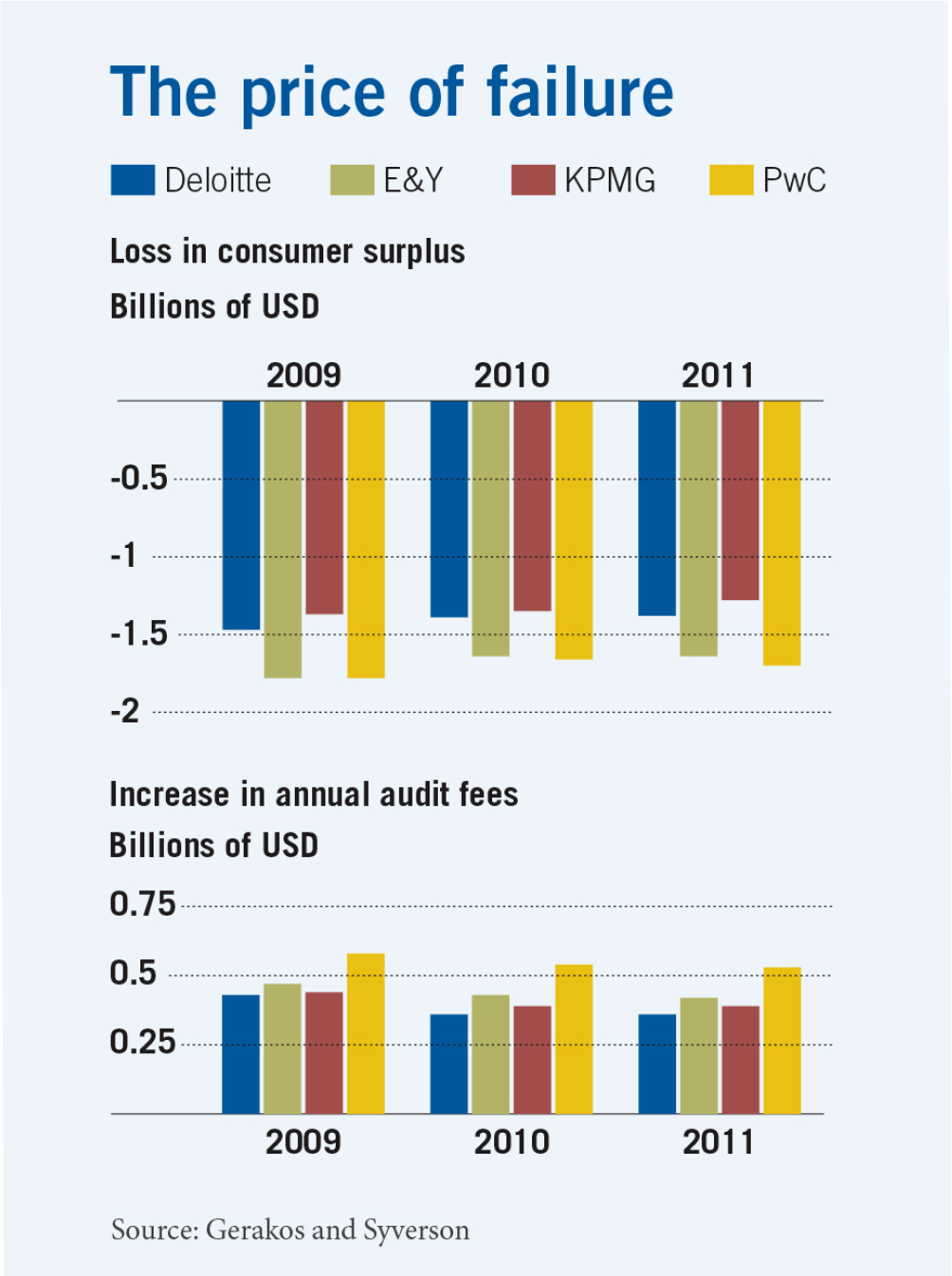

A sudden exit by one of the Big Four could cost US clients of the disappearing firm up to $1.8 billion per year.

- Arthur Andersen’s dissolution following the Enron scandal of the early 2000s reduced the number of large global accounting firms from five to four. Since then, Deloitte, Ernst & Young, KPMG, and PricewaterhouseCoopers have dominated the industry. A sudden exit by one of these Big Four could cost US clients of the disappearing firm $1.4 billion–$1.8 billion per year in lost “consumer surplus,” according to research by Chicago Booth’s Joseph Gerakos and Chad Syverson.

- The decline in consumer surplus reflects the value lost by a company forced to switch auditors, the drop in auditor options available to a company, and the value a company places on an extended relationship with its audit firm.

- If smaller firms don’t fill the vacuum, reduced competition among the remaining large auditors would likely lead to higher fees that could add as much as $360 million–$580 million per year, depending on which Big Four firm goes down (see chart). This amount is substantial—total audit fees for public firms amounted to $11 billion in 2010.

- Companies could incur even higher costs if regulators were to force companies to rotate auditors. The researchers find that a mandatory rotation every 10 years could cost US firms approximately $2.4 billion per year in lost consumer surplus.

Joseph Gerakos and Chad Syverson, “Competition in the Audit Market: Policy Implications,” Journal of Accounting Research, forthcoming.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.