CBR Briefing #14

- February 23, 2018

- CBR - Finance

In commercial real estate, less risk could mean higher returns

Investors who buy distressed property add risk to their portfolios, but not much more in returns.

High-risk funds outperformed low-risk funds by only a few basis points per year, an advantage that may not be worth the danger to investors.

- Pension funds have traditionally invested in low-risk commercial properties such as fully rented apartment and office buildings. But mounting claims and worries of underfunding have been driving these funds to seek higher returns, by using more debt to invest in riskier real estate, including new developments and distressed properties. Those aggressive strategies have not paid off, according to Chicago Booth’s Joseph L. Pagliari Jr.

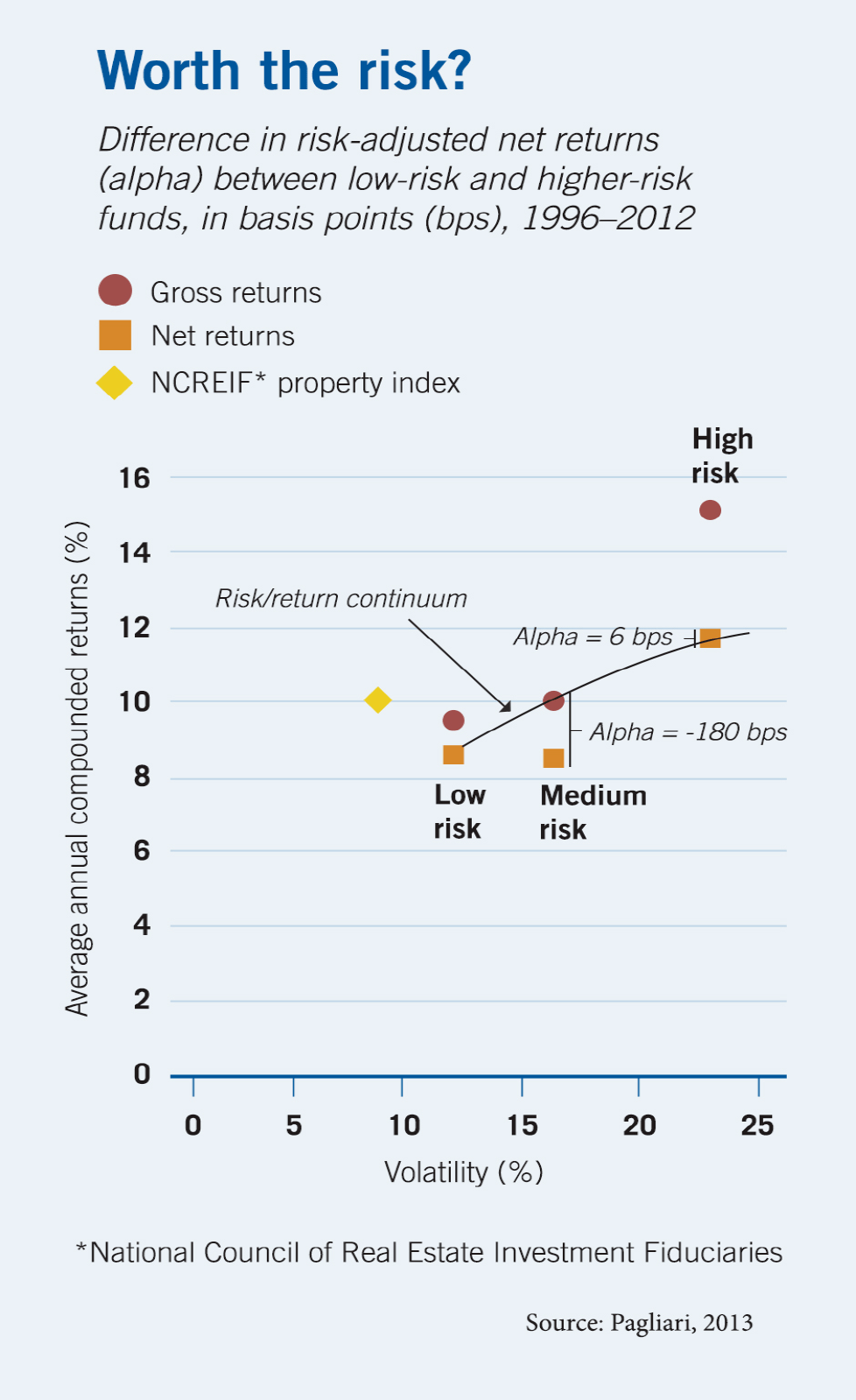

- To compare net returns on a risk-adjusted basis, Pagliari analyzed leverage to create a “risk/return continuum” in order to measure how returns on low-risk funds would compare with returns on medium-risk and high-risk funds if financed with more debt.

- Looking at 17 years of fund data, Pagliari finds low-risk funds with added leverage outperformed medium-risk funds by about 180 basis points per year—the difference in risk-adjusted net returns, or alpha (see chart). High-risk funds outperformed comparable low-risk funds by just 6 basis points per year, which Pagliari suggests may not be worth the danger to investors.

- One reason for the underperformance is higher fees for managing riskier funds. For example, rewarding managers with a portion of profits above a preferred rate of return diminishes investors’ upside and doesn’t give managers much incentive to limit investors’ downside risk.

- About 13% of high-risk funds stopped reporting returns during the financial crisis, says Pagliari, as some went out of business. This would overstate overall reported average returns and understate volatility, making riskier strategies appear more lucrative.

Joseph L. Pagliari Jr., “An Overview of Fee Structures in Real Estate Funds and Their Implications for Investors,” Research report for the Pension Real Estate Association, 2013.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.