Can This Model Time the Market?

- By

- May 22, 2016

- CBR - Finance

For almost four decades, many have expressed skepticism that investors or academics can reliably predict what the market is going to do. But other researchers have argued it’s possible to forecast movements, and a few have built models that attempt to do so. Blair Hull of Hull Investments, and Xiao Qiao, a Chicago Booth PhD candidate, are among those who argue it’s possible to time the market, and they cite a model they have devised, as well as an exchange-traded fund based on their model.

Hull and Qiao seek to predict market behavior over a six-month horizon. The researchers apply technical and fundamental factors to their analysis, drawing heavily on the factor work of Chicago Booth’s Eugene F. Fama, among others. Hull and Qiao use 20 factors that include some familiar fundamental standards such as book-to-market ratio, market-timing maxims including “sell in May and go away” (because returns tend to lag during summer vacations), and macroeconomic measures such as the Consumer Price Index.

The researchers create a forecast, as well as a trading strategy that can be implemented, taking into account real-life factors such as transaction costs and rebalancing.

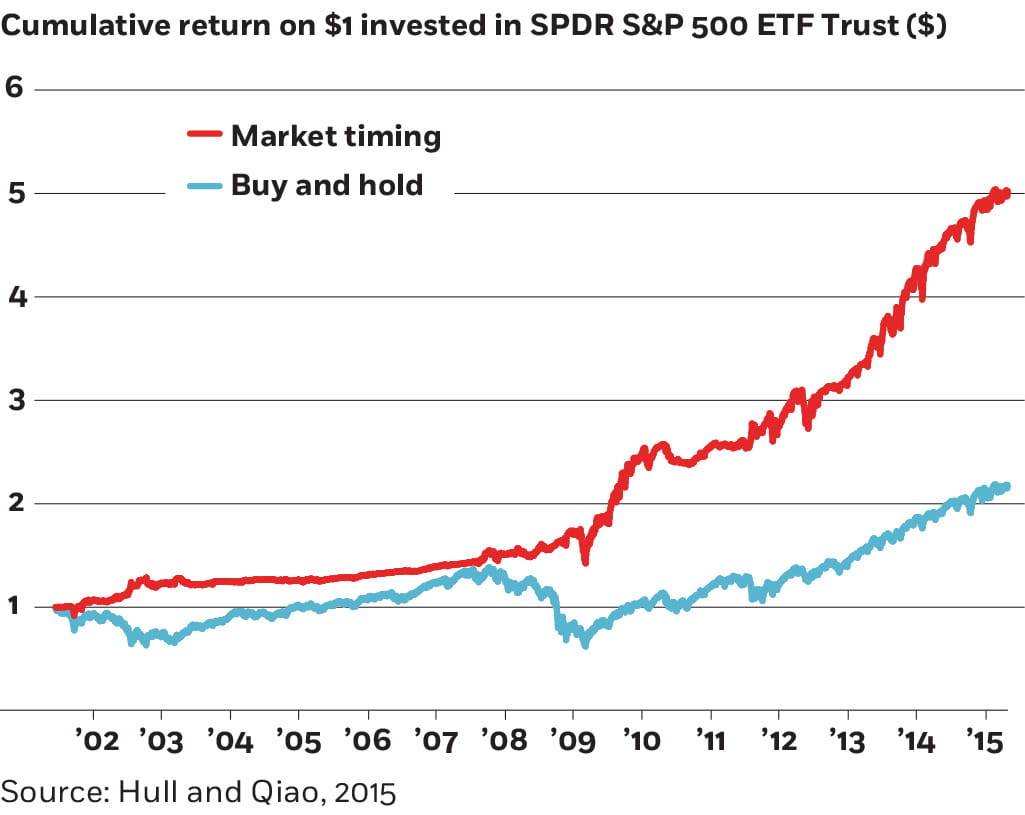

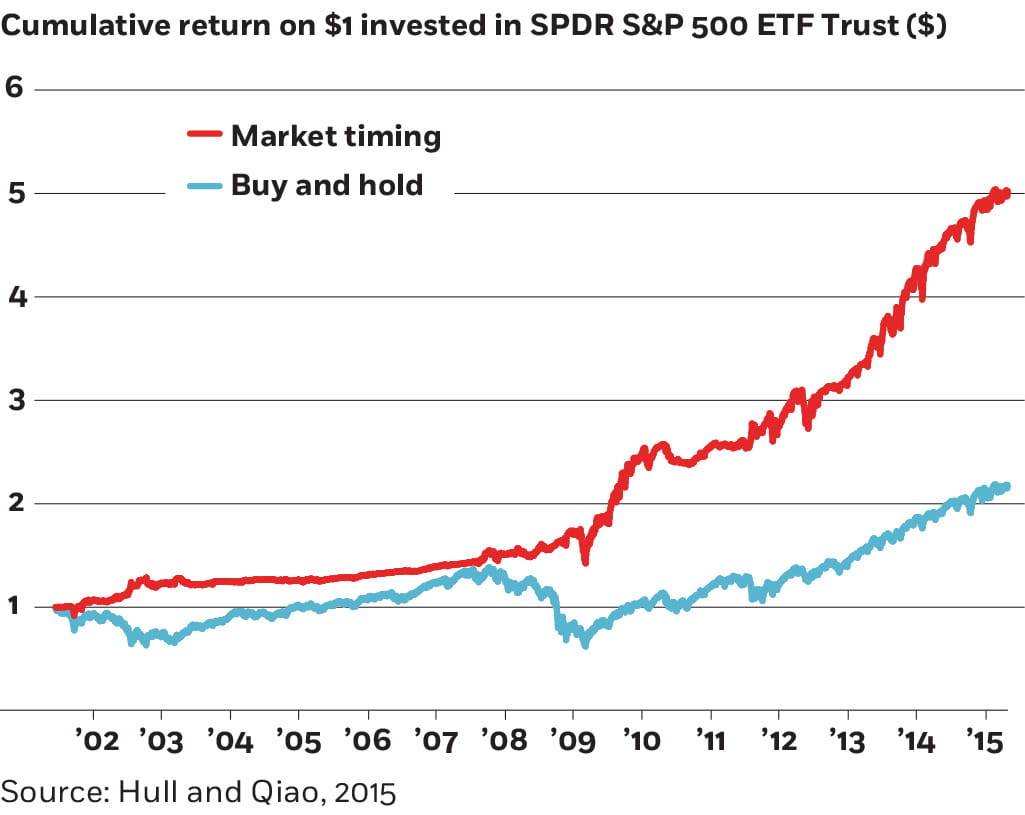

In a simulated trial, they applied their model to trading in the SPDR S&P 500 ETF Trust between June 8, 2001, and May 4, 2015, and got an annualized 12 percent return with a 0.85 Sharpe ratio (a measure of return per unit of risk). The return, they say, is double that earned by a buy-and-hold strategy in the same time period, and the Sharpe ratio is four times greater.

The model is theoretically promising even if it’s difficult to implement, Hull and Qiao say. A fund manager using it needs to know when individual factors are important and how to be nimbler than the traditional investment committee that meets quarterly to set a firm’s direction. “One needs to continually track the market, and effectively execute on the tiny signals that sometimes present themselves in a sea of noise,” the researchers write.

A manager also needs to be disciplined enough to be contrarian at times. Signals produced by Hull and Qiao’s model would have encouraged investors to increase equity allocations in the last quarter of 2008.

Buying low, selling high

In a back test, this market-timing strategy outperformed a buy-and-hold strategy, even during market downturns.

Blair Hull and Xiao Qiao, "A Practicioners' Defense of Return Predictability," Working paper, July 2015.

Your Privacy

We want to demonstrate our commitment to your privacy. Please review Chicago Booth's privacy notice, which provides information explaining how and why we collect particular information when you visit our website.