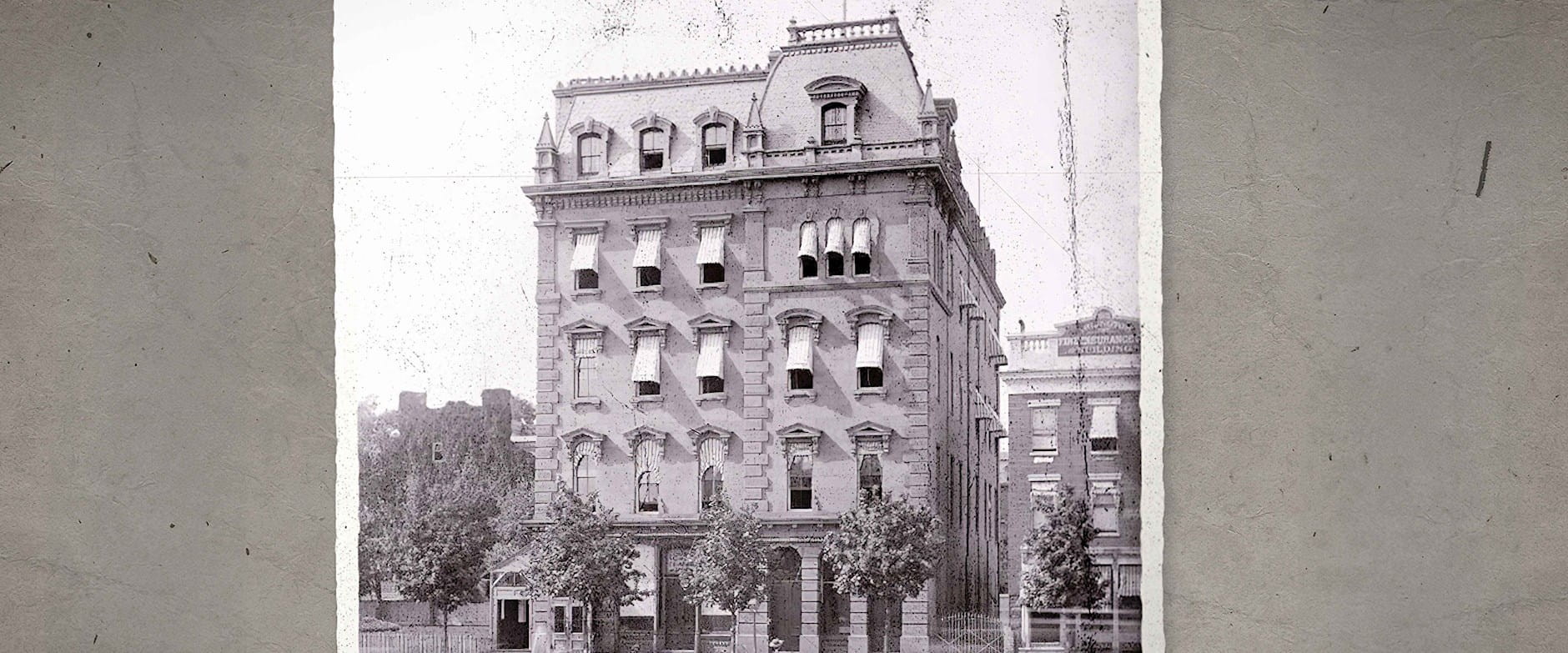

Narrator: In the waning days of the American Civil War, the US was home to a short-lived but highly significant experiment in banking. In 1865, the same year it passed the 13th Amendment to abolish slavery, Congress set up a bank for newly emancipated African Americans, nearly 4 million people freed from slavery, to accelerate their economic empowerment. The Freedman’s Savings and Trust Company opened in New York, and its headquarters swiftly moved to Washington, with a further 37 branches established in quick succession across 17 US states. The banks served more than 100,000 customers with a wide variety of occupations—farmers, cooks, barbers, nurses, carpenters—many of them likely earning money in exchange for their labor for the first time.

Constantine Yannelis: Initially, the bank provided services primarily to veterans, but very quickly the services of the bank spread throughout the African American community. At its height, the bank provided financial services to approximately one in seven African Americans living in the 19th century US South. If we look at the historical record, documents show that a large number of African Americans were using the services of the bank to purchase real estate, start businesses, and pay educational expenses, both for themselves and their children.

Narrator: Babson College’s Luke C. D. Stein and Chicago Booth’s Constantine Yannelis analyzed census data and bank records that both capture the important transitional moment in US history and offer an opportunity to analyze the impact of financial inclusion on traditionally excluded populations.

Constantine Yannelis: For individuals who are account holders, they had higher levels of income. They were more likely to start a business. They were more likely to own real estate and they were also more likely to send their children to school and themselves be literate. So this is consistent with very large, short-run effects of financial inclusion.

Narrator: But it was not meant to last. Just nine years after its inception, Freedman’s Bank, as it was known, closed in the wake of the panic of 1873.

Constantine Yannelis: The collapse of the bank was an overwhelmingly negative experience. You had people who were very poor to begin with losing their meager life savings. Frederick Douglass, for example, has a quote essentially arguing that the impact of the collapse of the Freedman’s Bank was equivalent to another 10 years of slavery for the African American community. So at least the historical record is consistent with the collapse of the bank being an absolute catastrophe, and very large negative impacts of the bank are consistent with the bank actually having very important positive effects in the short run before the collapse of the bank.

Narrator: Despite the original mandate to operate as an institution strictly dedicated to savings, the bank was largely co-opted by the First National Bank, which off-loaded its liabilities onto the Freedman’s books, with no objection from the Freedman’s Bank’s all-white trustees. Its depositors’ hard-earned savings disappeared into risky railroad companies and speculative real-estate ventures.

Constantine Yannelis: There’s actually a partial bailout and some depositors were given 60 cents on the dollar, which was very novel for the time, right? There was no deposit insurance in the 19th century in the United States or anywhere, but I think the fact that there was partial compensation speaks to just what a sense of moral outrage there was during the time period due to this catastrophic scenario with the collapse of the bank. You had this population that had suffered tremendously, losing their life’s savings in a scheme that was started by the US government, and many historians posit that this negative historical experience with the Freedman’s Bank is one of the reasons African Americans are less likely to access financial services even to this day.

Narrator: And that is exactly what Yannelis and his coauthor found.

Constantine Yannelis: And we obtained data from surveys conducted by the Federal Deposit Insurance Corporation, and what we find is that for individuals today living near a former Freedman’s Bank branch, African Americans are significantly less likely to report that they trust financial institutions. We don’t find the same effect for whites, so at least that’s consistent with the Freedman’s Bank having a negative impact, even to the present day, and certainly that’s been posited by many historians.

Narrator: It’s hard to separate out the effects of the bank’s collapse from the legacy of slavery, Jim Crow, redlining, school segregation, discriminatory courts, and many other examples of institutional racism. The totality of all of this likely dwarfs any effects traceable to the Freedman’s Bank in particular. So the research by Stein and Yannelis points to how powerful financial inclusion can be for economic empowerment, the devastating effects of financial exclusion, and perhaps, in the end, the inability of banking to close today’s racial wealth gap.