Representing four distinct disciplines, the 2016 Distinguished Alumni Award winners exemplify the resounding impact of Chicago Booth.

- May 01, 2016

- Leadership

Since 1971 we have celebrated innovative leaders across all industries, from finance to the arts, manufacturing to public service, and beyond. The Distinguished Alumni Awards honor individuals who continue to challenge and change the world we live in, exemplifying the resounding impact of Chicago Booth. Though they represent four distinct disciplines, our winners share a passion for forging new territory. Each has found a way to buck convention and create new opportunities through bold ideas and a clear vision for lasting impact.

Founding chair

Citizens United for Research in Epilepsy (CURE)

Susan Axelrod, LAB ’70, MBA ’82, didn’t go looking for her career; it came knocking on her door when her seven-month-old daughter was diagnosed with epilepsy. As she and her family grappled with her daughter’s condition, Axelrod also saw the bigger picture and realized through connecting with other families that something more could and should be done.

A trailblazer in an under-served field, Axelrod not only put a public spotlight on a little-understood disorder, she brought together scientists, medical professionals, and families in pursuit of innovative treatments and a cure.

Since Axelrod launched the organization, in 1998, CURE has been at the forefront of epilepsy research, raising more than $43 million to fund research and other initiatives focused on a cure for epilepsy. CURE funds grants for young and established investigators and has awarded more than 190 cutting-edge projects in 15 countries to date.

Susan Axelrod:

When I was in business school, I had a grand life plan as all of us do and everything was going according to that plan, including the birth of my first born daughter and what was not in the plan and what really sort of threw a curve ball at myself, my own plans and my family's plans was that she developed epilepsy at the age of seven months old.

Dan Lowenstein:

I first got to meet Susan as part of a planning committee charged with preparing for what was the first white house initiated curing epilepsy conference back in 2000 and I felt very lucky to be part of a committee that was thinking innovatively about a whole new way of presenting the challenges in epilepsy.

Susan Axelrod:

And so started to connect with people and realize that my personal situation was not the only one. I mean I honestly thought my daughter was maybe the only one who was struggling this way and fueled by that energy of meeting other people started to sort of look at this and say what is going on? How could there be so many people suffering? And so many people struggling and people losing their lives and looked to the research that was going on in the area.

Dan Lowenstein:

I can't think of any other person that I've known in my entire professional career that has had as much impact on the scientific and socio-political landscape of epilepsy than Susan Axelrod.

Susan Axelrod:

But there was very little research dollars invested in epilepsy at our federal agency, the national institutes of health. You can't make an impact in a disease without a pretty hefty investment of resources, research is very expensive. When I looked at this, it was never with the thought that I could impact my own child's life. It was really about correcting a wrong that I saw.

Frank Kalume:

Working with CURE and with Susan is working with the brightest in the field. Her leadership style has proven to be very important in helping the field move forward and trying to find a better solution for people with epilepsy.

Susan Axelrod:

It's not about my daughter. Personally, it is about a need in society and we can fill that need and we can do it together. I think one of the greatest challenges I've faced has been how to, as a startup, how to grow it in a way where it's going to one day be self-sustaining. And it's not that this will ever stop being the main cause of my life. This award is a huge honor for me personally and it's one that I never ever anticipated receiving. I think it's also an incredible recognition of the importance of this kind of work, this kind of venture. I am grateful for the opportunity to feel that epilepsy and research in general is of great importance to the university and to the alum of the university.

“We are the risk takers in the epilepsy research space. We’re diligent about what research we fund. We have an extensive review process, but we give priority to new, innovative, and cutting-edge ideas, because that’s the only way we’re going to change things.”

Early on in his career, Daniel P. Caruso, ’90, rode the boom and bust of the dot-com industry in the 1990s and the telecom meltdown during the first decade of the 21st century. With a level head, Caruso navigated the complexities, avoiding the traps that ensnared many of his colleagues.

Caruso was one of the founding executives of Level 3 Communications, which he helped start in 1997. He then served as president and chief executive officer of International Communications Group. He took the near-bankrupt company private and, in 2006, when Level 3 purchased ICG, Caruso cashed in on the opportunity to start his own new venture.

Caruso’s company, global communications infrastructure services provider Zayo Group, has developed a contrarian point of view, understanding that the real value of fiber networks is their long-term durability as the fundamental infrastructure of big data and the cloud. Zayo Group now connects thousands of office buildings, hundreds of data centers, and dozens of cloud destinations to a high-speed communications network.

Daniel Caruso:

Risk taking for me from a business standpoint is a bit of an addiction actually. And the whole premise of Zayo was really a set of thinking that was unorthodox. We had a very different point of view. We had a point of view that the recovery had long played its way through, it just wasn't well understood. And that the real value of these fiber networks was very longterm and duration and if applied in an infrastructure model. So we coined the term communication infrastructure and bandwidth infrastructure to imply that our role is to provide fundamental infrastructure for those companies that have a tremendous need for bandwidth. Companies that are changing the world. Companies like Apple and Google, the wireless carriers, the health tech companies, ad tech companies, companies that are doing really cool things, but they need an ample supply of bandwidth to make that happen.

Matt Erickson:

Dan's a very direct motivating entrepreneurial manager. Dan's both a visionary and he cares a lot about the tactical day in and day out, facts and nuts and bolts of running the business.

Donald Gips:

Joining the board of Zayo and watching what Dan built from nothing to now being one of the leading fiber providers in the world, our IPO, all of that's been incredibly exciting, but even more sort of the financial or the numbers of seeing the culture he's built within Zayo. Where all the employees feel empowered and we're really building a new business model that helps everyone feel like they're a business owner in a way that I've never seen in any other company. And that Dan really designed and engineered.

Daniel Caruso:

Try to build and develop and foster a very entrepreneurial culture so that we can do many things with teams of people, kind of divide the big opportunity into smaller, more bite sized pieces and then put a strong leader and a strong team and point them the right direction and see what they can achieve. So in many ways, Zayo's really collection of entrepreneurial entities within it, each of which kind of prosecute their own business model.

Matt Erickson:

It's been a phenomenal opportunity to have the experience to work with Dan since we started Zayo almost 10 years ago. Dan's a phenomenal entrepreneur.

Daniel Caruso:

Boulder think tank is a group of people who are the most successful entrepreneurs and those investors and those entrepreneurs that reside in the Boulder area. And we get together primarily to networking and informally collaborate with one another, but also around certain kind of topics that are just interesting and kind of stimulate conversation. One of our first topics was around quantum entanglement, which is a pretty ... Something I'm a little bit passionate about, but it was fun to expose a group of people who weren't even sure what we were going to talk about, but it's a great way to collaborate, a great way to compare notes on how we all contribute back to the community that we're a part of.

Phil Canfield:

First of all, Dan is just a great leader and he's built a great team and that became apparent really the first time that I met him. He's got a clear vision for what he's trying to do. I mean, he's trying to build the dominant leading provider in the wholesale bandwidth and infrastructure space. It's a great market opportunity. He sees that and he's been executing against that plan for a long time. One of the great things that great leaders do is surround themselves with great people, and Dan spends a tremendous amount of time thinking about who his people are, what roles they're in.

Daniel Caruso:

I think I'm fortunate to have a platform in which I can help a lot of other inspiring entrepreneurs and the companies that they create. The combination of having the relationship and involvement with Booth, having a company itself that provides an essential role for most entrepreneurial and tech companies and a heavy involvement in [inaudible 00:04:49] community allows me to kind of organize and lead and help influence and foster entrepreneurship in a much broad fashion. I feel like I'm scratching the surface already and making a difference, but I feel like there's so much more that can be done over the next 10 or 20 years, and that's really what I hope to accomplish.

“One of the biggest ways Booth helped me throughout my career—particularly at the more difficult times—is in having taught me the analytical and fundamental foundation of true value creation. Not the illusion of value, not chasing the latest idea or fad, but really building something that is a long-term platform for intrinsic value creation.”

After selling Braintree to PayPal in 2013, founder Bryan Johnson, ’07 (XP-76) looked back at the deal not merely as an achievement, but as the start of a new adventure. He set out to launch the OS Fund in support of “the world’s most audacious” scientists and entrepreneurs who are working to rewrite the operating systems of life.

Johnson’s defining belief is that we’re at a uniquely exciting moment in the story of humanity, because we can now literally create any kind of world we can imagine. He combines business acumen with an insatiable imagination to fuel all his endeavors, including writing a children’s book.

The OS Fund’s investments range from synthetic biology and artificial intelligence to energy storage and next-generation transportation. To create a more robust ecosystem for investors looking to fund entrepreneurs in these fields, the OS Fund developed a decision-making model it then open-sourced to help others better understand the risks and potential of promising sci-tech companies.

Bryan:

Discovering Braintree was an accident. I was broke up to my eyeballs in debt and I had no way to make money because nobody would hire me. And so I was out in the street trying to sell credit card processing door to door, and I discovered that it was a broken industry and that there was this great opportunity to build a company and I started building the foundations and soon we started getting some of the best technology companies in the whole world to become customers. And that's when I knew we really had something.

Waverly:

Bryan is a visionary who knows how to execute on vision. And I would put Bryan into the company of people like Richard Branson and Elon Musk, that when Bryan has an idea that he wants to bring to the world, he's going to find a way to do it. Resources aren't going to constraint him. Technology isn't going to constrain him. Bryan genuinely wants to change the world and he's one of the few entrepreneurs that I've met who I believe can.

Bryan:

In order for our society to thrive, we are dependent upon scientific breakthroughs to address our needs. But funding these scientific endeavors is very challenging because oftentimes I have long runways with a lot of risk. And so oftentimes venture capital won't venture into this world and so we've developed the OS fund, for example, a decision making model of how to understand these companies and invest wisely in them and I think that having been to Booth, it was really helpful and understanding how we could frame our thought processes to make good decisions about these endeavors or truly could have a very large impact on humanity, but just weren't receiving the investment capital from the community.

Scott:

What really caught my attention about Bryan is his passion for the future and his commitment to being involved in both technology and in social progress towards building a better future.

Bryan:

When I invest in entrepreneurs for the OS fund, I want to find people who are one, future literate, two, who are working on one of humanity's most audacious challenges or opportunities, and three, if successful, they would improve the lives of billions of people for generations to come. Those are the three criteria we evaluate on every investment.

Cynthea:

He wanted to know how he could help children understand that they have the power to offer their own lives. And that's like this huge statement, right? And it's like, well, [inaudible 00:02:55] we have to start somewhere. And that became this book. And then that then became something much larger when he was like, no, how do we really, like this is just one book, but what can we do on a much larger level?

Bryan:

The reason why I want to invest in the youth first, I'm a father of three and I love my children very much and I worked incredibly hard to be a good father to them. Also, I see them as humanity's future creators, that they will arrive at maturity when these powerful tools of creation are their maturity as well, and they'll have this ability to author our world unlike any other generation. And I want to invest in them now so that when they're at that age that they have the aspirations and conviction to create something remarkable.

“I invest in future-literate entrepreneurs, which I define as those who create mental models for the emerging future while living experimentally and adventurously. They’re working on any one of humanity’s most audacious challenges or opportunities, and aiming to improve the lives of billions of people for generations to come.”

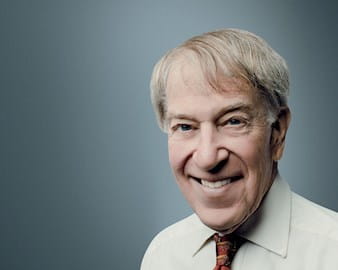

Roger C. Altman, ’69, began his investment banking career at Lehman Brothers and became a general partner of that firm in 1974. Beginning in 1977, he served as assistant secretary of the US Treasury for four years.

In 1987, Altman joined the Blackstone Group as vice chairman, head of the firm’s advisory business, and a member of its investment committee, with primary responsibility for Blackstone’s international business.

Beginning in January 1993, Altman returned to Washington to serve as deputy secretary of the US Treasury for two years.

With a unique vision, Altman launched investment banking advisory firm Evercore in 1995, guided by the idea that clients would be better served by advisers who were not tethered to the demands of a multiproduct financial institution.

Altman’s appetite for constant growth coupled with his continued ability to succeed in new directions is proof of his resiliency, curiosity, and entrepreneurial acumen. With a long career spanning five decades, he remains invigorated by his work.

Roger Altman:

Leadership is, at least in my own experiences, a very subtle mix of elements. For example, I don't think you can lead entirely by consensus, just taking a vote every time on any issue. On the other hand, elements of consensus are very important. There's a fine line, at least in what I've been exposed to, between waving a sword and saying, "We're going up that hill," and on the other hand, having an approach which builds support among your employees and your teammates so that you're not an autocrat, because autocrats, I think, at least in most aspects of what I've ever seen, don't last too long.

Roger Altman:

Well, I had a remarkable experience at the University of Chicago because I began there in the fall of 1967.

Howard Marks:

The anti-war protests were a big theme during the time we were there, and we were conscious of it.

Dick Jay:

I know we met in 1967 in Chicago, and we were in the same business school dorm on Blackstone Avenue. That's how we met, and we became very good friends in the course of business school.

Roger Altman:

The benefit of going to graduate school was about 50% in the classroom and about 50% the ecology of the graduate school and what you'll learn by just being there.

Roger Altman:

Again, there are lots of different types of leaders. We've all read biographies of great leaders who were very different than others. Apropos of Chicago and Illinois, Abraham Lincoln had a very distinct form of leadership, but it wasn't the same, for example, as George Patton or Dwight Eisenhower. So I don't think there's one formula for leadership, one formula for the type of temperament that is consistent with leadership. There's a lot of different types of temperament that can work, especially depending upon the field you're talking about. The certain temperaments, for example, that may apply to military leadership that may not at all apply to what you might call, well, academic leadership or business leadership or scientific leadership.

Howard Marks:

I've gotten to spend time with a lot of successful people in my life, and one of my observations is that success is not good for most people. Yet Roger has been enormously successful, and it hasn't changed him. He's still the Roger I knew... Should I say 49 years ago?

Roger Altman:

I grew up in a classically progressive Massachusetts family which was really interested in civic matters, and very, as I said, civic-minded and progressive from an ideological point of view. This was one of the things that I listened to as a child, and by the time I had come to the University of Chicago, I was firmly focused on that as something that someday I wanted to try to do.

Roger Altman:

I have had a couple of periods in my life when I was down and out, either economically at a very early age or from a health point of view 28-plus years ago. Those experiences put everything into perspective. I just think it's just my own philosophy as to why we're really here on this earth.

Roger Altman:

Also, I would say business is great. I like business. I said a moment ago I've never had a boring day in it, but there are limits to it. Some people think it's all they want to do all day long from the moment they wake up to when they go to sleep is pursue their business. I admire that. Great for them. That's not me.

Dick Jay:

I think helping people, whether it's the people who work with him or his clients, or whether it's helping people through government or helping people through nonprofit, I think that is Roger's mantra. I think he thinks about giving back, and by helping people is always the best way to help yourself in that it comes back to you.

Roger Altman:

The only way that we're going to enable living standards in this country to begin climbing again, because they've stagnated now, is through better educating our population.

“Leadership in my experience is a subtle mix of elements. There’s a fine line between waving a sword and saying we’re going up that hill, and on the other hand having an approach that builds support among your employees and your teammates so that you’re not an autocrat. Autocrats—at least in what I've ever seen—don't last too long.”

Laura Lo-Ip, ’89, used Booth’s ReLaunch program to reenter the workplace.

Starting Again

Professor Ann L. McGill, MBA ’85, PhD, ’86, invites us inside a course that aims to transform the workplace, one boss at a time.

Be the Boss You Wish You Were

One of the founding fathers of Booth’s alumni community in Hong Kong reflects on its growth and looks ahead to new milestones.

The Book of Booth: Lincoln Yung, ’70