Veteran banker José Antonio Álvarez, ’96 (EXP-1), on getting the bank through the European banking crisis and other difficult times.

- By

- October 10, 2015

- Finance

José Antonio Álvarez, ’96 (EXP-1), has seen some of banking’s darkest hours. He was elevated to CEO of Madrid-based Banco Santander a year ago—with Europe still struggling to climb out of an economic malaise and the Greek debt crisis threatening to destabilize the fragile eurozone.

Álvarez had been through worse. He was named CFO of the bank 10 years earlier, as the housing bubble was about to peak, then burst, hobbling highly leveraged US and European banks. Yet Santander emerged as Europe’s seventh largest bank, with assets of more than $1.5 trillion.

Of course Santander was by no means immune to the crisis that engulfed Europe and its banks, with Spain’s overleveraged construction industry contributing to the frenzy. “The worst was summer 2012,” Álvarez said. It’s when Spain was downgraded by the three major ratings agencies, “a few notches in one shot” from Fitch, Moody’s, and Standard and Poor’s. However, through it all, Santander never posted a quarterly loss, unlike many of its European peers, including BNP Paribas, Crédit Agricole Group, and Deutsche Bank. Royal Bank of Scotland suffered such steep losses that it had to be rescued by the UK government in 2008.

Álvarez was promoted to the CEO post by executive chairman Ana Botín, the fourth generation of Spain’s Botín family to run the institution that dates to 1857. Botín took over following the death of her father—longtime chairman Emilio Botín—and parted ways with her father’s CEO. “No one knows our business, our teams, and investors better than José Antonio,” Botín wrote in a letter to employees that complimented the “rigor and transparency” of the new leader.

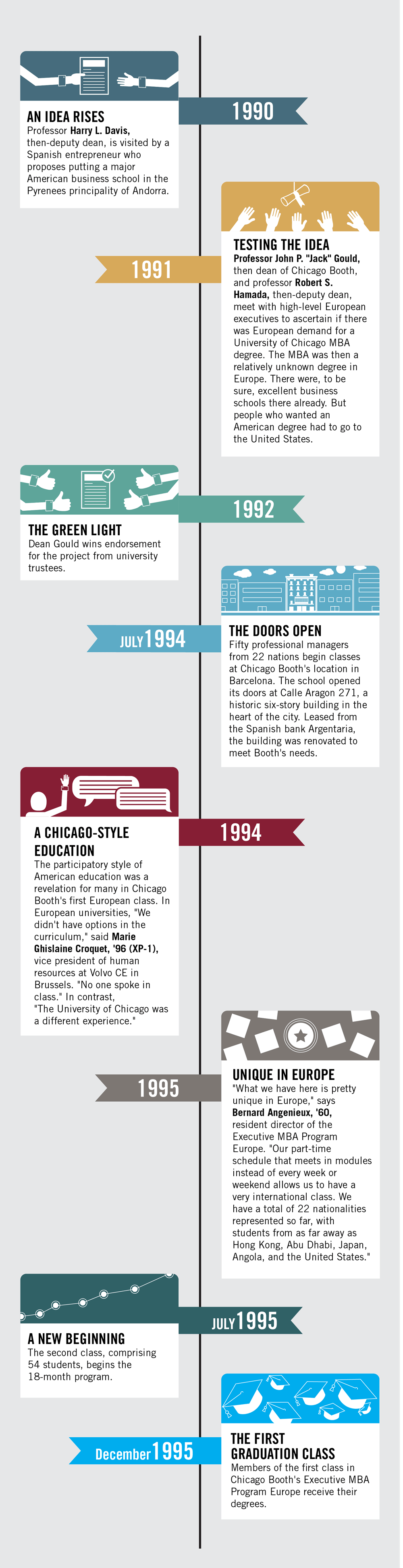

No doubt this rigorous approach to problem solving was instilled in part at Booth, where Álvarez was a member of the inaugural cohort of the Executive MBA Program Europe, based at the time in Barcelona (it relocated to London in 2005). The degree provided training that would help him navigate the complexities of the fiscal crisis more than a decade later.

A native of a small agricultural and mining community in northwest Spain, Álvarez was drawn to finance early in his life. After earning a business degree from Universidade de Santiago de Compostela in Spain’s Galicia region, he went on to analyze the credit quality of loans to industrial companies, working at two state-owned institutions.

From there he moved briefly into asset management, and, in 1993, to the finance division of mortgage bank Banco Hipotecario de España in Madrid. Before joining Santander, Álvarez was head of the finance division of Banco Bilbao Vizcaya Argentaria, Spain’s second largest bank, based in Madrid.

Álvarez recently spoke with Chicago Booth Magazine, sharing his rarefied view on issues including the European debt crisis, the solutions for Spain, and the growing problem of economic inequality.

CHICAGO BOOTH MAGAZINE: The European debt crisis has weighed on the continent and slowed a recovery from the crisis of 2008. Would you say that we’re past the worst of it?

Álvarez: In the summer of 2012, when Spain was downgraded [by the three major ratings agencies], some market participants had doubts about the sustainability of the euro. This created significant turbulence—until that July, when European Central Bank (ECB) president Mario Draghi committed to fight for the currency’s survival, saying he was “ready to do whatever it takes to preserve the euro.” So, yes, we are past the worst of it now.

CBM: It seems Spain has turned a corner.

Álvarez: The consensus is that Spain will see 3 percent GDP growth this year. Last year it grew for the first time after three years in a row in recession. Unemployment is still relatively high [at 22.4 percent in June], but this is a country with 17 to 18 million people employed. We’ve created 600,000 jobs in the past 12 months.

The economy is recovering, due to the structural reforms by the government during the crisis, labor reform [which cut maximum severance pay, made it easier for companies to set wages without sector-wide bargaining, and provided tax breaks for small businesses hiring people under 30, among other things], and a cut in public expenses. The government also raised taxes to reduce the public deficit.

Structurally, Spain is a low-labor-cost country. The infrastructure—transport, the airports, the railways—is excellent. The depreciation of the euro and cheaper oil plays in favor of this, and the ECB’s quantitative easing—the practice of buying financial assets from commercial banks to stimulate the economy—makes funding cheaper.

Tourism is growing as well—it represents 12 to 14 percent of GDP. And Spain is becoming a country of choice for manufacturing.

“It’s a fact that Europe is now growing again. Not only Spain, but you have Germany growing at 2 percent. Even Italy and France, who were the laggards, are experiencing growth.”

CBM: How has European banking changed following the crisis?

Álvarez: This industry is much more regulated now than it was seven or eight years ago. One example is the required increase in Tier 1 capital—the high-quality capital that banks use to support their activities and to cushion against losses. As a percent of assets that are weighted to account for degree of risk, this rose from 4 percent in 2007 to 6 percent in 2015. In 2019, some banks may need more than double what they were required before the crisis.

CBM: Spain’s real estate bubble produced heavy losses. How did Santander fare?

Álvarez: Naturally we had significant losses, where we granted loans to real estate developers at the peak of the real estate cycle in 2006, 2007, and 2008.

It was typical to grant a loan to a real estate developer that, let’s say, built 100 flats on a block. Then the developer would sell the flats to individuals, and we would split the original loan into 100 loans for the buyers of those flats. As the crisis mounted, the developers were unable to sell the flats and they defaulted. We got caught in the middle, forced to take the collateral at a loss—the collateral being a piece of land and a building that doesn’t have buyers. Home prices in Spain fell 30 to 35 percent.

CBM: Didn’t Santander’s geographic diversification save the day?

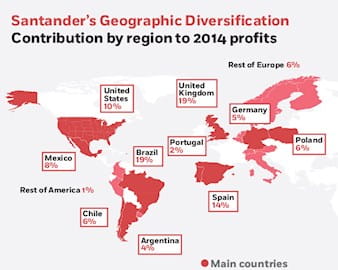

Álvarez: At the time, countries in Latin America were doing quite well due to high commodity prices. So we were reaping profits from those markets. Thanks to our geographic diversification, we haven’t had a single quarterly loss. Spain was our most important market before the crisis—at that time representing 25 percent of our profits. Now it represents around 15 percent, so we are less tied to the fortunes of our home economy.

CBM: This summer the Greek debt crisis came to a climax. What would be the impact across the continent if Greece ultimately exits from the euro?

Álvarez: The contagion risk is much lower than the one we had two or three years ago, when the fiscal deficit of Spain was running at 8 percent of GDP, the economy was in recession, and the debt-to-GDP was soaring. The fundamentals of Spain, Ireland, Italy, and Portugal are much better now. Currently Spain is growing, and the fiscal deficit is heading to 4 percent. Probably the debt-to-GDP ratio this year is not going to grow. The situation is similar in the other three countries.

CBM: Has the new financial infrastructure in the eurozone helped?

Álvarez: Before, the ECB was the only body inside the eurozone that was in a position to deal with the crisis. Now the European Union has incorporated other tools, such as the European Stability Mechanism (ESM), established in July 2011. This is a fund that can bail out a country by lending up to €500 billion. The ESM has total subscribed capital of €700 billion from the eurozone member states. On top of that, we now have the EU’s Single Resolution Mechanism, a framework of rules and procedures for dealing with failing banks. Also key to consumer confidence, deposits of up €100,000 are now guaranteed.

CBM: What is the impact of the ECB’s quantitative easing?

Álvarez: The ECB mandate is an inflation target close to, but below 2 percent, and now we have inflation close to zero, so success is better than imagined. Quantitative easing is inside the limits of this mandate. The ECB is buying sovereign bonds all across Europe with certain limits. And the risk of these bonds is shared only partially by the member states. You have a buyer of €60 billion of bonds a month, which prevents the interest rates each government pays on its debt from going too high.

CBM: Are there dangers to this?

Álvarez: Naturally, inflation. At some point when [former Fed Chairman Ben] Bernanke started this policy in the United States back in 2008, people were worried about the possibility of QE being inflationary. Now it seems less and less likely. But you need to normalize the situation at some point.

The US experience shows that the Federal Reserve has been able to manage quantitative easing properly without creating significant disruptions in the economy. So this policy already is tested. It’s a fact that Europe is now growing again. Not only Spain, but you have Germany growing at 2 percent. Even Italy and France, who were the laggards, are experiencing growth.

CBM: Quantitative easing has compressed interest rates to historically low levels, and in the case of very short-term rates, even below zero. How is Santander dealing with this?

Álvarez: Operating in a context of record low interest rates is challenging for banks as net interest income [the difference between what a bank pays for deposits and charges for loans] is our main source of profits, the way it is for all pure retail banks such as Santander. Margins are squeezed, which means there’s little room to reduce the cost of deposits, while competition on the asset side is increasing. But at the same time, low interest rates mean lower credit losses, and that will help reduce the economy’s high degree of leverage.

CBM: How has the upheaval of the past few years affected Santander’s bond rating?

Álvarez: In recent years, our rating has been higher than the sovereign debt in Spain and still is, in the case of Moody’s. [The rating of a government can act as a ceiling on the rating of corporations and banks domiciled there.] We have subsidiaries in the United Kingdom, Chile, and other countries that were, and are, higher rated than the parent company. Our discussions with the rating agencies have focused on how many notches we can be above the sovereign in Spain, because we are incorporated there. [Banco Santander at the group level and the government of Spain have long-term debt ratings of BBB+ from Fitch Ratings and BBB from Standard and Poor’s. For Moody’s Investors Service, the bank is a notch higher at Baa1 versus Baa2.]

CBM: Not that all global financial issues are solved, nor that you have plenty of leisure time, but what are you reading in your free moments?

Álvarez: I tend to read several books at a time in order not to be bored. Right now I’m reading one that is in fashion: The Second Machine Age [by Erik Brynjolfsson and Andrew McAfee]. It talks about the importance of the digital revolution. And it raises interesting questions, not only economic ones, but also about society, particularly the inequality issues that may arise if we are heading into a world in which the winners take all.

Inequality is rising in the United States and Europe. The wages of blue-collar workers have not grown in the last 20 years. Are we leaving an overwhelming majority of the people behind?

CBM: Do banks have a role to play in addressing inequality?

Álvarez: As a retail bank we are by definition in the mass market. We have 100 million customers. Clearly our aim, our vision, is to help people and companies prosper.

When the pandemic closed offices, Sheila Arora, ’11, took an opportunity to turn full time to her art.

Balancing Logic with Intuition

The Nobel laureate and his former student—now the namesake of Chicago Booth—discuss a friendship that goes back half a century.

A Fireside Chat with Eugene F. Fama and David Booth

The couple’s $75 million gift is their latest in more than 40 years of giving to Booth.

The Book of Booth: Amy and Richard Wallman